Compare Adani Energy Sol with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROCE of 8.65%

- The company has been able to generate a Return on Capital Employed (avg) of 8.65% signifying low profitability per unit of total capital (equity and debt)

High Debt Company with a Debt to Equity ratio (avg) at 2.34 times

Healthy long term growth as Net Sales has grown by an annual rate of 20.62% and Operating profit at 20.08%

Flat results in Dec 25

With ROCE of 11.3, it has a Expensive valuation with a 2.3 Enterprise value to Capital Employed

Total Returns (Price + Dividend)

Adani Energy Sol for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

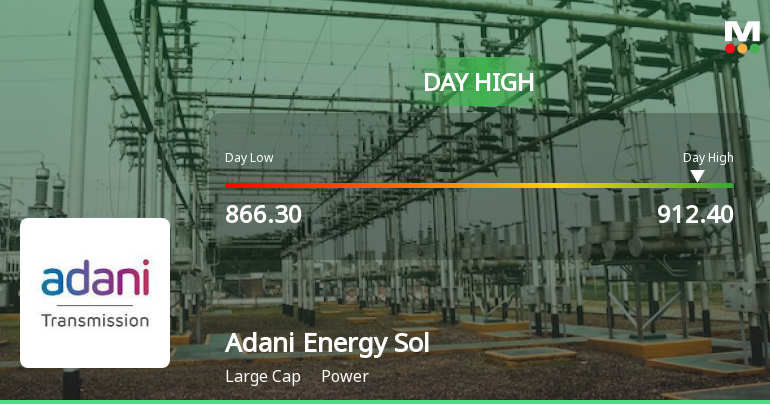

Adani Energy Solutions Ltd Hits Intraday High with 3.19% Surge on 29 Jan 2026

Adani Energy Solutions Ltd demonstrated robust intraday performance on 29 Jan 2026, reaching a day’s high of Rs 912.4, marking a 3.52% increase from its previous close. The stock outperformed its sector and the broader market, reflecting notable trading momentum within the power industry.

Read full news article

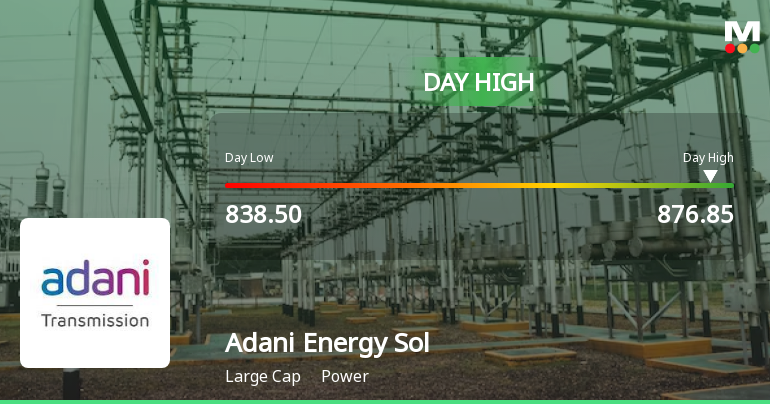

Adani Energy Solutions Ltd Hits Intraday High with 3.04% Surge on 28 Jan 2026

Adani Energy Solutions Ltd demonstrated robust intraday performance on 28 Jan 2026, surging 3.04% to touch a day’s high of Rs 873. This advance outpaced the broader Power sector and the Sensex, reflecting notable trading momentum in the stock.

Read full news article

Adani Energy Solutions Ltd Upgraded to Hold on Improved Financial and Quality Metrics

Adani Energy Solutions Ltd has seen its investment rating upgraded from Sell to Hold as of 27 Jan 2026, reflecting a notable improvement across financial performance, quality metrics, valuation, and technical indicators. The company’s flat financial trend, enhanced quality grade, and stabilising technical outlook have collectively contributed to this reassessment, signalling cautious optimism for investors amid a challenging sector environment.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

27-Jan-2026 | Source : BSETranscript of Earnings Call pertaining to Unaudited Financial Results for quarter and nine months ended December 31 2025

Announcement under Regulation 30 (LODR)-Credit Rating

27-Jan-2026 | Source : BSEUpdate on Credit Rating

Clarification sought from Adani Energy Solutions Ltd

27-Jan-2026 | Source : BSEThe Exchange has sought clarification from Adani Energy Solutions Ltd on January 27 2026 with reference to news appeared in https://economictimes.indiatimes.com/ dated January 27 2026 quoting Adani Energy Solutions secures hybrid power mandate from Asahi India Glass

The reply is awaited.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

0.5496

Held by 32 Schemes (6.44%)

Held by 187 FIIs (13.47%)

Gautambhai Shantilal Adani And Rajeshbhai Shantilal Adani (on Behalf Of S.b. Adani Family Trust) (50.08%)

Sbi Equity Hybrid Fund (3.7%)

3.08%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 15.43% vs 27.78% in Dec 2024

YoY Growth in quarter ended Dec 2025 is -1.69% vs 72.91% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 16.03% vs 57.57% in Sep 2024

Growth in half year ended Sep 2025 is 802.50% vs -133.03% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 15.82% vs 46.15% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 287.28% vs -46.79% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 43.11% vs 24.94% in Mar 2024

YoY Growth in year ended Mar 2025 is -6.80% vs -9.48% in Mar 2024