Compare Golub Capital BDC, Inc. with Similar Stocks

Dashboard

1

Strong Long Term Fundamental Strength with a 80.30% CAGR growth in Operating Profits

2

Healthy long term growth as Operating profit has grown by an annual rate of 80.30%

3

Flat results in Jun 25

4

With ROE of 7.29%, it has a very attractive valuation with a 1.00 Price to Book Value

5

Consistent Underperformance against the benchmark over the last 3 years

Total Returns (Price + Dividend)

TimePeriod

Price Return

Dividend Return

Total Return

3 Months

-12.01%

0%

-12.01%

6 Months

-15.84%

0%

-15.84%

1 Year

-21.0%

0%

-21.0%

2 Years

-18.98%

0%

-18.98%

3 Years

-10.42%

0%

-10.42%

4 Years

-21.94%

0%

-21.94%

5 Years

-16.35%

0%

-16.35%

Golub Capital BDC, Inc. for the last several years.

Risk Adjusted Returns v/s

News

Golub Capital BDC, Inc. Experiences Revision in Stock Evaluation Amid Financial Performance Trends

Golub Capital BDC, Inc. reported strong financial results for the quarter ending June 2025, with significant growth in operating cash flow, pre-tax profit, and net sales. However, rising interest expenses and raw material costs, along with a high debt-equity ratio, indicate potential challenges ahead for the company.

Read full news article Announcements

No announcement available

Corporate Actions

No corporate action available

Quality key factors

Factor

Value

Sales Growth (5y)

25.33%

EBIT Growth (5y)

80.30%

EBIT to Interest (avg)

3.80

Debt to EBITDA (avg)

Negative Net Debt

Net Debt to Equity (avg)

0

Sales to Capital Employed (avg)

0

Tax Ratio

Tax Ratio is Negative%

Dividend Payout Ratio

113.70%

Pledged Shares

0

Institutional Holding

47.94%

ROCE (avg)

16.90%

ROE (avg)

10.52%

Valuation key factors

Factor

Value

P/E Ratio

14

Industry P/E

Price to Book Value

1.00

EV to EBIT

6.68

EV to EBITDA

6.68

EV to Capital Employed

1.00

EV to Sales

5.15

PEG Ratio

NA

Dividend Yield

5.94%

ROCE (Latest)

14.92%

ROE (Latest)

7.29%

Technicals key factors

Indicator

Weekly

Monthly

MACD

Bearish

Bearish

RSI

No Signal

No Signal

Bollinger Bands

Bearish

Bearish

Moving Averages

Bearish (Daily)

KST

Bearish

Bearish

Dow Theory

Mildly Bearish

Mildly Bearish

OBV

Mildly Bearish

Mildly Bearish

Shareholding Snapshot : Sep 2025

Shareholding Compare (%holding)

Majority shareholders

Domestic Funds

Domestic Funds

Held in 21 Schemes (7.98%)

Foreign Institutions

Held by 57 Foreign Institutions (7.59%)

Strategic Entities with highest holding

Highest Public shareholder

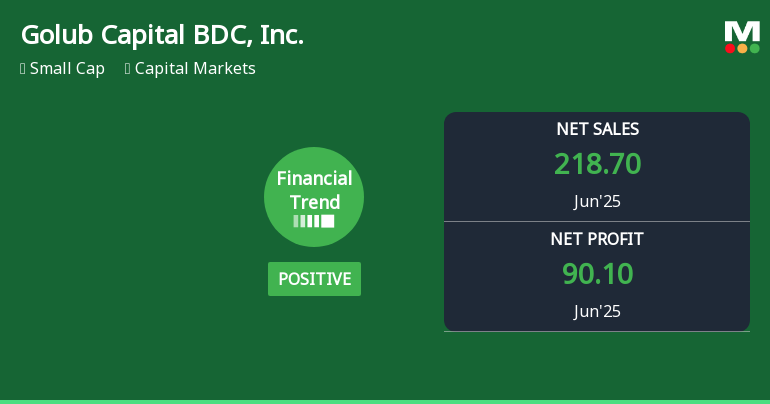

Quarterly Results Snapshot (Consolidated) - Jun'25 - YoY

Jun'25

Jun'24

Change(%)

Net Sales

218.70

139.80

56.44%

Operating Profit (PBDIT) excl Other Income

137.10

71.70

91.21%

Interest

70.70

60.10

17.64%

Exceptional Items

0.00

0.00

Consolidate Net Profit

90.10

9.30

868.82%

Operating Profit Margin (Excl OI)

626.80%

512.90%

11.39%

USD in Million.

Net Sales

YoY Growth in quarter ended Jun 2025 is 56.44% vs 25.16% in Jun 2024

Consolidated Net Profit

YoY Growth in quarter ended Jun 2025 is 868.82% vs -87.26% in Jun 2024

Annual Results Snapshot (Consolidated) - Sep'24

Sep'24

Sep'23

Change(%)

Net Sales

646.70

559.30

15.63%

Operating Profit (PBDIT) excl Other Income

467.00

392.80

18.89%

Interest

212.40

150.60

41.04%

Exceptional Items

0.00

0.00

Consolidate Net Profit

273.80

258.60

5.88%

Operating Profit Margin (Excl OI)

722.10%

702.30%

1.98%

USD in Million.

Net Sales

YoY Growth in year ended Sep 2024 is 15.63% vs 36.95% in Sep 2023

Consolidated Net Profit

YoY Growth in year ended Sep 2024 is 5.88% vs 68.58% in Sep 2023

About Golub Capital BDC, Inc.

Golub Capital BDC, Inc.

Capital Markets

Golub Capital BDC, Inc. is an externally managed, non-diversified closed-end management investment company. The Company invests primarily in senior secured and one-stop loans to United States middle market companies that are sponsored by private equity investors. The Company invests in various industries including diversified/conglomerate service; healthcare, education and childcare; retail stores; electronics; beverage, food and tobacco; leisure, amusement, motion pictures, entertainment; buildings and real estate; aerospace and defense, and insurance. The Company’s investment activities are managed by its investment adviser, GC Advisors LLC.

Company Coordinates

Company Details

200 Park Avenue, 25th Floor , NEW YORK NY : 10106

Registrar Details