Golub Capital BDC, Inc. Experiences Revision in Stock Evaluation Amid Financial Performance Trends

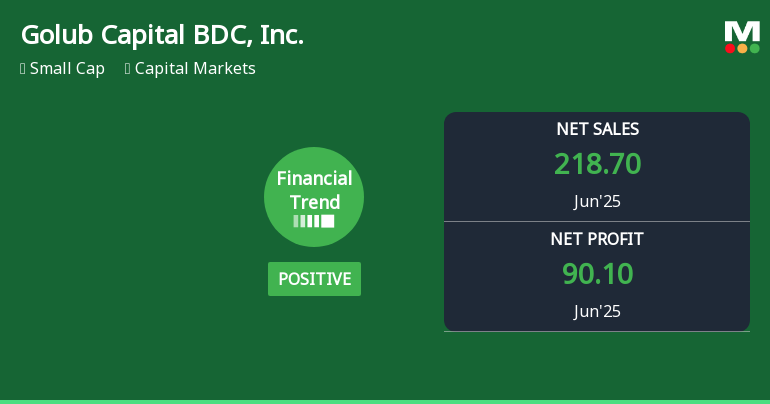

2025-11-25 15:24:48Golub Capital BDC, Inc. reported strong financial results for the quarter ending June 2025, with significant growth in operating cash flow, pre-tax profit, and net sales. However, rising interest expenses and raw material costs, along with a high debt-equity ratio, indicate potential challenges ahead for the company.

Read full news articleNo announcement available

Corporate Actions

No corporate action available