Compare Affle 3i with Similar Stocks

Dashboard

With ROE of 12.9, it has a Very Expensive valuation with a 7.1 Price to Book Value

- The stock is trading at a premium compared to its peers' average historical valuations

- Over the past year, while the stock has generated a return of 0.03%, its profits have risen by 19.7% ; the PEG ratio of the company is 2.7

Stock DNA

Computers - Software & Consulting

INR 22,894 Cr (Small Cap)

53.00

21

0.00%

-0.31

12.88%

7.19

Total Returns (Price + Dividend)

Affle 3i for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Affle 3i Ltd is Rated Sell by MarketsMOJO

Affle 3i Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 08 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 05 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news articleAre Affle 3i Ltd latest results good or bad?

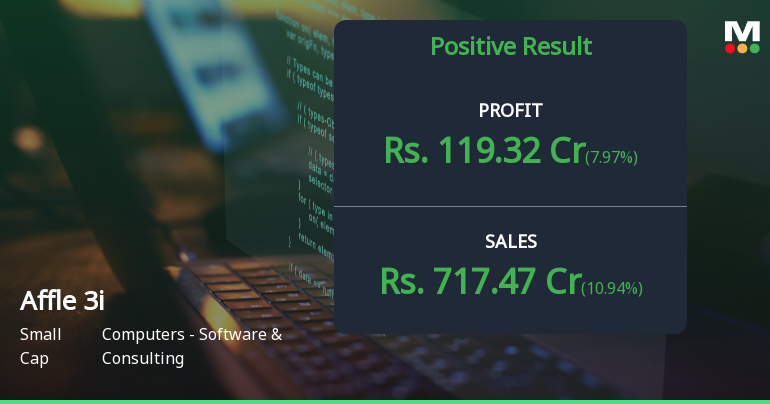

Affle 3i Ltd's latest financial results for Q3 FY26 reflect a notable performance in terms of revenue and profit growth. The company reported net sales of ₹717.47 crores, which represents a quarter-on-quarter growth of 10.94% and a year-on-year increase of 19.25%. This marks the highest quarterly revenue in its recent history, indicating strong demand for its mobile advertising technology services. The net profit for the same quarter reached ₹119.32 crores, showing a quarter-on-quarter growth of 7.97% and a year-on-year increase of 19.06%. The operating margin improved to 22.72%, the highest in seven quarters, demonstrating enhanced operational efficiency and effective cost management. Despite these positive operational trends, the company's return on equity (ROE) stands at 15.44%, which is lower than many of its peers in the IT sector. This suggests that while Affle is generating healthy profits, there i...

Read full news article

Affle 3i Q3 FY26: Strong Profit Growth Masks Valuation Concerns

Affle (India) Limited, a leading mobile advertising technology company, reported its third-quarter results for FY2026 with net profit reaching ₹119.32 crores, marking a sequential growth of 7.97% from Q2 FY26 and a robust year-on-year expansion of 19.06%. However, the stock has been under pressure, declining 18.91% over the past three months, trading at ₹1,568.00 as of January 30, 2026, with a market capitalisation of ₹21,529 crores. Despite strong operational performance, premium valuation multiples and deteriorating technical indicators present a mixed investment picture.

Read full news article Announcements

Submission Of Link Of Audio Recording Of Earnings Conference Call For The Third Quarter And Nine Months Ended December 31 2025

02-Feb-2026 | Source : BSEPlease refer to the letter attached

Announcement under Regulation 30 (LODR)-Newspaper Publication

02-Feb-2026 | Source : BSECopy of newspaper publication is attached

Announcement under Regulation 30 (LODR)-Investor Presentation

31-Jan-2026 | Source : BSEPlease find the Earnings Presentation attached

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

Affle 3i Ltd has announced 2:10 stock split, ex-date: 07 Oct 21

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 31 Schemes (13.23%)

Held by 162 FIIs (17.79%)

Affle Holdings Pte Ltd (40.67%)

Gamnat Pte. Ltd. (4.9%)

7.47%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 10.94% vs 4.19% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 7.97% vs 4.75% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 19.30% vs 26.79% in Sep 2024

Growth in half year ended Sep 2025 is 20.96% vs 34.31% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 19.28% vs 24.50% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 20.28% vs 32.90% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 22.98% vs 28.51% in Mar 2024

YoY Growth in year ended Mar 2025 is 28.46% vs 21.54% in Mar 2024