Compare AVI Polymers with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0.04 times

Healthy long term growth as Net Sales has grown by an annual rate of 142.75% and Operating profit at 94.73%

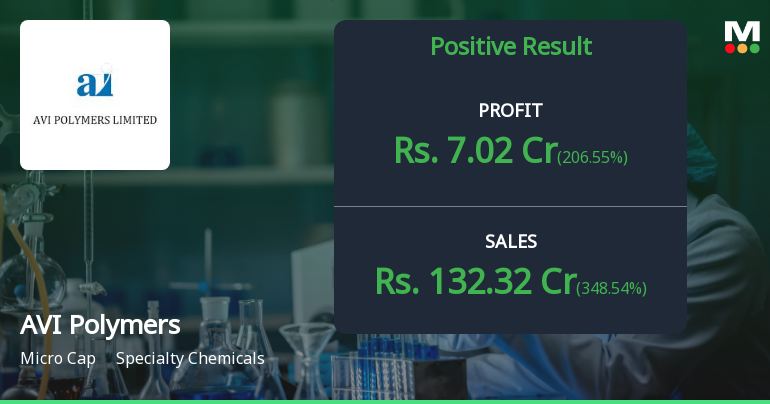

Positive results in Dec 25

With ROE of 126.5, it has a Very Attractive valuation with a 1.1 Price to Book Value

Rising Promoter Confidence

Market Beating Performance

Stock DNA

Specialty Chemicals

INR 9 Cr (Micro Cap)

1.00

25

0.00%

0.00

126.51%

1.07

Total Returns (Price + Dividend)

AVI Polymers for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Are AVI Polymers Ltd latest results good or bad?

AVI Polymers Ltd has reported significant financial results for the quarter ending December 2025, marking a notable return to operational activity after a prolonged period of dormancy. The company achieved net sales of ₹132.32 crores, reflecting a substantial quarter-on-quarter growth of 348.54% compared to the previous quarter, where sales were just ₹29.50 crores. This resurgence in revenue is particularly striking given that the company had reported virtually no sales throughout the previous fiscal year. Net profit for the same quarter reached ₹7.02 crores, which also indicates a considerable quarter-on-quarter increase of 206.55% from ₹2.29 crores in the prior quarter. This profit performance, while impressive in percentage terms, is influenced by the low base effect from earlier periods when the company was largely inactive. However, it is important to note that while the absolute profit figures are e...

Read full news article

AVI Polymers Q3 FY26: Dramatic Revenue Revival Drives 206% Profit Surge

AVI Polymers Ltd., a specialty chemicals company engaged in wholesale trading of chemical products, has reported a remarkable operational turnaround in Q3 FY26, with net profit surging 206.55% quarter-on-quarter to ₹7.02 crores from ₹2.29 crores in Q2 FY26. The micro-cap company, with a market capitalisation of just ₹6.00 crores, saw its stock rally 4.95% following the results announcement, closing at ₹16.31 on January 30, 2026.

Read full news articleAre AVI Polymers Ltd latest results good or bad?

AVI Polymers Ltd has reported a significant revival in its financial performance for Q2 FY26, marking a notable turnaround from a period of operational dormancy. The company recorded net sales of ₹29.50 crores, a substantial increase compared to the negligible revenue generated in the previous quarters. This revenue growth translates to a remarkable year-on-year increase of 294,900%, although it is important to note that this figure is against a very low base from the prior year. The net profit for the quarter was ₹2.29 crores, with an operating margin of 9.8%, indicating a positive operational outcome after several quarters of losses. However, the sustainability of this performance is uncertain. The previous quarter (Q1 FY26) reported zero revenue, making comparisons challenging. The recent financial results may reflect a one-off recovery rather than a sustained operational turnaround. The company’s retur...

Read full news article Announcements

Intimation Of Record Date For Issue Of Equity Shares On Rights (Rights Issue). The Company Has Fixed Wednesday 11Th February 2026 As The Record Date For The Purpose Of Ascertaining The Eligibility Of Shareholders Entitled For Rights Equity Share

05-Feb-2026 | Source : BSEIntimation of Record date for the issue of Equity shares on the right basis.

Board Meeting Outcome for Outcome Of Board Meeting Held Today I.E. 05Th February 2026 As Per The Regulation 30 Of SEBI (LODR) Regulation 2015.

05-Feb-2026 | Source : BSEOutcome of Board Meeting held today i.e. 05th February 2026 as per the Regulation 30 of SEBI (LODR) Regulation 2015. Pursuant to second proviso to Regulation 30(6) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 we hereby inform you that the Board of Directors in their meeting held today i.e. Thursday 5th February 2026 at the Registered Office of the Company situated inter-alia has considered and approved the terms of the rights Issue such as Record Date Right Issue Opening date and closing date Right entitlement ratio etc.

Announcement under Regulation 30 (LODR)-Newspaper Publication

02-Feb-2026 | Source : BSEAnnouncement under Regulation 30(LODR)- Newspaper Advertisement

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Rootsparkle Trading Private Limited (25.19%)

Yashiv Holdings Private Limited (3.43%)

68.18%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 348.54% vs 0.00% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 206.55% vs 0.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 49,066.67% vs -14.29% in Sep 2024

Growth in half year ended Sep 2025 is 4,480.00% vs 66.67% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 2,69,600.00% vs -90.32% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 13,200.00% vs 250.00% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -90.63% vs -83.16% in Mar 2024

YoY Growth in year ended Mar 2025 is 4,000.00% vs -83.33% in Mar 2024