Compare Baba Arts with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -18.81% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of 1.14

- The company has been able to generate a Return on Equity (avg) of 6.99% signifying low profitability per unit of shareholders funds

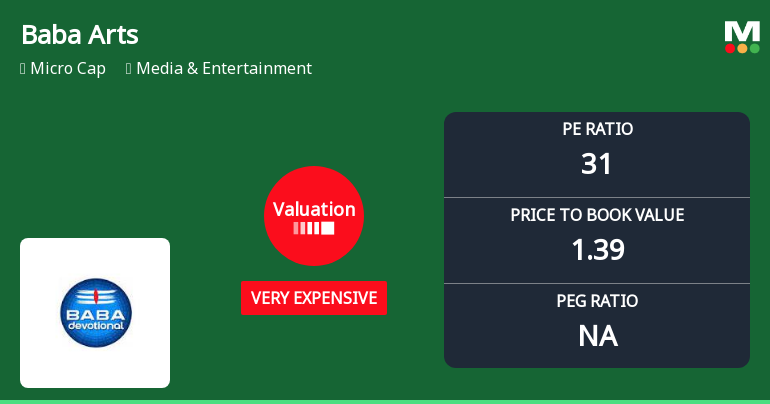

With ROE of 4.5, it has a Very Expensive valuation with a 1.6 Price to Book Value

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Media & Entertainment

INR 47 Cr (Micro Cap)

37.00

72

0.00%

-0.20

4.48%

1.65

Total Returns (Price + Dividend)

Latest dividend: 0.25 per share ex-dividend date: Aug-27-2010

Risk Adjusted Returns v/s

Returns Beta

News

Baba Arts Ltd is Rated Strong Sell

Baba Arts Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 18 Dec 2024. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 04 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Baba Arts Ltd Valuation Shifts Highlight Elevated Price Risks Amid Market Underperformance

Baba Arts Ltd, a key player in the Media & Entertainment sector, has seen its valuation parameters shift markedly, with price-to-earnings (P/E) and price-to-book value (P/BV) ratios moving into the 'very expensive' territory. This change signals a deterioration in price attractiveness relative to historical averages and peer benchmarks, prompting a reassessment of the stock’s investment appeal.

Read full news article

Baba Arts Ltd is Rated Strong Sell

Baba Arts Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 18 December 2024, reflecting a reassessment of the stock’s outlook. However, the analysis and financial metrics presented here are based on the company’s current position as of 15 January 2026, providing investors with the latest insights into its performance and valuation.

Read full news article Announcements

Disclosures under Reg. 10(5) in respect of acquisition under Reg. 10(1)(a) of SEBI (SAST) Regulations 2011

31-Jan-2026 | Source : BSEThe Exchange has received the disclosure under Regulation 10(5) in respect of acquisition under Regulation 10(1)(a) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Gordhan Prabhudas Tanwani

Board Meeting Intimation for To Consider And Approve The Un-Audited Financial Results Of The Company For The Quarter And Nine Months Ended 31St December 2025

30-Jan-2026 | Source : BSEBaba Arts Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/02/2026 inter alia to consider and approve The Un-Audited Financial Results of the Company for the Quarter and Nine Months ended 31st December 2025. Further as intimated earlier vide our communication dated 24th December 2025 the Trading Window for dealing in Equity Shares of the Company which was closed from 1st January 2026 in pursuance of Companys Insider Trading Policy shall remain closed till 13th February 2026 (both days inclusive) i.e till 48 hours after declaration of financial results of the Company in the afore stated Board Meeting.

Announcement under Regulation 30 (LODR)-Resignation of Director

15-Jan-2026 | Source : BSEPursuant to Regulation 30 of the Listing Regulations we have to inform you that Mr.Hasmukh Shah (DIN 00150891) Independent Director of the Company has vide his resignation letter dated 15/01/2026 resigned as Director of the Company with immediate effect. The Resignation is necessitated due to his inability to clear the mandatory Online Proficiency Self -Assessment Test for Independent Directors as prescribed under Rule 6 of the Companies(Appointment and Qualification of Directors) Rules 2014. We further confirm that there is no other material reason for his resignation other than provided above. Information furnished as SEBI Circular dated 11/11/2024 is enclosed.

Corporate Actions

11 Feb 2026

Baba Arts Ltd has declared 25% dividend, ex-date: 27 Aug 10

Baba Arts Ltd has announced 1:4 stock split, ex-date: 29 Oct 09

Baba Arts Ltd has announced 1:1 bonus issue, ex-date: 29 Sep 10

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Gordhan Prabhudas Tanwani (50.67%)

Karishma Const Investments Pvt Ltd (2.42%)

17.24%

Quarterly Results Snapshot (Standalone) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -1.94% vs 24.14% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 133.33% vs -65.91% in Jun 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 340.12% vs -70.55% in Sep 2024

Growth in half year ended Sep 2025 is -30.56% vs 63.64% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

YoY Growth in nine months ended Dec 2024 is -74.98% vs 424.39% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -50.00% vs 227.87% in Dec 2023

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -51.22% vs 310.75% in Mar 2024

YoY Growth in year ended Mar 2025 is -26.90% vs 93.14% in Mar 2024