Compare Bajaj Electrical with Similar Stocks

Stock DNA

Electronics & Appliances

INR 4,658 Cr (Small Cap)

54.00

57

0.76%

-0.04

5.22%

2.67

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Jul-18-2025

Risk Adjusted Returns v/s

Returns Beta

News

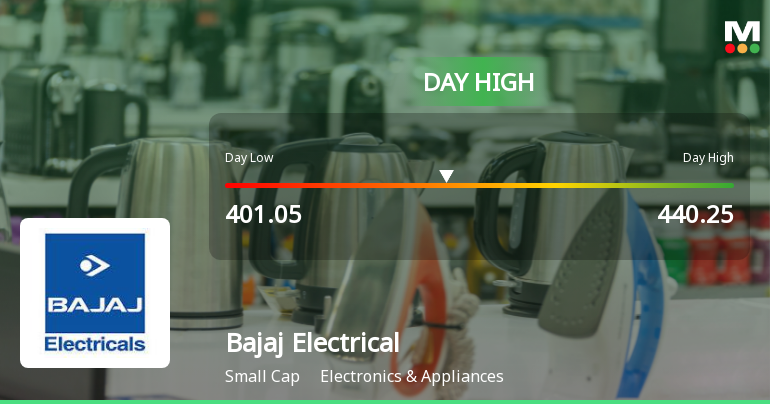

Bajaj Electricals Ltd Hits Intraday High with 7.67% Surge on 3 Feb 2026

Bajaj Electricals Ltd recorded a robust intraday performance on 3 Feb 2026, surging 7.67% to touch a day’s high of Rs 440.25. The stock outperformed its sector and broader market indices, reversing a two-day decline amid heightened volatility and active trading.

Read full news article

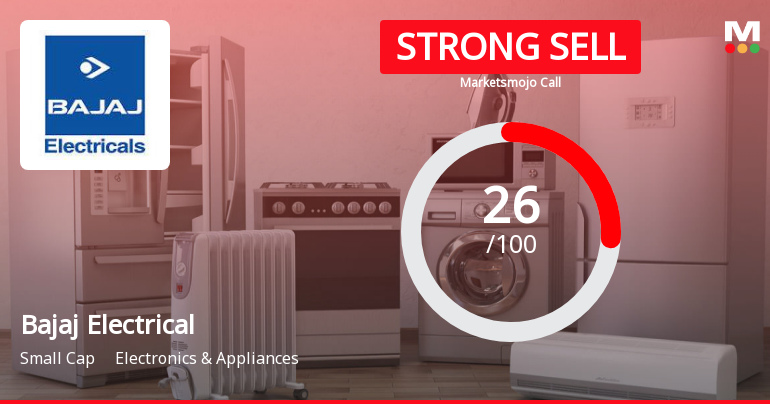

Bajaj Electricals Ltd is Rated Strong Sell

Bajaj Electricals Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 22 September 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with an up-to-date perspective on the company’s performance and outlook.

Read full news article

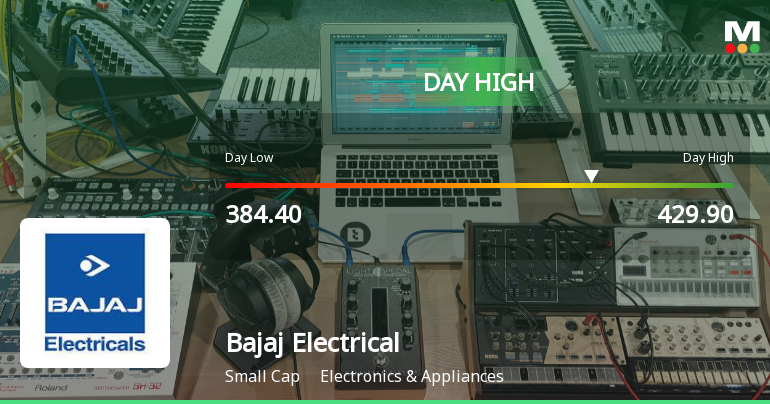

Bajaj Electricals Ltd Hits Intraday High with 7.26% Surge on 30 Jan 2026

Bajaj Electricals Ltd recorded a robust intraday performance on 30 Jan 2026, surging to a day’s high of Rs 422.75, marking a significant 7.26% increase. This strong upward movement outpaced the broader Electronics & Appliances sector and the Sensex, reflecting notable trading momentum amid a volatile market session.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

30-Jan-2026 | Source : BSEIntimation of the Q3FY26 Earnings Call of Bajaj Electricals Limited

Board Meeting Intimation for Consideration And Approval Of The Unaudited Standalone And Consolidated Financial Results Of The Company For The Third Quarter And Nine Months Period Ended December 31 2025.

27-Jan-2026 | Source : BSEBajaj Electricals Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 09/02/2026 inter alia to consider and approve unaudited standalone and consolidated financial results of the Company for the third quarter and nine months period ended December 31 2025.

Introduction/Adoption Of New Product/Business Line By Bajaj Electricals Limited Under Its Lighting Solutions Segment

20-Jan-2026 | Source : BSEPlease refer to the enclosed file

Corporate Actions

09 Feb 2026

Bajaj Electricals Ltd has declared 150% dividend, ex-date: 18 Jul 25

Bajaj Electricals Ltd has announced 2:10 stock split, ex-date: 28 Jan 10

Bajaj Electricals Ltd has announced 1:1 bonus issue, ex-date: 28 Aug 07

Bajaj Electricals Ltd has announced 13:118 rights issue, ex-date: 05 Feb 20

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

2.5484

Held by 11 Schemes (17.08%)

Held by 108 FIIs (6.48%)

Jamnalal Sons Private Limited (19.54%)

Hdfc Small Cap Fund (9.31%)

9.22%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -1.00% vs 0.50% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -23.57% vs -52.71% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -4.47% vs 2.17% in Sep 2024

Growth in half year ended Sep 2025 is -73.74% vs -36.33% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 3.18% vs -8.26% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -26.92% vs -38.06% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 4.03% vs -5.07% in Mar 2024

YoY Growth in year ended Mar 2025 is 1.79% vs -39.41% in Mar 2024