Compare Bliss GVS Pharma with Similar Stocks

Dashboard

Company has a low Debt to Equity ratio (avg) at 0 times

Poor long term growth as Net Sales has grown by an annual rate of 9.41% and Operating profit at 1.49% over the last 5 years

Flat results in Sep 25

With ROE of 9.7, it has a Fair valuation with a 1.9 Price to Book Value

Consistent Returns over the last 3 years

Stock DNA

Pharmaceuticals & Biotechnology

INR 2,041 Cr (Micro Cap)

20.00

32

0.27%

-0.13

9.68%

1.71

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Jul-24-2025

Risk Adjusted Returns v/s

Returns Beta

News

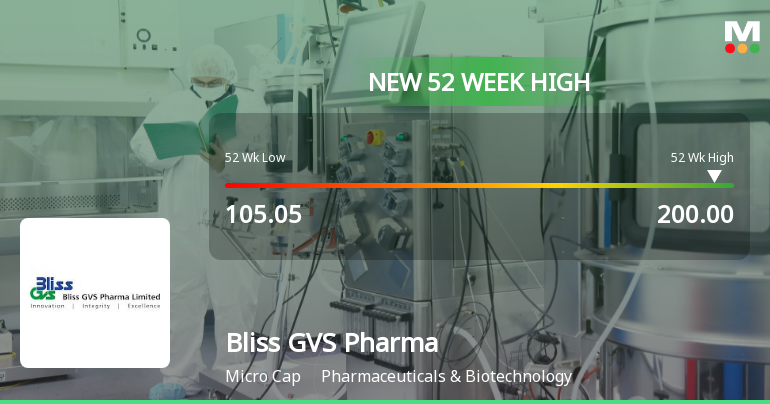

Bliss GVS Pharma Ltd Hits New 52-Week High of Rs 200

Bliss GVS Pharma Ltd has surged to a fresh 52-week high, touching Rs.200 today, reflecting robust momentum in the Pharmaceuticals & Biotechnology sector. This milestone underscores the stock’s strong performance over the past year, significantly outpacing broader market indices and sector peers.

Read full news articleWhen is the next results date for Bliss GVS Pharma Ltd?

The next results date for Bliss GVS Pharma Ltd is scheduled for 10 February 2026....

Read full news article

Bliss GVS Pharma Ltd is Rated Hold

Bliss GVS Pharma Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 12 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 02 February 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Board Meeting Intimation for The Meeting Board Of Directors Of The Company Is Scheduled To Be Held On Tuesday February 10 2026.

03-Feb-2026 | Source : BSEBliss GVS Pharma Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 10/02/2026 inter alia to consider and approve 1. The Unaudited Standalone and Consolidated Financial Results of the Company for the quarter and nine months ended December 31 2025. 2. The Interim Dividend if any for the financial year 2025-2026.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

30-Jan-2026 | Source : BSEPlease find enclosed herewith the Scrutinizer Report alongwith the Voting Results.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

30-Jan-2026 | Source : BSEPlease find enclosed herewith the Voting Result alongwith the Scrutinizer Report.

Corporate Actions

(10 Feb 2026)

Bliss GVS Pharma Ltd has declared 50% dividend, ex-date: 24 Jul 25

Bliss GVS Pharma Ltd has announced 1:10 stock split, ex-date: 11 Mar 08

Bliss GVS Pharma Ltd has announced 3:5 bonus issue, ex-date: 26 Sep 08

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 2 Schemes (0.0%)

Held by 43 FIIs (14.54%)

Narsimha Shibroor Kamath (30.66%)

Life Insurance Corporation Of India (5.78%)

31.48%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 12.27% vs 2.74% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 12.32% vs -42.66% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 12.60% vs 8.06% in Sep 2024

Growth in half year ended Sep 2025 is 56.34% vs -21.11% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 6.93% vs 0.94% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -18.72% vs 25.31% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 5.13% vs 2.48% in Mar 2024

YoY Growth in year ended Mar 2025 is 11.73% vs 6.48% in Mar 2024