Compare Bombay Dyeing with Similar Stocks

Dashboard

With a Operating Losses, the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 8.67% and Operating profit at 8.58% over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -1.15

- OPERATING CF(Y) Lowest at Rs -17.02 Cr

- PAT(Q) At Rs 1.96 cr has Fallen at -77.3% (vs previous 4Q average)

- NET SALES(Q) At Rs 362.63 cr has Fallen at -5.3% (vs previous 4Q average)

Risky - Negative EBITDA

Despite the size of the company, domestic mutual funds hold only 0% of the company

Underperformed the market in the last 1 year

Stock DNA

Garments & Apparels

INR 2,253 Cr (Small Cap)

39.00

64

1.06%

-0.26

2.53%

0.99

Total Returns (Price + Dividend)

Latest dividend: 1.2 per share ex-dividend date: Aug-06-2025

Risk Adjusted Returns v/s

Returns Beta

News

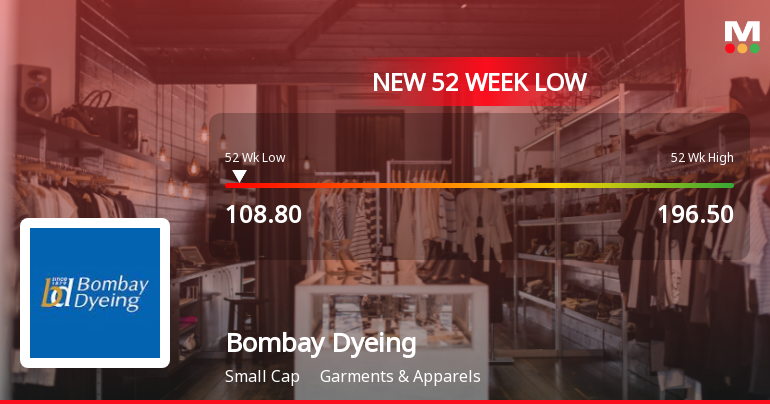

Bombay Dyeing & Manufacturing Company Ltd Falls to 52-Week Low of Rs.108.45

Bombay Dyeing & Manufacturing Company Ltd has reached a new 52-week low, closing at Rs.108.45 today, marking a significant decline amid broader market fluctuations and sectoral pressures.

Read full news article

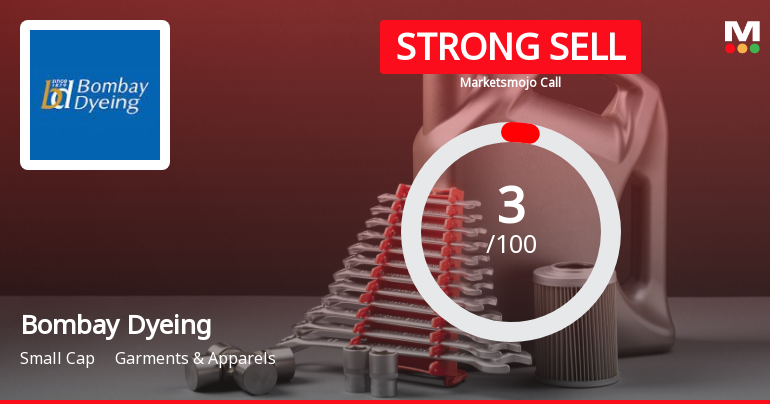

Bombay Dyeing & Manufacturing Company Ltd is Rated Strong Sell

Bombay Dyeing & Manufacturing Company Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 01 September 2025, reflecting a significant reassessment of the stock’s outlook. However, all fundamentals, returns, and financial metrics discussed below are current as of 02 February 2026, providing investors with the latest perspective on the company’s position.

Read full news article

Bombay Dyeing & Manufacturing Company Ltd Hits 52-Week Low at Rs.109.2

Bombay Dyeing & Manufacturing Company Ltd’s stock touched a fresh 52-week low of Rs.109.2 today, marking a significant decline amid broader market fluctuations and sectoral underperformance. The stock’s fall to this level reflects ongoing pressures on the company’s financial metrics and market positioning within the garments and apparels sector.

Read full news article Announcements

Bombay Dyeing & Mfg Company Limited - Press Release

13-Nov-2019 | Source : NSEBombay Dyeing & Mfg Company Limited has informed the Exchange regarding a press release dated November 12, 2019, titled "Extract of Unaudited Financial Results (Standalone and Consolidated) for the quarter and half year ended 30th September, 2019".

Bombay Dyeing & Mfg Company Limited - Press Release

31-Oct-2019 | Source : NSEBombay Dyeing & Mfg Company Limited has informed the Exchange regarding a press release dated October 31, 2019, titled "Board Meeting Notice".

Press Release

07-Aug-2019 | Source : NSE

| Bombay Dyeing & Mfg Company Limited has informed the Exchange regarding a press release dated August 07, 2019, titled "Extract of Unaudited Financial Results (Standalone and Consolidated) for the quarter ended 30th June, 2019". |

Corporate Actions

No Upcoming Board Meetings

Bombay Dyeing & Manufacturing Company Ltd has declared 60% dividend, ex-date: 06 Aug 25

Bombay Dyeing & Manufacturing Company Ltd has announced 2:10 stock split, ex-date: 30 Oct 12

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.0%)

Held by 38 FIIs (0.88%)

Baymanco Investments Limited (28.76%)

Madhuri Madhusudan Kela (1.59%)

36.38%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is -4.03% vs 5.24% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is -86.10% vs 19.67% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -10.96% vs -11.40% in Sep 2024

Growth in half year ended Sep 2025 is -96.15% vs 337.81% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -4.70% vs -34.72% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -83.39% vs 1,165.06% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -4.92% vs -36.85% in Mar 2024

YoY Growth in year ended Mar 2025 is -83.38% vs 670.67% in Mar 2024