Compare Borosil Scienti. with Similar Stocks

Dashboard

Poor Management Efficiency with a low ROE of 4.53%

- The company has been able to generate a Return on Equity (avg) of 4.53% signifying low profitability per unit of shareholders funds

Poor long term growth as Net Sales has grown by an annual rate of 9.80% and Operating profit at 2.86% over the last 5 years

Negative results in Sep 25

Despite the size of the company, domestic mutual funds hold only 0.04% of the company

Below par performance in long term as well as near term

Stock DNA

Industrial Products

INR 942 Cr (Micro Cap)

52.00

51

0.00%

-0.27

4.53%

2.29

Total Returns (Price + Dividend)

Borosil Scienti. for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

When is the next results date for Borosil Scientific Ltd?

The next results date for Borosil Scientific Ltd is scheduled for 11 February 2026....

Read full news article

Borosil Scientific Ltd is Rated Strong Sell

Borosil Scientific Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 21 January 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 02 February 2026, providing investors with the most up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

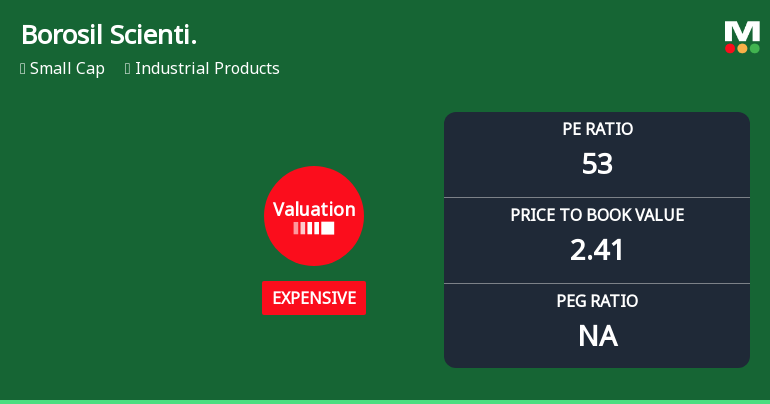

Borosil Scientific Ltd Valuation Shifts Signal Price Attractiveness Concerns

Borosil Scientific Ltd has witnessed a marked shift in its valuation parameters, moving from fair to expensive territory, as reflected in its elevated price-to-earnings (P/E) and price-to-book value (P/BV) ratios. Despite a recent uptick in share price, the company’s multiples now stand significantly above historical averages and peer benchmarks, raising questions about price attractiveness amid subdued return metrics and a challenging market backdrop.

Read full news article Announcements

Board Meeting Intimation for Board Meeting Intimation For Meeting Of The Board Of Directors Of The Company - Wednesday February 11 2026.

04-Feb-2026 | Source : BSEBorosil Scientific Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/02/2026 inter alia to consider and approve Borosil Scientific Ltd has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 11/02/2026 inter alia to consider and approve the Unaudited Financial Results (Standalone & Consolidated) for the quarter and nine months ended December 31 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Jan-2026 | Source : BSECertificate for the quarter ended December 31 2025

Closure of Trading Window

22-Dec-2025 | Source : BSEClosure of Trading Window

Corporate Actions

11 Feb 2026

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.01%)

Held by 18 FIIs (0.07%)

Kiran Kheruka (25.52%)

Borosil Scientific Limited Unclaimed Securities Suspense Escrow Account (2.2%)

23.06%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 11.38% vs -25.87% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 169.47% vs -147.98% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -1.90% vs 15.21% in Sep 2024

Growth in half year ended Sep 2025 is -109.18% vs 62.32% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'24

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 10.51% vs 9.00% in Mar 2024

YoY Growth in year ended Mar 2025 is 11.32% vs 3.25% in Mar 2024