Compare Broadcom Inc. with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 18.75%

Healthy long term growth as Net Sales has grown by an annual rate of 20.90% and Operating profit at 43.37%

With a growth in Operating Profit of 26.04%, the company declared Very Positive results in Jul 25

High Institutional Holdings at 77.68%

Market Beating Performance

Stock DNA

Other Electrical Equipment

USD 1,558,931 Million (Large Cap)

80.00

NA

0.56%

0.60

29.23%

19.18

Total Returns (Price + Dividend)

Broadcom Inc. for the last several years.

Risk Adjusted Returns v/s

News

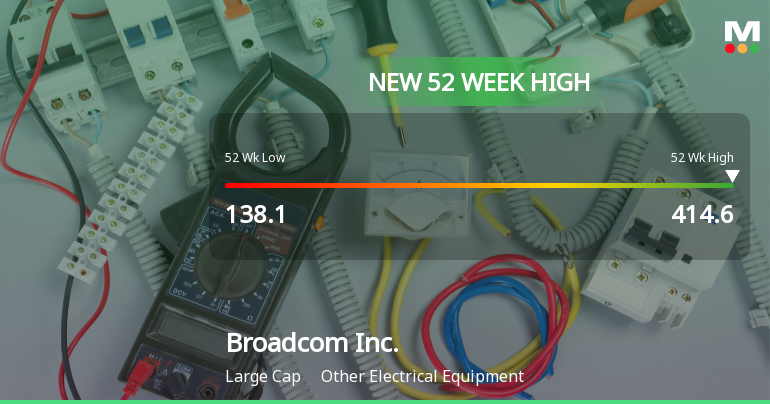

Broadcom Inc. Hits New 52-Week High at USD 414.60

Broadcom Inc. has achieved a new 52-week high, reflecting its strong performance in the Other Electrical Equipment industry with a significant increase over the past year. The company boasts a market capitalization of approximately USD 1.63 trillion, impressive financial metrics, and consistent positive results, reinforcing its market position.

Read full news article

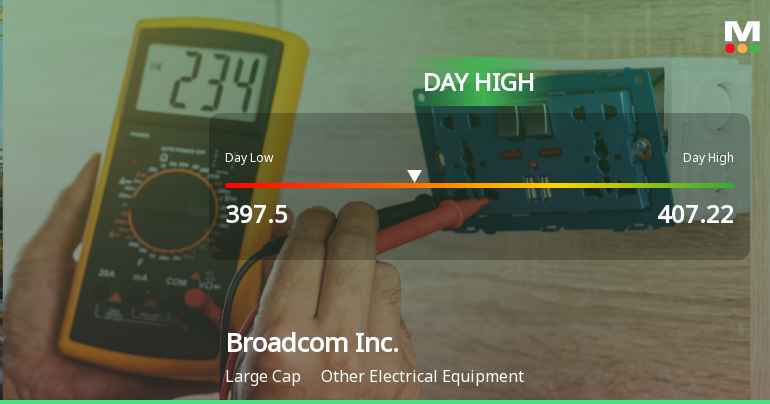

Broadcom Inc. Hits Day High with 5.27% Surge Amid Strong Market Activity

Broadcom Inc. has shown remarkable stock performance, achieving a significant increase on December 8, 2025. Over the past year, the company has outperformed the S&P 500, with impressive growth metrics including a 366.48% rise in net profit and a market capitalization of USD 1,625,755 million.

Read full news article

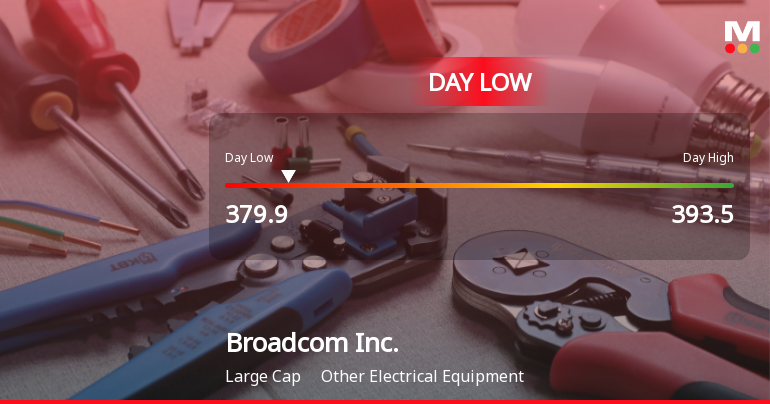

Broadcom Inc. Hits Day Low of $379.90 Amid Price Pressure

Broadcom Inc. saw a significant decline in its stock today, contrasting with a modest decrease in the S&P 500. Despite recent fluctuations, the company has achieved impressive annual returns and maintains strong financial health, highlighted by a high return on capital employed and substantial net profit growth.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Oct 2025

Shareholding Compare (%holding)

Domestic Funds

Held in 326 Schemes (36.7%)

Held by 849 Foreign Institutions (15.9%)

Quarterly Results Snapshot (Consolidated) - Oct'25 - YoY

YoY Growth in quarter ended Oct 2025 is 28.18% vs 51.20% in Oct 2024

YoY Growth in quarter ended Oct 2025 is 102.57% vs 19.32% in Oct 2024

Annual Results Snapshot (Consolidated) - Oct'25

YoY Growth in year ended Oct 2025 is 23.87% vs 43.99% in Oct 2024

YoY Growth in year ended Oct 2025 is 274.94% vs -56.20% in Oct 2024