Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.58 times

- Poor long term growth as Operating profit has grown by an annual rate 3.56% of over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.58 times

- The company has been able to generate a Return on Capital Employed (avg) of 7.13% signifying low profitability per unit of total capital (equity and debt)

Poor long term growth as Operating profit has grown by an annual rate 3.56% of over the last 5 years

Total Returns (Price + Dividend)

Latest dividend: 6 per share ex-dividend date: Oct-27-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are CESC Ltd latest results good or bad?

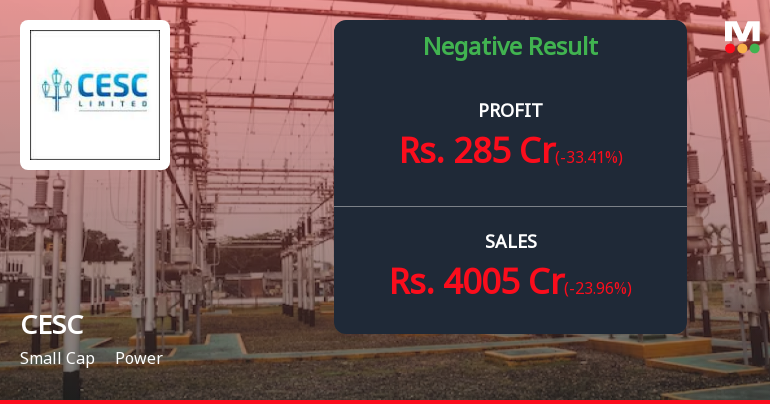

CESC Ltd.'s latest financial results for Q3 FY26 present a complex picture characterized by contrasting year-on-year and quarter-on-quarter performance metrics. The company reported a net profit of ₹285 crores, reflecting a year-on-year increase of 7.55% from ₹265 crores in Q3 FY25. However, this figure represents a significant quarter-on-quarter decline of 33.41% from ₹428 crores in Q2 FY26. Similarly, net sales amounted to ₹4,005 crores, showing a year-on-year growth of 12.47% compared to ₹3,561 crores in the same quarter last year, but a notable quarter-on-quarter drop of 23.96% from ₹5,267 crores in the previous quarter. The operating margin for CESC Ltd. stood at 19.45%, which is a decrease of 69 basis points from the prior quarter's margin of 20.14%, although it is an improvement of 232 basis points from 17.13% year-on-year. The profit after tax (PAT) margin also contracted to 7.59%, down from 8.51% ...

Read full news article

CESC Ltd Q3 FY26: Profit Slumps 33% Despite Revenue Growth

CESC Ltd., the Kolkata-based integrated power utility and flagship company of the RP-Sanjiv Goenka Group, reported a sharp 33.41% quarter-on-quarter decline in consolidated net profit to ₹285.00 crores for Q3 FY26, despite posting a 12.47% year-on-year revenue increase. The disappointing results triggered a bearish technical shift, with the stock trading at ₹154.05 as of February 6, 2026, down 12.22% over the past three months and significantly below all key moving averages.

Read full news article

CESC Ltd is Rated Sell by MarketsMOJO

CESC Ltd is rated Sell by MarketsMOJO, with this rating last updated on 23 January 2026. However, the analysis and financial metrics discussed here reflect the company’s current position as of 06 February 2026, providing investors with the latest insights into the stock’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article Announcements

Unaudited Financial Result For The Quarter And Nine Months Ended 31.12.2025

06-Feb-2026 | Source : BSEFinancial Results is attached

Board Meeting Outcome for Outcome Of Board Meeting- Financial Results

06-Feb-2026 | Source : BSEOutcome of Board Meeting- Results

Announcement under Regulation 30 (LODR)-Investor Presentation

06-Feb-2026 | Source : BSEInvestor Presentation

Corporate Actions

No Upcoming Board Meetings

CESC Ltd has declared 600% dividend, ex-date: 27 Oct 25

CESC Ltd has announced 1:10 stock split, ex-date: 17 Sep 21

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 30 Schemes (17.41%)

Held by 198 FIIs (11.88%)

Rainbow Investments Limited (44.36%)

Life Insurance Corporation Of India (6.58%)

7.98%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -23.96% vs 1.25% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -33.41% vs 10.59% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 9.47% vs 10.40% in Sep 2024

Growth in half year ended Sep 2025 is 11.08% vs 5.18% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 10.29% vs 10.23% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 10.14% vs 2.05% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 11.17% vs 7.35% in Mar 2024

YoY Growth in year ended Mar 2025 is -0.51% vs 2.46% in Mar 2024