Compare C P C L with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 21.83%

Healthy long term growth as Net Sales has grown by an annual rate of 23.57% and Operating profit at 34.53%

With a growth in Net Profit of 40.57%, the company declared Very Positive results in Dec 25

With ROCE of 15.8, it has a Attractive valuation with a 1.4 Enterprise value to Capital Employed

Increasing Participation by Institutional Investors

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: Aug-01-2025

Risk Adjusted Returns v/s

Returns Beta

News

Chennai Petroleum Corporation Ltd is Rated Buy

Chennai Petroleum Corporation Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 16 December 2025. While the rating change occurred then, the analysis and financial metrics discussed here reflect the company’s current position as of 31 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news articleAre Chennai Petroleum Corporation Ltd latest results good or bad?

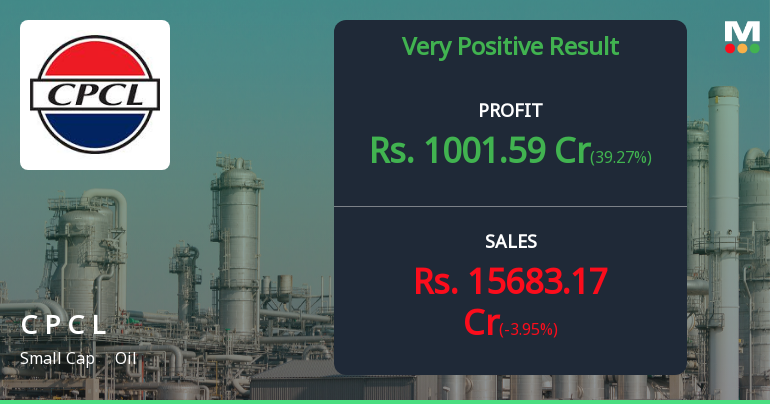

Chennai Petroleum Corporation Ltd's latest financial results for Q3 FY26 indicate a significant turnaround in performance compared to previous periods. The company reported a consolidated net profit of ₹1,001.59 crores, marking a substantial year-on-year increase, reflecting a strong recovery from the challenges faced in FY25. Net sales for the quarter reached ₹15,683.17 crores, which represents a year-on-year growth of 21.34%, although there was a sequential decline of 3.95% from the previous quarter. The operating margin improved markedly to 9.42%, the highest in eight quarters, showcasing the company's ability to enhance profitability through better refining economics and operational efficiency. This is a notable recovery from a loss-making margin of -5.58% in Q2 FY25. The operating profit (PBDIT excluding other income) also saw a significant increase, reaching ₹1,477.95 crores, which is a substantial r...

Read full news article

Chennai Petroleum Q3 FY26: Refining Margins Power 4,720% Profit Surge

Chennai Petroleum Corporation Ltd. (CPCL) has delivered a spectacular turnaround in Q3 FY26, posting a consolidated net profit of ₹1,001.59 crores compared to a modest ₹20.78 crores in the year-ago quarter—a staggering 4,719.97% year-on-year surge that marks one of the most dramatic profit recoveries in India's refining sector. The ₹12,494 crore market capitalisation company, majority-owned by Indian Oil Corporation, saw its stock trading at ₹843.50 on January 23, 2026, up 1.81% as investors digested the robust quarterly performance that underscores a remarkable revival in refining economics.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

26-Jan-2026 | Source : BSENewspaper Clippings - Publication of Audited Standalone & Consolidated Financial Results for the Quarter and Nine Months ended 31.12.2025

Board Meeting Outcome for Audited Financial Results (Standalone And Consolidated ) For The Quarter And Nine Months Ended 31St December 2025.

24-Jan-2026 | Source : BSEAudited Financial results ( Standalone & Consolidated) for the Quarter and Nine Months ended 31.12.2025

Audited Financial Results (Standalone And Consolidated ) For The Quarter And Nine Months Ended 31St December 2025.

24-Jan-2026 | Source : BSEAudited Financial Results (Standalone & Consolidated) for the Quarter and Nine Months ended 31.12.2025

Corporate Actions

No Upcoming Board Meetings

Chennai Petroleum Corporation Ltd has declared 50% dividend, ex-date: 01 Aug 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 20 Schemes (0.66%)

Held by 205 FIIs (12.87%)

Indian Oil Corporation Limited (51.89%)

None

15.27%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -3.95% vs 10.23% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 39.27% vs 1,893.49% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 6.71% vs -6.74% in Sep 2024

Growth in half year ended Sep 2025 is 345.57% vs -115.79% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 11.20% vs -13.48% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 757.02% vs -112.08% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -10.59% vs -13.49% in Mar 2024

YoY Growth in year ended Mar 2025 is -92.20% vs -22.27% in Mar 2024