Compare Craftsman Auto with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 15.89%

Healthy long term growth as Net Sales has grown by an annual rate of 41.11% and Operating profit at 30.84%

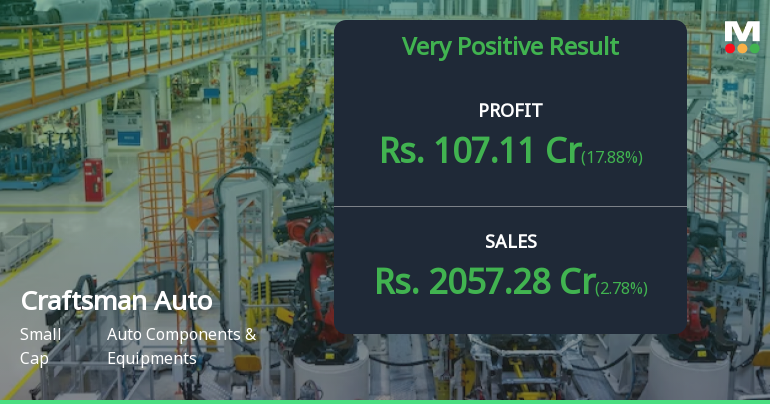

With a growth in Net Profit of 18.05%, the company declared Very Positive results in Dec 25

With ROCE of 9.7, it has a Fair valuation with a 3.5 Enterprise value to Capital Employed

High Institutional Holdings at 41.26%

Stock DNA

Auto Components & Equipments

INR 17,523 Cr (Small Cap)

52.00

30

0.06%

1.03

8.65%

6.12

Total Returns (Price + Dividend)

Latest dividend: 5 per share ex-dividend date: Jul-14-2025

Risk Adjusted Returns v/s

Returns Beta

News

Are Craftsman Automation Ltd latest results good or bad?

Craftsman Automation Ltd's latest financial results for Q3 FY26 highlight a significant year-on-year recovery in net profit, which reached ₹107.11 crores, reflecting a substantial increase from the previous year's low base. Revenue also showed robust growth, amounting to ₹2,057.28 crores, marking the highest quarterly sales in the company's history. This revenue performance indicates sustained demand in the auto components sector, despite broader industry challenges. The operating margin improved to 15.18%, up from 12.62% in Q3 FY25, demonstrating enhanced operational efficiency. However, the profit after tax (PAT) margin of 5.21% remains below historical levels, suggesting that while profitability has rebounded, it has not yet reached new heights. The company experienced a quarter-on-quarter revenue growth of 2.78% and a net profit increase of 17.88%, indicating ongoing operational progress, although thes...

Read full news article

Craftsman Automation Q3 FY26: Strong Profit Surge Masks Margin Compression Concerns

Craftsman Automation Ltd., a diversified engineering company specialising in manufacturing components and sub-assemblies for the automotive sector, reported a consolidated net profit of ₹107.11 crores for Q3 FY26, marking an exceptional 728.38% year-on-year surge from ₹12.93 crores in Q3 FY25. On a sequential basis, profit advanced 17.88% from ₹90.86 crores in Q2 FY26. The stock responded positively, gaining 2.84% to close at ₹7,794.45 on January 28, 2026, pushing the company's market capitalisation to ₹18,594.11 crores.

Read full news article

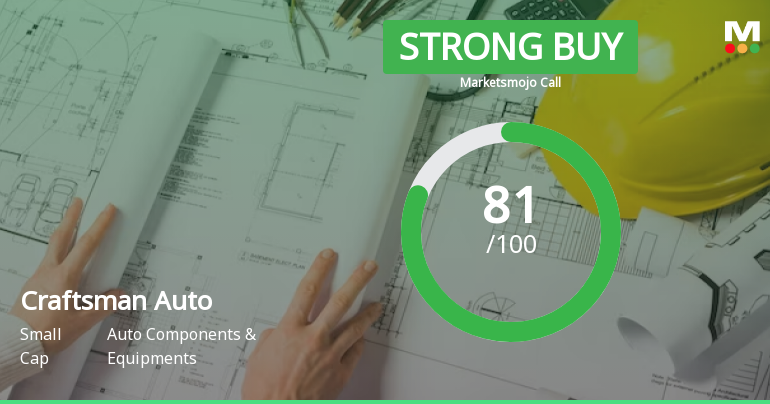

Craftsman Automation Ltd is Rated Strong Buy

Craftsman Automation Ltd is rated 'Strong Buy' by MarketsMOJO, with this rating last updated on 16 December 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 20 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article Announcements

Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI (LODR) Regulations 2015);

15-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI LODR Regulation 2015 and in continuation to our earlier intimation letter dated 4th Jan 2025 we wish to inform you that the Commissioner (Appeals) Gurugram vide order dated 30th December 2025 (received by the Company on 14th January 2026) has upheld the tax demand of Rs.962.89 Lakhs and the penalty demand of Rs.962.89 Lakhs in connection with the appeal of the Company against the order passed by the Joint Commissioner of CGST Faridabad.

Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015 (SEBI (LODR) Regulations 2015)

15-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI LODR Regulations 2015 and in continuation to our earlier intimation letter dated 4th Jan 2025 we wish to inform you that the Commissioner (Appeals) Gurugram vide order dated 30th December 2025 (received by the Company on 14th January 2026) has upheld the tax demand of Rs.962.89 lakhs and the penalty amount of Rs.962.89 lakhs in connection with the appeal of the Company against the order passed by the Joint Commissioner of CGST Faridabad.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Jan-2026 | Source : BSEPlease find enclosed the Certificate under Regulation 74(5) of the SEBI(DP)Regulations 2018 for the quarter ended 31st December 2025 received from MUFG Intime India Private limited RTA of the Company.

Corporate Actions

No Upcoming Board Meetings

Craftsman Automation Ltd has declared 100% dividend, ex-date: 14 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 28 Schemes (18.4%)

Held by 157 FIIs (16.02%)

Mr. Srinivasan Ravi (44.01%)

Invesco India Consumption Fund (3.1%)

6.16%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 2.78% vs 12.20% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 17.88% vs 30.55% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 60.06% vs 6.70% in Sep 2024

Growth in half year ended Sep 2025 is 39.68% vs -32.03% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 48.25% vs 17.78% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 109.35% vs -47.22% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 27.83% vs 39.88% in Mar 2024

YoY Growth in year ended Mar 2025 is -36.10% vs 22.58% in Mar 2024