Compare CWD with Similar Stocks

Dashboard

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.39 times

Healthy long term growth as Net Sales has grown by an annual rate of 70.50% and Operating profit at 46.20%

Flat results in Sep 23

Despite the size of the company, domestic mutual funds hold only 0% of the company

Market Beating Performance

Total Returns (Price + Dividend)

CWD for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

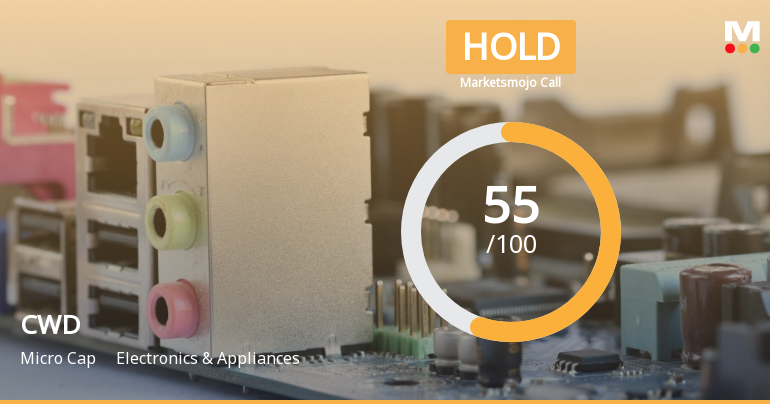

CWD Ltd is Rated Hold by MarketsMOJO

CWD Ltd is currently rated 'Hold' by MarketsMOJO, a rating that was last updated on 02 June 2025. However, the analysis and financial metrics discussed here reflect the stock's present position as of 03 February 2026, providing investors with the most up-to-date insight into the company’s performance and outlook.

Read full news article

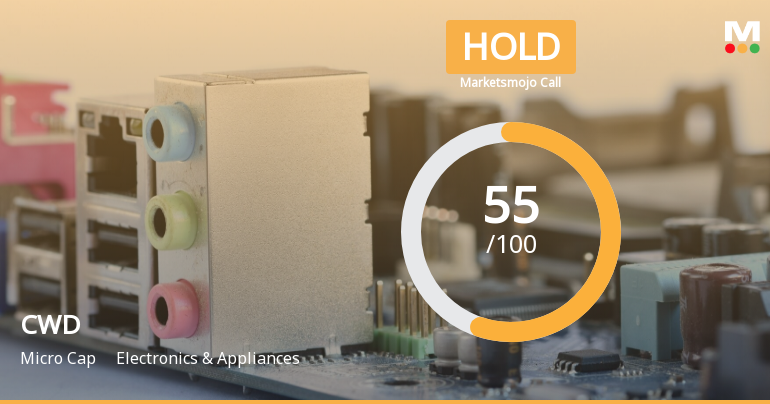

CWD Ltd is Rated Hold by MarketsMOJO

CWD Ltd is currently rated 'Hold' by MarketsMOJO, a rating that was last updated on 02 June 2025. While the rating change occurred mid-2025, the analysis and financial metrics discussed here reflect the stock’s present position as of 23 January 2026, providing investors with the most up-to-date perspective on the company’s performance and outlook.

Read full news article

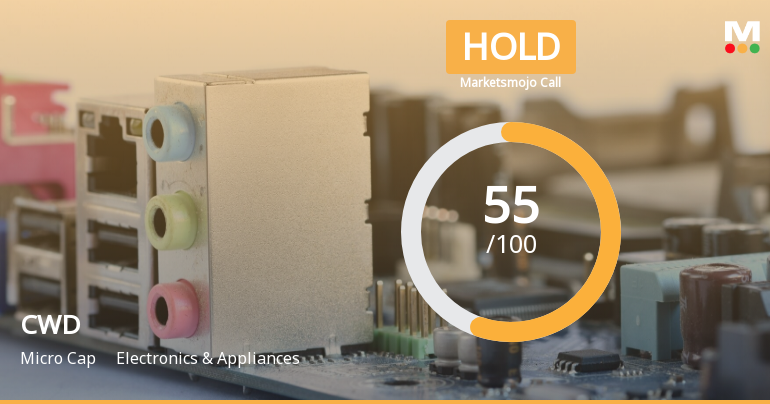

CWD Ltd is Rated Hold by MarketsMOJO

CWD Ltd is rated 'Hold' by MarketsMOJO, a rating that was last updated on 02 June 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 12 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Allotment

16-Jan-2026 | Source : BSEAllotment of Equity Shares on Conversion of Warrants.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

14-Jan-2026 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regultion 2018 for the quarter ended December 31 2025

Announcement Under Regulation 30 (LODR) - Business Update For The Quarter & Nine Months Ended December 31 2025 (Q3 & 9M FY26)

06-Jan-2026 | Source : BSEAnnouncement under Regulation 30 (LODR) - Business Update for the Quarter & Nine Months Ended December 31 2025 (Q3 & 9M FY26)

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

CWD Ltd has announced 4:1 bonus issue, ex-date: 02 Jan 26

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Sodagudi Siddhartha Xavier (29.7%)

Arc Finance Limited (3.09%)

20.6%

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 56.23% vs 277.91% in Mar 2025

Growth in half year ended Sep 2025 is -3.23% vs 336.61% in Mar 2025

Nine Monthly Results Snapshot (Consolidated) - Sep'23

YoY Growth in nine months ended Sep 2023 is 272.57% vs -13.70% in Sep 2023

YoY Growth in nine months ended Sep 2023 is 138.07% vs -282.46% in Sep 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 61.20% vs -7.66% in Mar 2024

YoY Growth in year ended Mar 2025 is 122.12% vs -47.69% in Mar 2024