Compare Diversified Energy Co. Plc with Similar Stocks

Total Returns (Price + Dividend)

Diversified Energy Co. Plc for the last several years.

Risk Adjusted Returns v/s

News

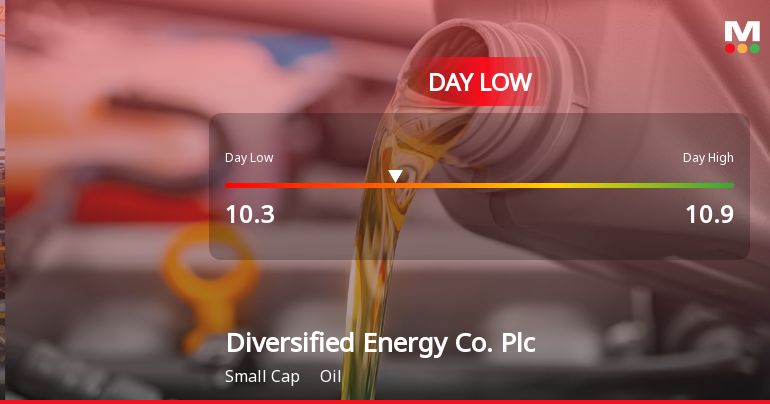

Diversified Energy Co. Hits Day Low of GBP 10.30 Amid Price Pressure

Diversified Energy Co. Plc has faced significant stock declines, with notable downturns over the past week, month, and year. Despite high management efficiency and a strong return on equity, the company struggles with a high debt burden and decreasing profits, reflecting a challenging financial environment.

Read full news article

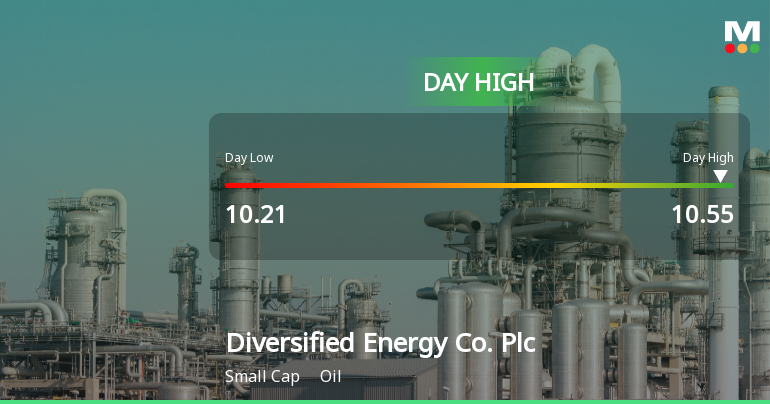

Diversified Energy Co. Hits Day High with 9.45% Surge in Stock Price

Diversified Energy Co. Plc has seen a notable increase in stock performance, with a significant rise on November 5, 2025. The company, operating in the oil industry, has outperformed the FTSE 100 recently, demonstrating strong management efficiency and financial health, despite a negative year-to-date performance.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Jun 2025

Shareholding Compare (%holding)

Foreign Institutions

Held in 13 Schemes (13.14%)

Held by 224 Foreign Institutions (33.52%)

Annual Results Snapshot (Consolidated) - Dec'23

YoY Growth in year ended Dec 2023 is -55.17% vs 112.69% in Dec 2022

YoY Growth in year ended Dec 2023 is 221.32% vs -113.02% in Dec 2022