Compare Dollar Industrie with Similar Stocks

Stock DNA

Garments & Apparels

INR 1,778 Cr (Small Cap)

17.00

20

0.95%

0.38

11.80%

1.99

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Jul-18-2025

Risk Adjusted Returns v/s

Returns Beta

News

Dollar Industries Ltd is Rated Sell

Dollar Industries Ltd is rated Sell by MarketsMOJO, with this rating last updated on 05 Jan 2026. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 28 January 2026, providing investors with an up-to-date perspective on the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

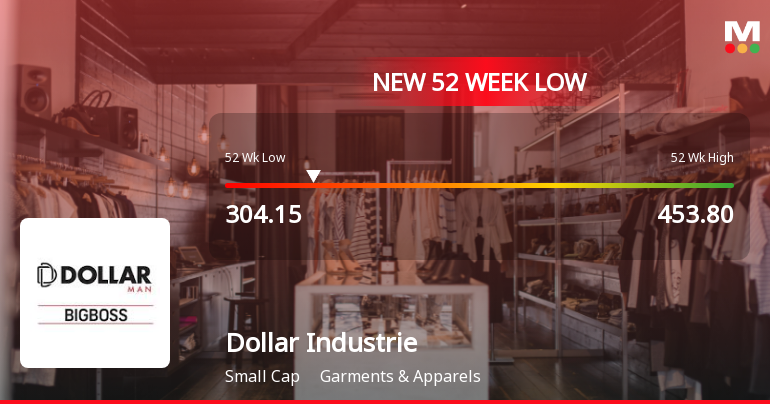

Dollar Industries Ltd Falls to 52-Week Low Amid Continued Underperformance

Shares of Dollar Industries Ltd, a key player in the Garments & Apparels sector, have declined to a fresh 52-week low, closing near Rs 304.15 on 23 Jan 2026. This marks a significant milestone as the stock trades just 2.83% above its lowest price in the past year, reflecting ongoing challenges in its market performance and valuation metrics.

Read full news article

Dollar Industries Ltd Falls to 52-Week Low Amid Continued Underperformance

Dollar Industries Ltd has declined to its 52-week low, reflecting ongoing challenges in its market performance. The stock’s recent fall to this significant price level underscores persistent headwinds despite some positive financial indicators.

Read full news article Announcements

Dollar Industries Limited - Other General Purpose

03-Dec-2019 | Source : NSEDollar Industries Limited has informed the Exchange regarding Disclosure of Related Party Transactions pursuant to Regulation 23(9) of SEBI ( LODR) Regulations, 2015.

Dollar Industries Limited - Investor Presentation

13-Nov-2019 | Source : NSEDollar Industries Limited has informed the Exchange regarding Investor Presentation, Further to our intimation dated 07.11.2019 regarding Schedule of Analyst/ Institutional Investor Meet (Earning Call) and pursuant to Regulation 30(6) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, we are enclosing a copy of presentation to be made on the financials and other matters of the Company at the aforesaid Meet on 13.11.2019.

Dollar Industries Limited - Updates

05-Nov-2019 | Source : NSEDollar Industries Limited has informed the Exchange regarding 'Pursuant to Regulation 30 read with Part-A of Schedule-III of Securities& Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, the Company has published the Notice of the Board Meeting to be held on 12th November, 2019 in the newspapers viz. The Economic Times in English and Ei Samay in Bengali on 04.11.2019, inter alia, to consider and approve the un-audited financial results (both standalone and consolidated) of the Company for the quarter and half year ended 30th September, 2019.

Corporate Actions

No Upcoming Board Meetings

Dollar Industries Ltd has declared 150% dividend, ex-date: 18 Jul 25

Dollar Industries Ltd has announced 2:10 stock split, ex-date: 31 Aug 17

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.0%)

Held by 34 FIIs (4.36%)

Dollar Holdings Private Limited (46.28%)

Fidelity Funds-asian Smaller Companies (2.35%)

13.29%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 5.59% vs 8.33% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 32.67% vs 6.59% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 11.58% vs 5.38% in Sep 2024

Growth in half year ended Sep 2025 is 35.08% vs 6.14% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 8.30% vs 8.59% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 8.19% vs 9.85% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 8.79% vs 12.80% in Mar 2024

YoY Growth in year ended Mar 2025 is 0.93% vs 71.68% in Mar 2024