Compare Dynamic Cables with Similar Stocks

Dashboard

Falling Participation by Institutional Investors

- Institutional investors have decreased their stake by -0.57% over the previous quarter and collectively hold 1.56% of the company

- These investors have better capability and resources to analyse fundamentals of companies than most retail investors

Underperformed the market in the last 1 year

Stock DNA

Cables - Electricals

INR 1,411 Cr (Small Cap)

17.00

39

0.08%

-0.01

20.43%

3.48

Total Returns (Price + Dividend)

Latest dividend: 0.5 per share ex-dividend date: Jun-23-2025

Risk Adjusted Returns v/s

Returns Beta

News

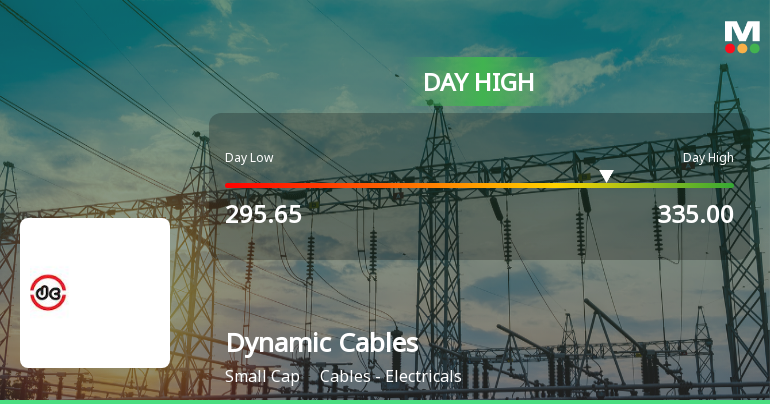

Dynamic Cables Ltd Hits Intraday High with 13.43% Surge on 28 Jan 2026

Dynamic Cables Ltd recorded a robust intraday performance on 28 Jan 2026, surging 13.43% to touch a day’s high of Rs 318.8. The stock outperformed its sector and broader market indices amid heightened volatility and sustained buying momentum.

Read full news articleAre Dynamic Cables Ltd latest results good or bad?

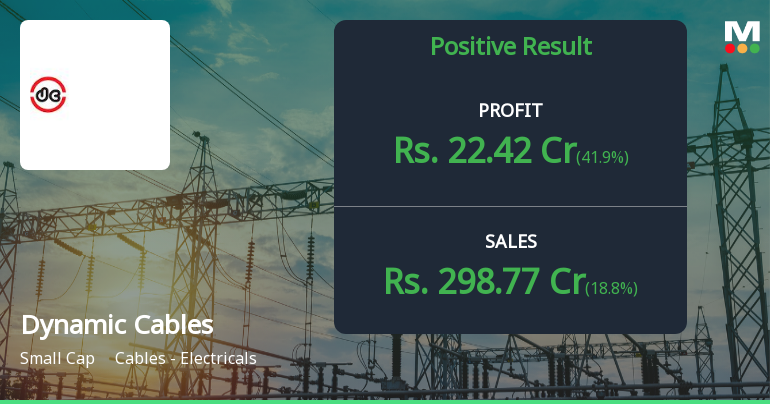

Dynamic Cables Ltd's latest financial results for the quarter ending December 2025 indicate a strong operational performance, with notable growth in both net profit and revenue. The company reported a net profit of ₹22.42 crore, reflecting a year-on-year growth of 41.90%, while revenue reached ₹298.77 crore, marking an 18.80% increase compared to the same quarter last year. This performance highlights the company's effective cost management and operational leverage, particularly in a challenging market environment characterized by volatile raw material prices. The operating profit margin for the quarter stood at 11.46%, which is the highest margin recorded in the company's history, showcasing significant improvement in operational efficiency. Additionally, the profit after tax (PAT) margin increased to 7.50%, up by 122 basis points year-on-year, further emphasizing the company's ability to enhance profitab...

Read full news article

Dynamic Cables Q3 FY26: Strong Profit Growth Masks Technical Weakness

Dynamic Cables Ltd., a Jaipur-based electrical cables manufacturer, reported robust financial performance in Q3 FY26, with net profit surging 41.90% year-on-year to ₹22.42 crores, driven by strong revenue growth and expanding margins. However, the stock remains under severe technical pressure, trading 44.51% below its 52-week high of ₹525.00, reflecting broader market concerns about valuation sustainability and near-term momentum.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

Dynamic Cables Ltd has declared 5% dividend, ex-date: 23 Jun 25

No Splits history available

Dynamic Cables Ltd has announced 1:1 bonus issue, ex-date: 11 Jul 25

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 6 FIIs (0.53%)

Ashish Mangal (31.81%)

None

25.91%

Quarterly Results Snapshot (Standalone) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 18.80% vs 30.77% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 41.90% vs 110.11% in Dec 2024

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 22.79% vs 32.23% in Sep 2024

Growth in half year ended Sep 2025 is 48.68% vs 54.52% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 21.34% vs 31.70% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 46.08% vs 71.95% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 33.51% vs 14.86% in Mar 2024

YoY Growth in year ended Mar 2025 is 71.62% vs 21.80% in Mar 2024