Compare Eveready Inds. with Similar Stocks

Dashboard

Low ability to service debt as the company has a high Debt to EBITDA ratio of 2.51 times

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 2.51 times

Poor long term growth as Operating profit has grown by an annual rate -3.50% of over the last 5 years

Flat results in Sep 25

Consistent Underperformance against the benchmark over the last 3 years

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: Jul-29-2025

Risk Adjusted Returns v/s

Returns Beta

News

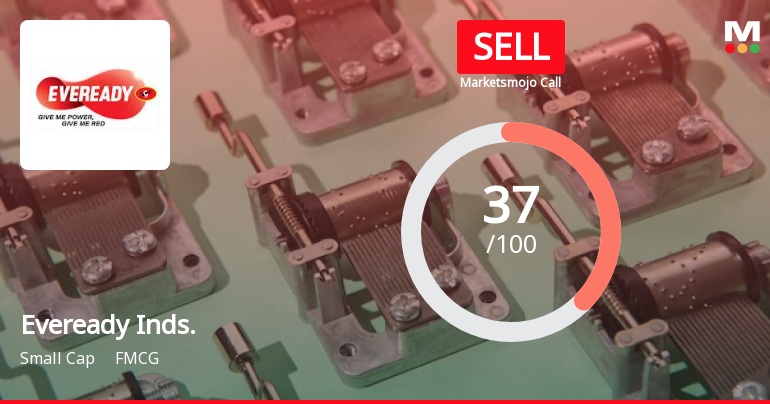

Eveready Industries India Ltd is Rated Sell

Eveready Industries India Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 06 Nov 2025, but the analysis below reflects the stock's current position as of 22 January 2026, incorporating the latest fundamentals, returns, and financial metrics.

Read full news article

Eveready Industries India Ltd is Rated Sell

Eveready Industries India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 06 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 11 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

Eveready Industries India Ltd is Rated Sell

Eveready Industries India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 06 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 31 December 2025, providing investors with an up-to-date view of the company's fundamentals, returns, and market standing.

Read full news article Announcements

Eveready Industries India Limited - Updates

14-Nov-2019 | Source : NSEEveready Industries India Limited has informed the Exchange regarding 'Pursuant to the provisrons of Regulation 47 of the SEBI (Listing Obligations and Disclosure Requirements), Regulations, 2015, and further to our letter of November 12, 2019, we enclose a copy of

Eveready Industries India Limited - Limited Review Report

13-Nov-2019 | Source : NSEEveready Industries India Limited has informed the Exchange regarding Limited Review Report for the Quarter ended September 30, 2019

Eveready Industries India Limited - Updates

06-Nov-2019 | Source : NSEEveready Industries India Limited has informed the Exchange regarding 'Pursuant to the provisions of Regulation 47 of the SEBI (Listing Obligations and Disclosure Requirements), Regulations, 2015 and further to our letter of November 04, 2019 we enclose a copy of the advertisement which was published in Financial Express and Aajkaal on Tuesday, November 05,2019.'.

Corporate Actions

05 Feb 2026

Eveready Industries India Ltd has declared 30% dividend, ex-date: 29 Jul 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

5.3193

Held by 5 Schemes (2.65%)

Held by 37 FIIs (5.05%)

M B Finmart Private Limited (11.81%)

Theleme India Master Fund Limited (4.31%)

22.17%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 6.67% vs -0.62% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -126.76% vs 16.19% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 6.87% vs -2.26% in Sep 2024

Growth in half year ended Sep 2025 is -62.12% vs 17.14% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 1.17% vs -0.79% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 22.67% vs 39.72% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 2.30% vs -1.01% in Mar 2024

YoY Growth in year ended Mar 2025 is 23.49% vs 141.62% in Mar 2024