Compare Filatex India with Similar Stocks

Dashboard

High Management Efficiency with a high ROE of 18.10%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 0.68 times

Poor long term growth as Operating profit has grown by an annual rate 17.63% of over the last 5 years

The company has declared Positive results for the last 5 consecutive quarters

With ROE of 13.1, it has a Attractive valuation with a 1.6 Price to Book Value

Majority shareholders : Promoters

Stock DNA

Garments & Apparels

INR 2,276 Cr (Small Cap)

12.00

22

0.00%

-0.15

12.57%

1.52

Total Returns (Price + Dividend)

Latest dividend: 0.2 per share ex-dividend date: Sep-19-2022

Risk Adjusted Returns v/s

Returns Beta

News

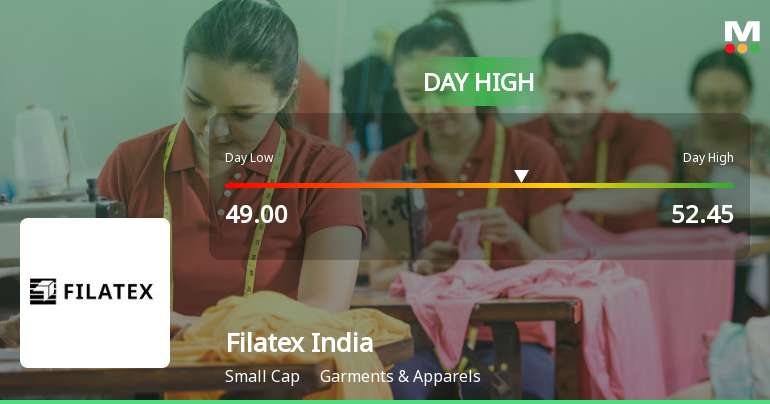

Filatex India Ltd Hits Intraday High with 7.82% Surge on 9 Feb 2026

Filatex India Ltd recorded a robust intraday performance on 9 Feb 2026, surging to a day’s high of Rs 51.57, marking a 7.53% increase from its previous close. The stock outperformed its sector and broader market indices, reflecting heightened trading activity and volatility throughout the session.

Read full news article

Filatex India Ltd Technical Momentum Shifts Amid Bearish Signals

Filatex India Ltd, a key player in the Garments & Apparels sector, has experienced a notable shift in its technical momentum, moving from a mildly bearish to a more pronounced bearish trend. Despite some mixed signals from various technical indicators, the overall outlook has prompted a downgrade in its Mojo Grade from Buy to Hold as of 22 Dec 2025, reflecting growing caution among investors.

Read full news articleAre Filatex India Ltd latest results good or bad?

Filatex India Ltd's latest financial results for Q2 FY26 indicate a complex performance landscape. The company reported net sales of ₹1,075.93 crores, reflecting a modest year-on-year growth of 2.56%. However, this growth is tempered by the broader challenges in the textile sector, where demand remains weak, as evidenced by the Garments & Apparels sector's decline of 5.93% over the past year. The net profit for the quarter surged to ₹47.55 crores, marking a significant year-on-year increase of 256.45%. This impressive figure, however, is influenced by a low base from the previous year, where net profit was only ₹13.34 crores. Sequentially, net profit grew by 16.95% from ₹40.66 crores in Q1 FY26, aided by improved operating leverage and reduced interest costs. Operating margins, excluding other income, improved to 7.67%, up from 6.47% in the previous quarter, but remain below historical peaks. The company...

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Investor Presentation

07-Feb-2026 | Source : BSEPlease find attached Investor Presentation - Q3FY2026 .

Board Meeting Outcome for Unaudited Financial Results For The Quarter And Nine Months Ended 31St December 2025

07-Feb-2026 | Source : BSEStandalone and Consolidated Unaudited Financial Results for the quarter and nine months ended 31st December 2025 are enclosed. In this regard please also find enclosed Earnings Release.

Unaudited Financial Results (The Standalone And Consolidated) For The Quarter And Nine Months Ended 31St December 2025

07-Feb-2026 | Source : BSEPlease find attached financial results alongwith Limited Review reports for the quarter and nine months ended 31st December 2025. Earning release for the same is also attached.

Corporate Actions

No Upcoming Board Meetings

Filatex India Ltd has declared 25% dividend, ex-date: 19 Sep 25

Filatex India Ltd has announced 1:2 stock split, ex-date: 27 Dec 22

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 2 Schemes (0.83%)

Held by 46 FIIs (4.51%)

Madhav Bhageria (9.7%)

Chaturbhuj Properties Llp (4.92%)

17.85%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -2.44% vs 2.53% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 16.31% vs 16.82% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 1.04% vs -3.38% in Sep 2024

Growth in half year ended Sep 2025 is 92.99% vs 12.38% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 0.09% vs -2.70% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 54.15% vs 22.91% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

Not Applicable: The company has declared_date for only one period

Not Applicable: The company has declared_date for only one period