Compare FratelliVineyard with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -160.50% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 4.54 times

- The company has reported losses. Due to this company has reported negative ROE

The company has declared Negative results for the last 4 consecutive quarters

Risky - Negative EBITDA

Underperformed the market in the last 1 year

Stock DNA

Beverages

INR 391 Cr (Micro Cap)

NA (Loss Making)

26

0.00%

0.95

-15.52%

2.63

Total Returns (Price + Dividend)

FratelliVineyard for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

Fratelli Vineyards Ltd Stock Falls to 52-Week Low of Rs.86

Fratelli Vineyards Ltd, a player in the beverages sector, recorded a fresh 52-week low of Rs.86 today, marking a significant decline in its stock price amid broader market gains. This new low reflects ongoing pressures on the company’s financial performance and market valuation.

Read full news article

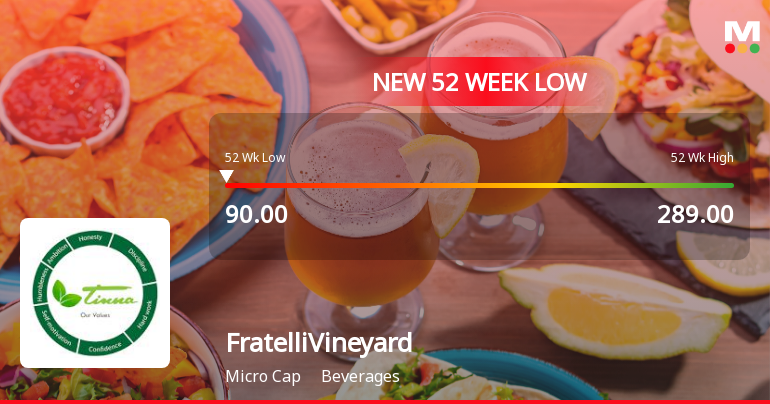

Fratelli Vineyards Ltd Stock Falls to 52-Week Low of Rs.90

Fratelli Vineyards Ltd, a key player in the beverages sector, has reached a new 52-week low of Rs.90 today, marking a significant decline in its stock price amid ongoing downward momentum and underperformance relative to its sector and broader market indices.

Read full news article

Fratelli Vineyards Ltd is Rated Strong Sell

Fratelli Vineyards Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 15 Jan 2025. However, the analysis and financial metrics discussed here reflect the stock’s current position as of 24 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article Announcements

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

17-Jan-2026 | Source : BSECompliance certificate under regulation 74(5) of SEBI (Depository and Participants) Regulation 2018 for the quarter ended 31st December 2025

Closure of Trading Window

29-Dec-2025 | Source : BSEPursuant to the SEBI (PIT) Regulation 2015 as amended the Trading window for dealing in the securities of the company shall remain closed for all designated persons and their Immediate relatives as well as connected persons therof with effect from Thursday 1st January 2026 untill 48 hours after the un-audited financial results of the company for the 3rd quarter and nine months period ended on December 31st 2025 are generally available to the public.

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

26-Nov-2025 | Source : BSEwe hereby submit the Transcript of Earning concall held on Tuesday 18 2025 on the operation and financial performance of the Company Q2H1FY26

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 1 FIIs (0.48%)

Bgk Infratech Private Limited (13.45%)

Mayank Singhal (9.48%)

32.53%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 25.66% vs 14.38% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 43.13% vs 46.85% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -61.18% vs -3.18% in Sep 2024

Growth in half year ended Sep 2025 is -3,415.38% vs -136.36% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is -18.73% vs 71.92% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -876.92% vs 138.24% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is -33.03% vs 84.18% in Mar 2024

YoY Growth in year ended Mar 2025 is -9,220.00% vs 90.85% in Mar 2024