Compare Games Workshop Group Plc with Similar Stocks

Dashboard

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 55.12%

- Healthy long term growth as Net Sales has grown by an annual rate of 16.10% and Operating profit at 20.49%

- Company has very low debt and has enough cash to service the debt requirements

The company has declared Positive results for the last 4 consecutive quarters

With ROE of 70.37%, it has a fair valuation with a 16.67 Price to Book Value

Total Returns (Price + Dividend)

Games Workshop Group Plc for the last several years.

Risk Adjusted Returns v/s

News

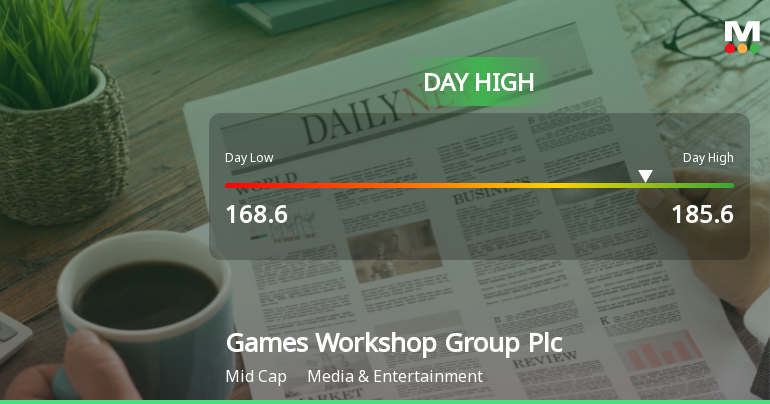

Games Workshop Stock Soars 13.63%, Hits Intraday High of GBP 185.60

Games Workshop Group Plc's stock has shown remarkable growth, with a notable increase on November 20, 2025. The company has achieved significant gains over the past week, month, and year, outperforming the FTSE 100. Its strong financial metrics highlight its operational strength and solid market position.

Read full news article

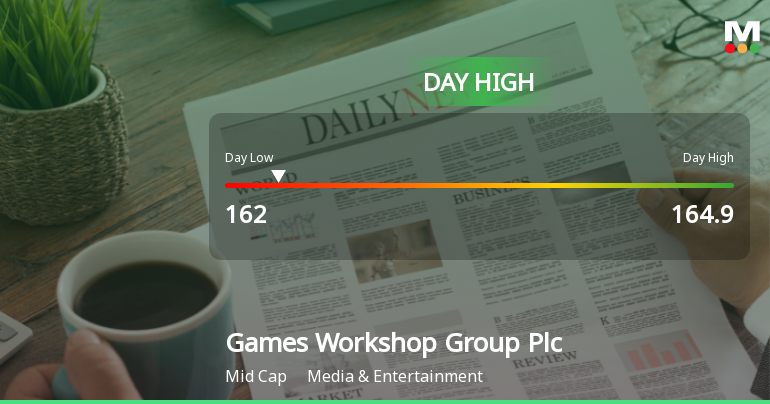

Games Workshop Stock Hits Day High with 5.39% Surge in Strong Performance

Games Workshop Group Plc has experienced notable stock performance, significantly outperforming the FTSE 100 over various timeframes. The company reported strong financial metrics, including a high return on equity and substantial net sales. Its low debt levels and consistent positive quarterly results underscore its operational strength and growth potential.

Read full news article

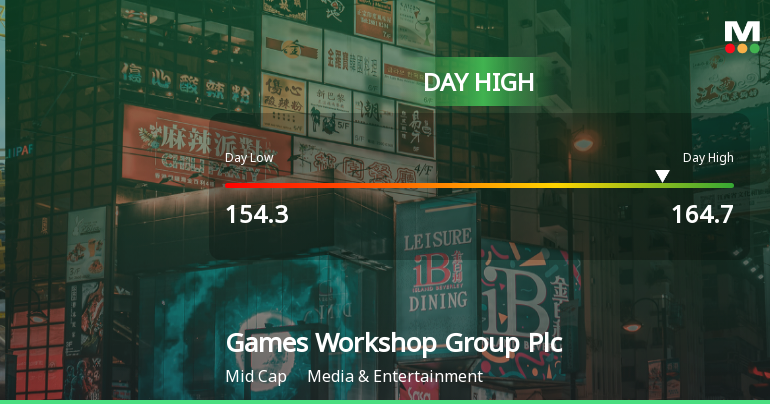

Games Workshop Group Plc Hits Day High with 5.97% Surge

Games Workshop Group Plc has shown strong stock performance, with notable growth over the past year. The company boasts impressive financial metrics, including a high return on equity and consistent annual sales growth. Its valuation remains fair, and it has outperformed the FTSE 100 over the last three years.

Read full news article Announcements

Corporate Actions

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Nov 2025

Shareholding Compare (%holding)

Foreign Institutions

Held in 0 Schemes (0%)

Held by 2 Foreign Institutions (0.01%)

Annual Results Snapshot (Consolidated) - May'23

YoY Growth in year ended May 2023 is 13.50% vs 12.26% in May 2022

YoY Growth in year ended May 2023 is 4.91% vs 5.25% in May 2022