Compare GMR Urban with Similar Stocks

Dashboard

With HIgh Debt (Debt-Equity Ratio at 7.45 times)- the company has a Weak Long Term Fundamental Strength

- Poor long term growth as Net Sales has grown by an annual rate of 12.16% and Operating profit at 0% over the last 5 years

- High Debt Company with a Debt to Equity ratio (avg) at 0 times

Negative results in Sep 25

Stock DNA

Power

INR 7,916 Cr (Small Cap)

NA (Loss Making)

19

0.00%

7.45

-31.78%

5.72

Total Returns (Price + Dividend)

GMR Urban for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

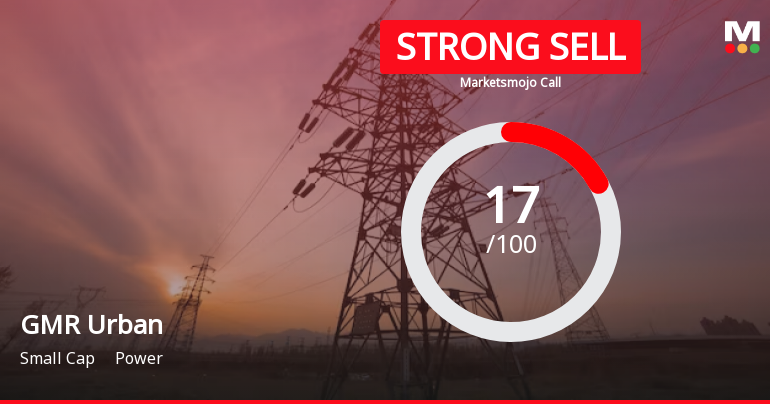

GMR Power & Urban Infra Ltd is Rated Strong Sell

GMR Power & Urban Infra Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 19 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

GMR Power & Urban Infra Ltd Valuation Shifts to Fair Amidst Market Pressure

GMR Power & Urban Infra Ltd has seen a notable shift in its valuation parameters, moving from an attractive to a fair rating, reflecting a complex interplay of deteriorating profitability metrics and challenging market sentiment. Despite a strong long-term return record, recent price-to-earnings and price-to-book value ratios suggest investors are reassessing the company’s growth prospects amid sector headwinds.

Read full news article

GMR Power & Urban Infra Ltd Downgraded to Strong Sell Amid Weak Financials and Bearish Technicals

GMR Power & Urban Infra Ltd has been downgraded from a Sell to a Strong Sell rating as of 19 Jan 2026, reflecting deteriorating technical indicators and weakening financial fundamentals. The company’s stock has underperformed the broader market, with a sharp decline in quarterly profits and mounting debt concerns weighing heavily on investor sentiment.

Read full news article Announcements

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 5 Schemes (0.13%)

Held by 72 FIIs (3.44%)

Gmr Enterprises Private Limited (21.56%)

Synergy Industrials, Metals And Power Holdings Ltd (8.71%)

15.95%

Quarterly Results Snapshot (Consolidated) - Sep'25 - QoQ

QoQ Growth in quarter ended Sep 2025 is 9.82% vs -5.12% in Jun 2025

QoQ Growth in quarter ended Sep 2025 is 11,489.62% vs -117.84% in Jun 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 15.47% vs 71.00% in Sep 2024

Growth in half year ended Sep 2025 is -40.51% vs 576.60% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 61.38% vs -30.32% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 618.01% vs -116.02% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 41.34% vs -18.62% in Mar 2024

YoY Growth in year ended Mar 2025 is 1,475.84% vs -108.71% in Mar 2024