Compare Goodricke Group with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -204.87% CAGR growth in Operating Profits over the last 5 years

- Company's ability to service its debt is weak with a poor EBIT to Interest (avg) ratio of -2.65

- The company has been able to generate a Return on Equity (avg) of 2.64% signifying low profitability per unit of shareholders funds

Risky - Negative EBITDA

Below par performance in long term as well as near term

Total Returns (Price + Dividend)

Latest dividend: 3 per share ex-dividend date: Jul-19-2022

Risk Adjusted Returns v/s

Returns Beta

News

Are Goodricke Group Ltd latest results good or bad?

Goodricke Group Ltd's latest financial results for Q2 FY26 reflect a complex operational landscape. The company reported net sales of ₹216.56 crores, which indicates a sequential improvement of 24.10% from the previous quarter, although it represents a significant decline of 31.46% compared to the same quarter last year. This seasonal performance aligns with the peak cropping season for tea production, suggesting that the company is able to leverage favorable conditions to some extent. Net profit for the quarter surged to ₹43.53 crores, showcasing a remarkable sequential growth of 1,264.89%. However, this figure is down 27.78% year-on-year, highlighting ongoing challenges in maintaining profitability over a longer period. The operating margin improved to 15.14%, a substantial recovery from the previous quarter's low margin of 1.67%, driven by better revenue realization and reduced employee costs. Despite ...

Read full news article

Goodricke Group Q2 FY26: Sharp Profit Surge Masks Underlying Volatility in Tea Business

Goodricke Group Ltd., a Kolkata-based tea cultivation and manufacturing company, reported a dramatic turnaround in Q2 FY26 with net profit surging to ₹43.53 crores from just ₹3.19 crores in Q1 FY26—a remarkable 1,264.89% quarter-on-quarter jump. However, year-on-year comparisons reveal a more sobering reality, with profit declining 27.78% from ₹60.27 crores in Q2 FY25, underscoring the inherent volatility in the tea industry's seasonal business model.

Read full news articleAre Goodricke Group Ltd latest results good or bad?

Goodricke Group Ltd's latest financial results for Q2 FY26 present a complex picture characterized by both significant sequential gains and persistent year-on-year challenges. The company reported net sales of ₹216.56 crores, reflecting a 24.10% increase compared to the previous quarter. However, this figure represents a substantial decline of 31.46% when compared to the same quarter in the previous year, indicating ongoing difficulties in the tea industry, particularly regarding pricing power and volume growth. Net profit for the quarter surged to ₹43.53 crores, a remarkable increase from the near-breakeven point in Q1 FY26. This dramatic rise, however, is largely attributed to favorable tax adjustments rather than a sustainable operational improvement, as evidenced by a year-on-year decline of 27.78%. The operating margin, excluding other income, improved to 15.14%, a significant recovery from the previo...

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

07-Feb-2026 | Source : BSENewspaper Publication for Unaudited Financial Results of the Company for the quarter and nine months ended 31st December 2025.

Unaudited Financial Results For The Quarter And Nine Months Ended 31St December 2025

05-Feb-2026 | Source : BSEUnaudited Financial Results of the Company for the quarter and nine months ended 31st December 2025

Board Meeting Outcome for Unaudited Financial Results For The Quarter And Nine Months Ended 31.12.2025

05-Feb-2026 | Source : BSEUnaudited Financial Results for the quarter and nine months ended 31.12.2025

Corporate Actions

No Upcoming Board Meetings

Goodricke Group Ltd has declared 30% dividend, ex-date: 19 Jul 22

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 1 Schemes (0.0%)

Held by 0 FIIs

Assam Dooars Investments Limited (48.1%)

None

22.22%

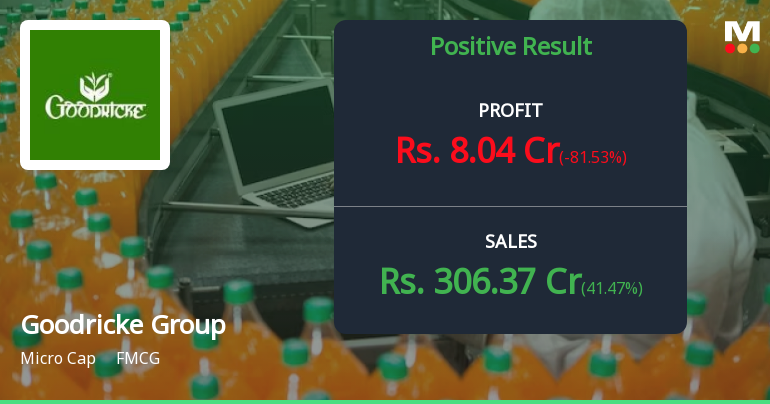

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 41.47% vs 24.10% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -81.53% vs 1,264.58% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -23.82% vs 26.08% in Sep 2024

Growth in half year ended Sep 2025 is -35.79% vs 130.47% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -12.56% vs 14.97% in Dec 2024

YoY Growth in nine months ended Dec 2025 is -3.30% vs 767.23% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 12.80% vs -6.60% in Mar 2024

YoY Growth in year ended Mar 2025 is 128.95% vs -21,556.25% in Mar 2024