Compare Grovy India with Similar Stocks

Total Returns (Price + Dividend)

Latest dividend: 0.1 per share ex-dividend date: Sep-23-2025

Risk Adjusted Returns v/s

Returns Beta

News

Grovy India Ltd is Rated Sell

Grovy India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 28 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 03 February 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news articleAre Grovy India Ltd latest results good or bad?

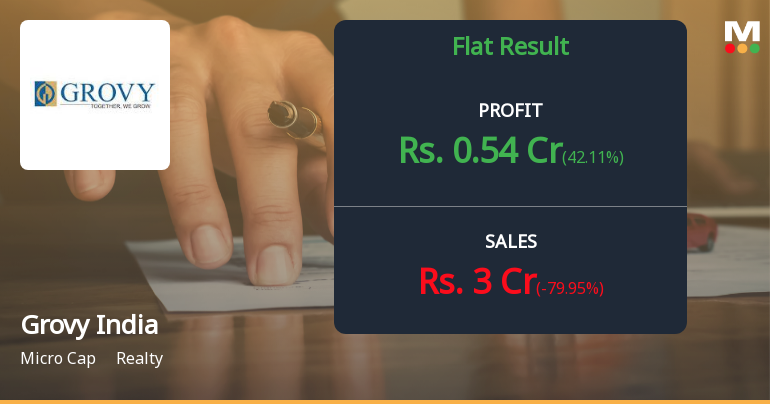

Grov India Ltd's latest financial results for the quarter ended December 2025 present a complex picture of operational performance. The company reported a net profit of ₹0.54 crores, reflecting a sequential increase of 42.11% from the previous quarter. However, this profit growth occurred alongside a significant decline in net sales, which dropped to ₹3.00 crores, representing a 79.95% decrease compared to the prior quarter's sales of ₹14.96 crores. This stark contrast highlights severe operational challenges within the company's property development business. The profit margin also exhibited noteworthy improvement, with the PAT margin rising to 18.00% from 2.54% in the previous quarter, indicating enhanced profitability relative to the reduced revenue base. Additionally, the return on equity for the latest quarter stood at 15.89%, suggesting a temporary boost in profitability metrics, although this may be...

Read full news article

Grovy India Q3 FY26: Revenue Collapse Raises Red Flags Despite Quarterly Profit

Grovy India Ltd., a micro-cap property development company with a market capitalisation of ₹62.00 crores, reported a concerning 79.95% quarter-on-quarter revenue collapse in Q3 FY26, raising serious questions about business sustainability despite posting a quarterly profit of ₹0.54 crores. The stock, trading at ₹44.00, has declined 0.05% following the results announcement, reflecting investor unease over the sharp revenue contraction.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Newspaper Publication

29-Jan-2026 | Source : BSENewspaper publication of un-audited financial results for the quarter ended 31st December 2025.

Financial Result For The Quarter Ended 31St December 2025.

28-Jan-2026 | Source : BSEFinancial results along with limited review report for the quarter ended 31st December 2025.

Announcement under Regulation 30 (LODR)-Investor Presentation

28-Jan-2026 | Source : BSEInvestor Presentation for the quarter ended 31st December 2025.

Corporate Actions

No Upcoming Board Meetings

Grovy India Ltd has declared 1% dividend, ex-date: 23 Sep 25

No Splits history available

Grovy India Ltd has announced 3:1 bonus issue, ex-date: 23 Oct 24

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 0 FIIs

Prakash Chand Jalan (22.66%)

Oceanic Auto Finlease Private Limited (2.95%)

12.64%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -79.95% vs 81.33% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 42.11% vs -65.45% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 879.32% vs -76.53% in Sep 2024

Growth in half year ended Sep 2025 is 739.13% vs -128.75% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is 19.03% vs 37.28% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 26.42% vs 63.92% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 30.03% vs -6.55% in Mar 2024

YoY Growth in year ended Mar 2025 is 79.00% vs 9.89% in Mar 2024