Compare Indian Energy Ex with Similar Stocks

Dashboard

Poor long term growth as Net Sales has grown by an annual rate of 14.74% and Operating profit at 17.66% over the last 5 years

Flat results in Dec 25

With ROE of 37.5, it has a Very Expensive valuation with a 8.8 Price to Book Value

Below par performance in long term as well as near term

Stock DNA

Capital Markets

INR 11,256 Cr (Small Cap)

23.00

20

1.22%

-1.11

37.54%

8.76

Total Returns (Price + Dividend)

Latest dividend: 1.5 per share ex-dividend date: May-16-2025

Risk Adjusted Returns v/s

Returns Beta

News

Indian Energy Exchange Ltd Sees Sharp Open Interest Surge Amid Bearish Momentum

Indian Energy Exchange Ltd (IEX) has witnessed a notable 10.46% increase in open interest in its derivatives segment, rising from 43,156 to 47,668 contracts. This surge comes despite the stock hitting a fresh 52-week low of Rs 119 and underperforming its sector by nearly 5% on 2 February 2026, signalling a complex market positioning scenario for investors.

Read full news article

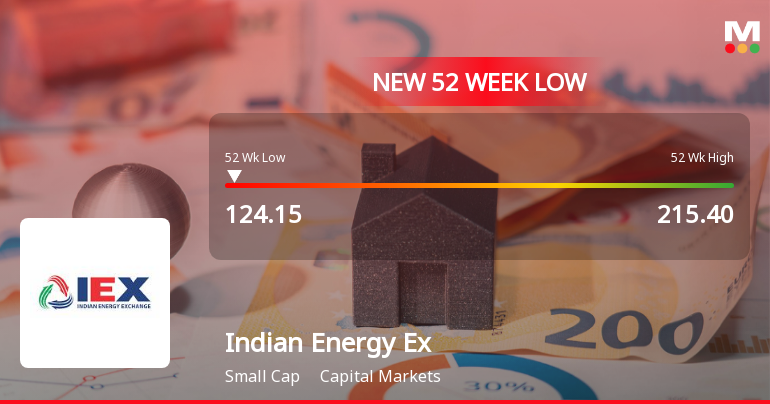

Indian Energy Exchange Ltd Falls to 52-Week Low of Rs.119.2

Indian Energy Exchange Ltd’s stock declined sharply to a fresh 52-week low of Rs.119.2 on 2 Feb 2026, marking a significant milestone in its recent price trajectory as it continues to underperform both its sector and broader market indices.

Read full news article

Indian Energy Exchange Ltd Falls to 52-Week Low of Rs.122.2

Indian Energy Exchange Ltd’s stock declined to a fresh 52-week low of Rs.122.2 on 1 Feb 2026, marking a significant downturn amid broader market weakness and sectoral pressures. The stock has underperformed both its sector and benchmark indices over recent periods, reflecting a challenging environment for the company’s shares.

Read full news article Announcements

Indian Energy Exchange Limited - Press Release

05-Dec-2019 | Source : NSEIndian Energy Exchange Limited has informed the Exchange regarding a press release dated December 05, 2019, titled "Power Market Update November 2019".

Indian Energy Exchange Limited - Analysts/Institutional Investor Meet/Con. Call Updates

28-Nov-2019 | Source : NSEIndian Energy Exchange Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Indian Energy Exchange Limited - Analysts/Institutional Investor Meet/Con. Call Updates

27-Nov-2019 | Source : NSEIndian Energy Exchange Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Corporate Actions

No Upcoming Board Meetings

Indian Energy Exchange Ltd has declared 150% dividend, ex-date: 04 Feb 26

Indian Energy Exchange Ltd has announced 1:10 stock split, ex-date: 19 Oct 18

Indian Energy Exchange Ltd has announced 2:1 bonus issue, ex-date: 03 Dec 21

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 27 Schemes (27.12%)

Held by 158 FIIs (11.41%)

None

Parag Parikh Mutual Fund Under Its Various Schemes (9.5%)

36.03%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 10.31% vs 14.53% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 11.02% vs 16.86% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 12.44% vs 23.71% in Sep 2024

Growth in half year ended Sep 2025 is 19.18% vs 26.17% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 11.73% vs 20.48% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 16.38% vs 22.81% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 19.62% vs 12.05% in Mar 2024

YoY Growth in year ended Mar 2025 is 22.35% vs 14.68% in Mar 2024