Compare I R F C with Similar Stocks

Stock DNA

Finance

INR 148,066 Cr (Large Cap)

21.00

22

1.57%

2.73

12.37%

2.65

Total Returns (Price + Dividend)

Latest dividend: 1 per share ex-dividend date: Oct-24-2025

Risk Adjusted Returns v/s

Returns Beta

News

Indian Railway Finance Corporation Ltd Hits Intraday Low Amid Price Pressure

Indian Railway Finance Corporation Ltd (IRFC) experienced a notable decline in intraday trading on 1 Feb 2026, hitting a low of Rs 116.35 as price pressures intensified amid broader market weakness. The stock underperformed its sector and the benchmark Sensex, reflecting immediate selling pressure and subdued market sentiment.

Read full news article

Indian Railway Finance Corporation Ltd is Rated Sell

Indian Railway Finance Corporation Ltd is rated 'Sell' by MarketsMOJO. This rating was last updated on 11 August 2025. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 31 January 2026, providing investors with the latest insights into the company’s performance and outlook.

Read full news article

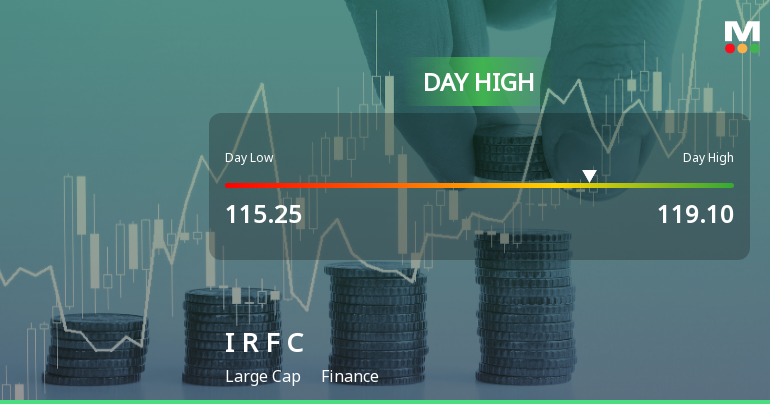

Indian Railway Finance Corporation Ltd Hits Intraday High with Strong 3.4% Surge

Indian Railway Finance Corporation Ltd recorded a robust intraday performance on 28 Jan 2026, surging to a day’s high of Rs 118.85, marking a 3.53% increase. The stock outpaced the broader Sensex and its sector peers, reflecting strong trading momentum amid a generally positive market environment.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Press Release / Media Release

03-Feb-2026 | Source : BSEPress Release- IRFC Strengthens Infrastructure Diversification with Strategic MoU for outer Harbour Development at Tuticorin Port

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

27-Jan-2026 | Source : BSETranscript of Earnings call for Q3 FY 2025-26 and nine months ended 31.12.2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

20-Jan-2026 | Source : BSEAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

Corporate Actions

No Upcoming Board Meetings

Indian Railway Finance Corporation Ltd has declared 10% dividend, ex-date: 24 Oct 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 24 Schemes (0.36%)

Held by 116 FIIs (0.98%)

President Of India Acting Through Mor (86.36%)

Life Insurance Corporation Of India (1.1%)

10.57%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 4.48% vs -7.67% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 1.42% vs 1.79% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is -2.87% vs 1.63% in Sep 2024

Growth in half year ended Sep 2025 is 10.45% vs 2.67% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -2.44% vs 1.22% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 10.47% vs 2.44% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is 1.89% vs 11.52% in Mar 2024

YoY Growth in year ended Mar 2025 is 1.40% vs 1.19% in Mar 2024