Compare Infosys with Similar Stocks

Dashboard

Strong Long Term Fundamental Strength with an average Return on Equity (ROE) of 31.88%

- Healthy long term growth as Net Sales has grown by an annual rate of 12.19%

- Company has a low Debt to Equity ratio (avg) at 0 times

With ROE of 34.8, it has a Fair valuation with a 8 Price to Book Value

High Institutional Holdings at 71.55%

With its market cap of Rs 6,60,507 cr, it is the second biggest company in the sector (behind TCS)and constitutes 16.10% of the entire sector

Stock DNA

Computers - Software & Consulting

INR 672,346 Cr (Large Cap)

23.00

20

2.83%

-0.22

34.81%

7.96

Total Returns (Price + Dividend)

Latest dividend: 23 per share ex-dividend date: Oct-27-2025

Risk Adjusted Returns v/s

Returns Beta

News

Infosys Ltd Sees Robust Trading Activity Amid Sector Outperformance

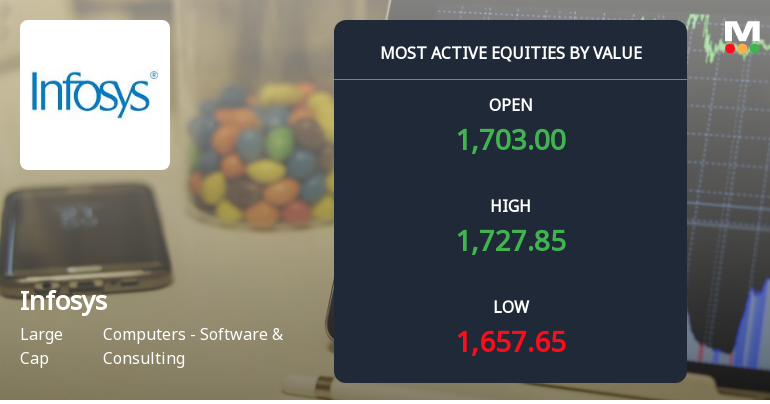

Infosys Ltd (INFY) demonstrated robust trading activity on 3 February 2026, emerging as one of the highest value stocks on the Indian equity market. The software and consulting giant recorded a total traded value exceeding ₹466 crore, supported by strong institutional interest and a notable upgrade in its investment rating, signalling renewed confidence among market participants.

Read full news article

Infosys Sees Heavy Put Option Activity Amid Bullish Price Momentum

Infosys Ltd (INFY), a leading player in the Computers - Software & Consulting sector, has witnessed a notable spike in put option trading ahead of the 24 February 2026 expiry. Despite the surge in bearish derivative activity, the stock continues to demonstrate robust price performance, reflecting a complex interplay of hedging strategies and market positioning among investors.

Read full news article

Infosys Ltd Sees Robust Call Option Activity Amid Bullish Market Momentum

Infosys Ltd (INFY) has emerged as the most actively traded stock in the call options segment, signalling strong bullish positioning among investors ahead of the 24 February 2026 expiry. The surge in call option contracts at the ₹1700 strike price reflects growing optimism about the software giant’s near-term prospects, supported by robust price performance and positive technical indicators.

Read full news article Announcements

Infosys Limited - Analysts/Institutional Investor Meet/Con. Call Updates

05-Dec-2019 | Source : NSEInfosys Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Infosys Limited - Analysts/Institutional Investor Meet/Con. Call Updates

03-Dec-2019 | Source : NSEInfosys Limited has informed the Exchange regarding Analysts/Institutional Investor Meet/Con. Call Updates

Infosys Limited - Press Release

26-Nov-2019 | Source : NSEInfosys Limited has informed the Exchange regarding a press release dated November 26, 2019, titled "Infosys Launches Cyber Next Platform-Based Offerings, Powered by Microsoft Azure Sentinel".

Corporate Actions

No Upcoming Board Meetings

Infosys Ltd has declared 460% dividend, ex-date: 27 Oct 25

No Splits history available

Infosys Ltd has announced 1:1 bonus issue, ex-date: 04 Sep 18

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

FIIs

None

Held by 45 Schemes (22.12%)

Held by 1483 FIIs (30.26%)

Sudha Gopalakrishnan (2.57%)

Life Insurance Corporation Of India - Ulif00220091 (11.28%)

11.35%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 2.22% vs 5.23% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -9.64% vs 6.40% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 8.06% vs 4.38% in Sep 2024

Growth in half year ended Sep 2025 is 10.96% vs 5.90% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 8.34% vs 5.46% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 6.40% vs 7.76% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 6.06% vs 4.70% in Mar 2024

YoY Growth in year ended Mar 2025 is 1.83% vs 8.87% in Mar 2024