Compare ISF with Similar Stocks

Stock DNA

Non Banking Financial Company (NBFC)

INR 9 Cr (Micro Cap)

24.00

22

0.00%

0.21

2.88%

0.69

Total Returns (Price + Dividend)

ISF for the last several years.

Risk Adjusted Returns v/s

Returns Beta

News

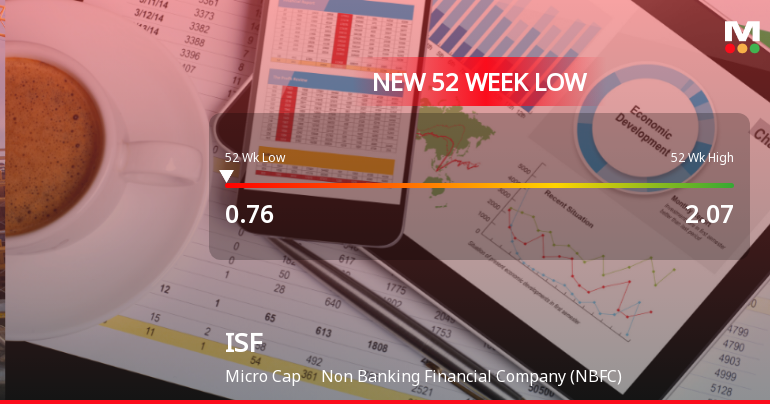

ISF Ltd Stock Falls to 52-Week Low of Rs.0.76 Amidst Weak Performance

ISF Ltd, a Non Banking Financial Company (NBFC), touched a fresh 52-week low of Rs.0.76 today, marking a significant decline in its share price amid ongoing market pressures and subdued financial metrics.

Read full news articleAre ISF Ltd latest results good or bad?

ISF Ltd. has reported its latest financial results for the quarter ended December 2025, which reveal several concerning trends. The company's net sales experienced a quarter-on-quarter decline of 11.11%, falling from ₹0.40 crores in September 2025. This downturn is indicative of ongoing operational challenges, as the previous quarter had shown a modest growth. In terms of profitability, ISF Ltd. reported a standalone net profit of ₹0.09 crores for the December quarter, which reflects an 18.18% decrease compared to the prior quarter where the profit was ₹0.11 crores. This decline in net profit further emphasizes the company's struggle to maintain profitability amidst declining sales. The operating profit margin, although remaining relatively high at 62.50% in September 2025, has shown a notable contraction in the latest quarter. This margin is critical as it indicates the company's ability to manage its co...

Read full news article

ISF Ltd: Micro-Cap NBFC Struggles with Persistent Losses and Elevated Valuation

ISF Ltd., a micro-cap non-banking financial company (NBFC) with a market capitalisation of just ₹10.00 crores, continues to face severe operational challenges as reflected in its historical financial performance. Trading at ₹0.95 per share as of January 19, 2026, the stock has plunged 6.86% in a single session, extending a brutal decline that has seen it lose 39.49% over the past year and a staggering 64.42% over two years. With an average Return on Equity of merely 1.75% and a troubling loss-making track record in recent quarters, the company presents a compelling case study in financial distress within the NBFC sector.

Read full news article Announcements

Disclosure Under Regulation 29(2) Of SEBI (SAST) Regulations 2011

24-Jan-2026 | Source : BSEThe disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares and Takeovers) Regulations 2011

Disclosure Under Regulation 7(2) Read With Regulation 6(2) Of Securities And Exchange Board Of India (Prohibition Of Insider Trading) Regulations 2015

24-Jan-2026 | Source : BSEDisclosure under Regulation 7(2) read with Regulation 6(2)of SEBI (PIT) Regulations 2015

Announcement under Regulation 30 (LODR)-Newspaper Publication

20-Jan-2026 | Source : BSESubmission of Newspaper Publication pursuant to Regulation 47 read with Part A of Schedule III of the SEBI (LODR) Regulations 2015 pertaining to Financial Results for the quarter and nine months ended 31st December 2025.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Non Institution

None

Held by 0 Schemes

Held by 0 FIIs

Neelam Taneja (0.52%)

Prem Kumar Jain (9.25%)

89.2%

Quarterly Results Snapshot (Standalone) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is -11.11% vs 4.65% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is -18.18% vs 0.00% in Sep 2025

Half Yearly Results Snapshot (Standalone) - Sep'25

Growth in half year ended Sep 2025 is 1.15% vs -20.18% in Sep 2024

Growth in half year ended Sep 2025 is 200.00% vs 0.00% in Sep 2024

Nine Monthly Results Snapshot (Standalone) - Dec'25

YoY Growth in nine months ended Dec 2025 is -0.78% vs -22.75% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 205.00% vs -242.86% in Dec 2024

Annual Results Snapshot (Standalone) - Mar'25

YoY Growth in year ended Mar 2025 is -11.88% vs 21.69% in Mar 2024

YoY Growth in year ended Mar 2025 is 98.65% vs -7,500.00% in Mar 2024