Compare Kennametal India with Similar Stocks

Dashboard

With ROE of 14.6, it has a Expensive valuation with a 5.8 Price to Book Value

- The stock is trading at a discount compared to its peers' average historical valuations

- Over the past year, while the stock has generated a return of -17.36%, its profits have risen by 0.2% ; the PEG ratio of the company is 39.6

Consistent Underperformance against the benchmark over the last 3 years

Stock DNA

Industrial Manufacturing

INR 4,725 Cr (Small Cap)

40.00

31

2.03%

-0.22

14.63%

5.79

Total Returns (Price + Dividend)

Latest dividend: 40 per share ex-dividend date: May-28-2025

Risk Adjusted Returns v/s

Returns Beta

News

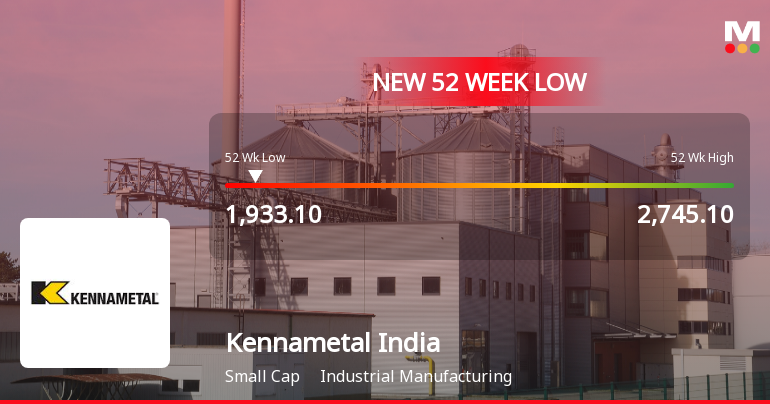

Kennametal India Ltd Stock Hits 52-Week Low at Rs.1932.1 Amidst Market Fluctuations

Kennametal India Ltd’s share price declined to a fresh 52-week low of Rs.1932.1 on 2 Feb 2026, marking a significant milestone in its recent trading performance. This new low reflects ongoing challenges in the stock’s valuation and market positioning within the industrial manufacturing sector.

Read full news article

Kennametal India Ltd Stock Falls to 52-Week Low of Rs.1933.1

Kennametal India Ltd’s shares declined to a fresh 52-week low of Rs.1933.1 on 1 Feb 2026, marking a significant milestone in the stock’s recent performance. This new low comes amid a backdrop of sustained underperformance relative to the broader market and peers within the industrial manufacturing sector.

Read full news article

Kennametal India Ltd is Rated Sell

Kennametal India Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 24 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 29 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article Announcements

Board Meeting Intimation for The Second Quarter And Half Year Ended December 31 2025

13-Jan-2026 | Source : BSEKennametal India Ltd-has informed BSE that the meeting of the Board of Directors of the Company is scheduled on 05/02/2026 inter alia to consider and approve This is to inform you that a meeting of the Board of Directors of Kennametal India Limited (the Company) is scheduled to be held on Thursday February 5 2026 to inter alia consider the Un-audited Financial Results of the Company for the second quarter and half year ended December 31 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Jan-2026 | Source : BSEPlease find enclosed the confirmation certificate as per Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 received from Integrated Registry Management Services Private Limited the Registrar and Share Transfer (RTA) of Kennametal India Limited for the quarter ended December 31 2025.

Announcement under Regulation 30 (LODR)-Credit Rating

17-Dec-2025 | Source : BSEPursuant to Regulation 30 of SEBI LODR Regulations 2015 this is to inform you that India Ratings & Research have assigned Kennametal India Limited a Long-Term Issuer Rating IND AA- and the Outlook is Stable.

Corporate Actions

05 Feb 2026

Kennametal India Ltd has declared 400% dividend, ex-date: 28 May 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 7 Schemes (14.06%)

Held by 36 FIIs (0.38%)

Meturit Ag (51.0%)

Nippon Life India Trustee Ltd-a/c Nippon India Multi Cap Fund (8.89%)

8.69%

Quarterly Results Snapshot (Standalone) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 9.47% vs 4.85% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 25.60% vs 46.20% in Sep 2024

Half Yearly Results Snapshot (Standalone) - Dec'24

Growth in half year ended Dec 2024 is 5.43% vs -2.47% in Dec 2023

Growth in half year ended Dec 2024 is 12.38% vs -21.35% in Dec 2023

Nine Monthly Results Snapshot (Standalone) - Mar'25

YoY Growth in nine months ended Mar 2025 is 6.21% vs -0.04% in Mar 2024

YoY Growth in nine months ended Mar 2025 is -10.83% vs 16.38% in Mar 2024

Annual Results Snapshot (Standalone) - Jun'25

YoY Growth in year ended Jun 2025 is 6.40% vs 2.12% in Jun 2024

YoY Growth in year ended Jun 2025 is -6.88% vs 26.00% in Jun 2024