Compare KNR Construct. with Similar Stocks

Stock DNA

Construction

INR 4,088 Cr (Small Cap)

6.00

35

0.17%

0.41

13.27%

0.86

Total Returns (Price + Dividend)

Latest dividend: 0.24 per share ex-dividend date: Sep-15-2025

Risk Adjusted Returns v/s

Returns Beta

News

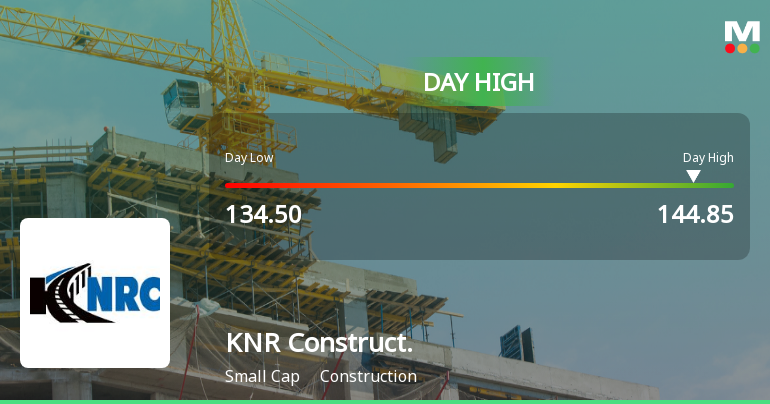

KNR Constructions Ltd Hits Intraday High with 7.29% Surge on 28 Jan 2026

KNR Constructions Ltd demonstrated robust intraday momentum on 28 Jan 2026, surging to an intraday high of Rs 143.6, marking a 6.77% rise from its previous close. The stock outperformed its sector and the broader market, reflecting significant trading activity and renewed focus within the construction industry.

Read full news article

KNR Constructions Ltd Falls to 52-Week Low Amid Continued Downtrend

KNR Constructions Ltd touched a new 52-week low of Rs.130.25 today, marking a significant decline in its stock price as it continues to underperform both its sector and broader market indices. The stock has now recorded losses over the past two consecutive days, reflecting ongoing pressures within the construction sector and company-specific financial setbacks.

Read full news article

KNR Constructions Ltd Falls to 52-Week Low Amid Continued Downtrend

KNR Constructions Ltd touched a new 52-week low of Rs.133.5 today, marking a significant decline amid a sustained downward trend. The stock has underperformed both its sector and the broader market, reflecting ongoing pressures on the company’s financial performance and market sentiment.

Read full news article Announcements

Board Meeting Intimation for Unaudited Financial Results For The Quarter And Nine Months Ended 31St December 2025

23-Jan-2026 | Source : BSEKNR Constructions Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 05/02/2026 inter alia to consider and approve a) unaudited financial results for the quarter and nine months ended 31st December 2025 b) Any other matter with the permission of the chair

Announcement Under Regulation 30 Of SEBI(LODR)Regulations 2015- Consequential Order

07-Jan-2026 | Source : BSEIntimation of receipt of Consequential order

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSECertificate under Reg 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st December 2025

Corporate Actions

05 Feb 2026

KNR Constructions Ltd has declared 12% dividend, ex-date: 15 Sep 25

KNR Constructions Ltd has announced 2:10 stock split, ex-date: 13 Dec 16

KNR Constructions Ltd has announced 1:1 bonus issue, ex-date: 03 Feb 21

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 17 Schemes (19.47%)

Held by 99 FIIs (7.38%)

Kamidi Narsimha Reddy (30.4%)

Icici Prudential Infrastructure Fund (0.043%)

20.79%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is -66.76% vs 87.28% in Sep 2024

YoY Growth in quarter ended Sep 2025 is -76.29% vs 199.55% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -57.02% vs 45.08% in Sep 2024

Growth in half year ended Sep 2025 is -62.86% vs 115.85% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 25.29% vs 7.04% in Dec 2023

YoY Growth in nine months ended Dec 2024 is 103.41% vs 36.48% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 7.31% vs 9.04% in Mar 2024

YoY Growth in year ended Mar 2025 is 28.87% vs 69.73% in Mar 2024