Compare MRPL with Similar Stocks

Dashboard

High Debt Company with a Debt to Equity ratio (avg) at 2.41 times

- High Debt Company with a Debt to Equity ratio (avg) at 2.41 times

Healthy long term growth as Net Sales has grown by an annual rate of 22.62% and Operating profit at 25.12%

With a growth in Net Profit of 131.72%, the company declared Very Positive results in Dec 25

With ROCE of 10.4, it has a Attractive valuation with a 1.5 Enterprise value to Capital Employed

Majority shareholders : Promoters

Total Returns (Price + Dividend)

Latest dividend: 2 per share ex-dividend date: Aug-09-2024

Risk Adjusted Returns v/s

Returns Beta

News

Mangalore Refinery & Petrochemicals Ltd. Downgraded to Hold Amid Mixed Technicals and Strong Financials

Mangalore Refinery & Petrochemicals Ltd. (MRPL) has seen its investment rating downgraded from Buy to Hold as of 19 Jan 2026, reflecting a nuanced assessment of its financial strength, valuation, and technical indicators. While the company’s financial performance has improved markedly, technical signals have turned cautious, prompting a more balanced outlook for investors.

Read full news article

Mangalore Refinery & Petrochemicals Ltd. Faces Technical Momentum Shift Amid Market Volatility

Mangalore Refinery & Petrochemicals Ltd. (MRPL) has experienced a notable shift in its technical momentum, transitioning from a mildly bullish to a mildly bearish stance as of January 2026. This change is reflected across key technical indicators including MACD, Bollinger Bands, and moving averages, signalling a cautious outlook for investors amid recent price declines and sector headwinds.

Read full news article

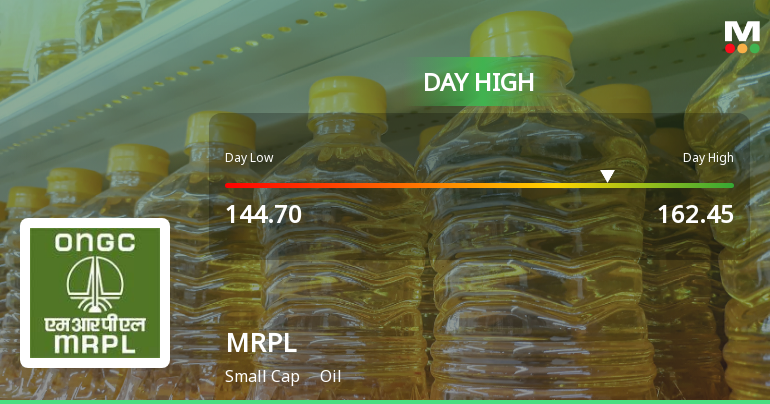

Mangalore Refinery & Petrochemicals Ltd. Hits Intraday High with 9.09% Surge

Mangalore Refinery & Petrochemicals Ltd. (MRPL) demonstrated robust intraday performance on 14 Jan 2026, surging 9.09% to touch an intraday high of Rs 162.45. This significant uptick outpaced the broader Sensex, which declined by 0.29%, underscoring MRPL’s notable strength within the oil sector today.

Read full news article Announcements

Mangalore Refinery and Petrochemicals Limited - Clarification

15-Nov-2019 | Source : NSEMangalore Refinery and Petrochemicals Limited Limited with respect to announcement dated 05-Nov-2019, regarding Board meeting held on November 04, 2019. On basis of above the Company is required to clarify following: 1. Brief profile (in case of appointment)

Mangalore Refinery and Petrochemicals Limited - Outcome of Board Meeting

05-Nov-2019 | Source : NSEMangalore Refinery and Petrochemicals Limited has informed the Exchange regarding Board meeting held on November 04, 2019.

Mangalore Refinery and Petrochemicals Limited - Change in Director(s)

22-Oct-2019 | Source : NSEMangalore Refinery and Petrochemicals Limited has informed the Exchange regarding Change in Director(s) of the company.

Corporate Actions

No Upcoming Board Meetings

Mangalore Refinery & Petrochemicals Ltd. has declared 20% dividend, ex-date: 09 Aug 24

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 28 Schemes (0.81%)

Held by 99 FIIs (2.05%)

Oil And Natural Gas Corporation Ltd (71.63%)

Foreign Bank - The Hongkong And Shanghai Banking Corp.ltd. (0%)

6.17%

Quarterly Results Snapshot (Consolidated) - Dec'25 - QoQ

QoQ Growth in quarter ended Dec 2025 is 9.11% vs 30.49% in Sep 2025

QoQ Growth in quarter ended Dec 2025 is 131.27% vs 331.79% in Sep 2025

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is -17.03% vs 19.31% in Sep 2024

Growth in half year ended Sep 2025 is 157.19% vs -130.18% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is -7.66% vs 7.69% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 674.90% vs -112.79% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 4.73% vs -17.08% in Mar 2024

YoY Growth in year ended Mar 2025 is -98.44% vs 35.46% in Mar 2024