Compare Monte Carlo Fas. with Similar Stocks

Dashboard

Weak Long Term Fundamental Strength with a -5.53% CAGR growth in Operating Profits over the last 5 years

- Low ability to service debt as the company has a high Debt to EBITDA ratio of 2.82 times

- The company has been able to generate a Return on Capital Employed (avg) of 9.76% signifying low profitability per unit of total capital (equity and debt)

Flat results in Dec 25

Despite the size of the company, domestic mutual funds hold only 0% of the company

Stock DNA

Garments & Apparels

INR 1,226 Cr (Micro Cap)

13.00

50

3.50%

0.67

10.36%

1.49

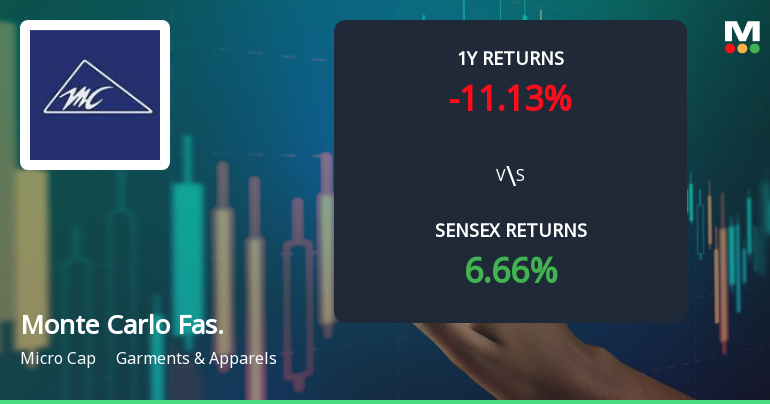

Total Returns (Price + Dividend)

Latest dividend: 20 per share ex-dividend date: Sep-22-2025

Risk Adjusted Returns v/s

Returns Beta

News

Monte Carlo Fashions Ltd Faces Technical Momentum Shift Amid Mixed Market Signals

Monte Carlo Fashions Ltd has experienced a notable shift in its technical momentum, transitioning from a mildly bullish trend to a sideways pattern. This change is underscored by a complex interplay of technical indicators, including bearish MACD signals on weekly and monthly charts, a mixed RSI outlook, and mildly bearish Bollinger Bands, all of which suggest a cautious stance for investors amid recent price volatility.

Read full news article

Monte Carlo Fashions Ltd Technical Momentum Shifts Amid Mixed Market Signals

Monte Carlo Fashions Ltd has experienced a notable shift in price momentum, moving from a sideways trend to a mildly bullish stance as of early February 2026. Despite this positive directional change, technical indicators present a mixed picture, with some suggesting caution while others hint at potential upside. This article analyses the recent technical developments, price action, and relative performance against the broader market to provide a comprehensive view for investors.

Read full news article

Monte Carlo Fashions Ltd Technical Momentum Shifts Amid Mixed Market Signals

Monte Carlo Fashions Ltd has experienced a notable shift in its technical momentum, moving from a mildly bearish stance to a sideways trend, reflecting a complex interplay of technical indicators. Despite a modest daily gain of 1.78%, the stock’s broader technical signals present a mixed picture, prompting a downgrade in its Mojo Grade from Hold to Sell as of 22 Dec 2025.

Read full news article Announcements

Announcement under Regulation 30 (LODR)-Earnings Call Transcript

31-Jan-2026 | Source : BSETranscript of Earnings Conference Call-Q3 & 9M FY26 Results

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

29-Jan-2026 | Source : BSEPursuant to the provisions of Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirement) Regulations 2015 please find below link for Audio Recording of Conference Call of Monte Carlo Fashions Limited held on January 29 2026 at 11:00 a.m. (IST) to discuss the results of Q3 FY 26. Link: https://www.montecarlocorporate.com/Pdfs/MCFL%20Q3%209M%20FY261769681825.mp3

Announcement under Regulation 30 (LODR)-Newspaper Publication

29-Jan-2026 | Source : BSENewspaper Publication of Financial Results for the Quarter and Nine Months Ended December 31 2025

Corporate Actions

No Upcoming Board Meetings

Monte Carlo Fashions Ltd has declared 200% dividend, ex-date: 22 Sep 25

No Splits history available

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

None

Held by 0 Schemes

Held by 33 FIIs (1.18%)

Nagdevi Trading & Investment Co. Ltd. (24.15%)

Carnelian Structural Shift Fund (1.33%)

19.84%

Quarterly Results Snapshot (Consolidated) - Dec'25 - YoY

YoY Growth in quarter ended Dec 2025 is 10.86% vs 8.84% in Dec 2024

YoY Growth in quarter ended Dec 2025 is 10.60% vs 25.20% in Dec 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 12.01% vs -1.57% in Sep 2024

Growth in half year ended Sep 2025 is 100.76% vs -413.17% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'25

YoY Growth in nine months ended Dec 2025 is 11.31% vs 4.57% in Dec 2024

YoY Growth in nine months ended Dec 2025 is 16.96% vs 15.92% in Dec 2024

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 3.63% vs -4.99% in Mar 2024

YoY Growth in year ended Mar 2025 is 35.42% vs -54.77% in Mar 2024