Compare Navin Fluo.Intl. with Similar Stocks

Dashboard

High Management Efficiency with a high ROCE of 15.58%

Strong ability to service debt as the company has a low Debt to EBITDA ratio of 1.00 times

With a growth in Net Profit of 152.24%, the company declared Very Positive results in Sep 25

High Institutional Holdings at 51.83%

Market Beating performance in long term as well as near term

Stock DNA

Specialty Chemicals

INR 30,281 Cr (Small Cap)

70.00

39

0.22%

0.09

12.33%

8.65

Total Returns (Price + Dividend)

Latest dividend: 6.5 per share ex-dividend date: Nov-07-2025

Risk Adjusted Returns v/s

Returns Beta

News

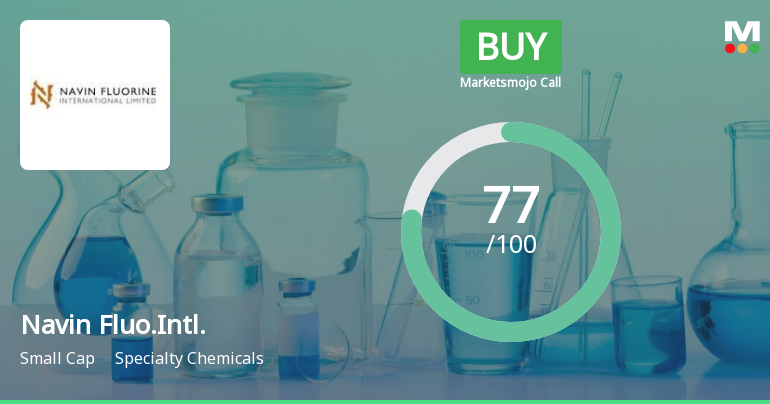

Navin Fluorine International Ltd is Rated Buy

Navin Fluorine International Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 16 June 2025. However, the analysis and financial metrics discussed here reflect the company’s current position as of 31 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news article

Navin Fluorine International Ltd Technical Momentum Shifts Signal Bullish Outlook

Navin Fluorine International Ltd has demonstrated a marked shift in price momentum, supported by a series of bullish technical signals and an upgrade in its MarketsMOJO rating from Hold to Buy. The specialty chemicals company’s stock price has surged to ₹5,974.50, reflecting growing investor confidence amid improving market dynamics and positive technical indicators.

Read full news article

Navin Fluorine International Ltd Technical Momentum Shifts Signal Bullish Outlook

Navin Fluorine International Ltd has recently experienced a notable shift in its technical momentum, with several key indicators signalling a transition from a mildly bullish to a more confident bullish trend. Despite a slight dip in the daily price, the stock’s longer-term technicals and fundamental metrics suggest a robust outlook for investors in the specialty chemicals sector.

Read full news article Announcements

Navin Fluorine International Limited - Updates

14-Nov-2019 | Source : NSENavin Fluorine International Limited has informed the Exchange regarding 'Disclosure of Related Party Transactions pursuant to Regulation 23(9) of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015'.

Navin Fluorine International Limited - Updates

25-Oct-2019 | Source : NSENavin Fluorine International Limited has informed the Exchange regarding 'Regulation 47 of SEBI (Listing Obligations & Disclosure Requirements)

Updates

19-Aug-2019 | Source : NSE

| Navin Fluorine International Limited has informed the Exchange regarding 'Publication of notice for attention of the shareholders of the Company in respect of transfer of shares to the Investor Education and Protection Fund'. |

Corporate Actions

09 Feb 2026

Navin Fluorine International Ltd has declared 325% dividend, ex-date: 07 Nov 25

Navin Fluorine International Ltd has announced 2:10 stock split, ex-date: 19 Jul 17

No Bonus history available

No Rights history available

Quality key factors

Valuation key factors

Technicals key factors

Shareholding Snapshot : Dec 2025

Shareholding Compare (%holding)

Promoters

1.0798

Held by 35 Schemes (17.82%)

Held by 262 FIIs (23.74%)

Mafatlal Impex Private Limited (mafatlal Exim Pvt Ltd Amalgamated With Mafatlal Impex Pvt Ltd) (25.44%)

Life Insurance Corporation Of India (6.43%)

16.65%

Quarterly Results Snapshot (Consolidated) - Sep'25 - YoY

YoY Growth in quarter ended Sep 2025 is 46.26% vs 9.91% in Sep 2024

YoY Growth in quarter ended Sep 2025 is 152.24% vs -2.91% in Sep 2024

Half Yearly Results Snapshot (Consolidated) - Sep'25

Growth in half year ended Sep 2025 is 42.37% vs 8.24% in Sep 2024

Growth in half year ended Sep 2025 is 141.35% vs -9.90% in Sep 2024

Nine Monthly Results Snapshot (Consolidated) - Dec'24

YoY Growth in nine months ended Dec 2024 is 12.67% vs 6.00% in Dec 2023

YoY Growth in nine months ended Dec 2024 is -3.25% vs -16.20% in Dec 2023

Annual Results Snapshot (Consolidated) - Mar'25

YoY Growth in year ended Mar 2025 is 13.77% vs -0.60% in Mar 2024

YoY Growth in year ended Mar 2025 is 6.68% vs -27.90% in Mar 2024