Key Events This Week

16 Feb: Stock opens at Rs.35.90, down 0.28% amid positive Sensex momentum

17 Feb: Q3 FY26 results reveal profit decline despite strong margins; valuation shifts noted

18 Feb: Sharp 4.97% drop following earnings concerns

20 Feb: Week closes at Rs.30.62, down 8.90% on final trading day

Aastamangalam Finance Q3 FY26: Profit Decline Raises Concerns Despite Strong Margins

2026-02-17 09:02:47Aastamangalam Finance Limited, a Chennai-based micro-cap non-banking financial company, reported a net profit of ₹1.91 crores for Q3 FY26 (October-December 2025), marking a sequential decline of 19.75% from ₹2.38 crores in Q2 FY26 and a year-on-year drop of 25.39% from ₹2.56 crores in Q3 FY25. The company's market capitalisation stands at ₹56.00 crores, with shares trading at ₹34.99, down 2.53% on the day and significantly below all key moving averages, reflecting investor concerns about the deteriorating financial trajectory.

Read full news article

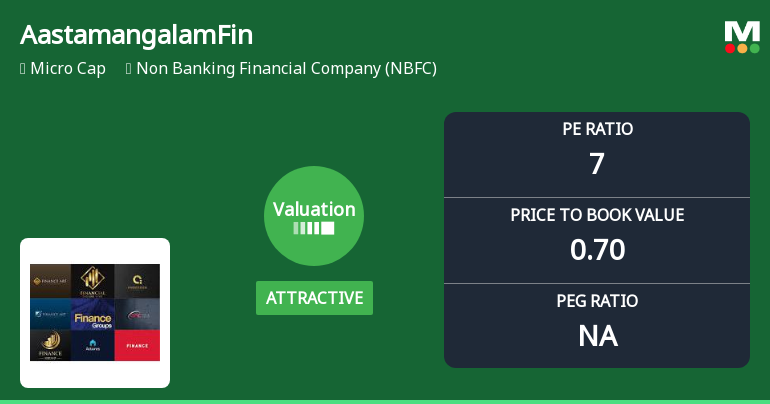

Aastamangalam Finance Ltd Valuation Shifts Signal Changing Market Sentiment

2026-02-17 08:00:23Aastamangalam Finance Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, has seen a notable shift in its valuation parameters, moving from a very attractive to an attractive rating. This change reflects evolving market perceptions amid a challenging macroeconomic backdrop and sector-specific dynamics. Despite a modest day decline of 0.28%, the company’s valuation metrics and relative performance against peers warrant a detailed examination for investors seeking clarity on its price attractiveness.

Read full news articleAastamangalam Finance Ltd Declines 0.30%: Bearish Signals and Downgrade Mark the Week

2026-02-15 17:00:04

Key Events This Week

09 Feb: Stock opens at Rs.35.16, declines 2.63% amid broader market gains

11 Feb: Death Cross formation signals bearish trend; stock surges 6.46% to Rs.36.92

12 Feb: Downgrade to Strong Sell by MarketsMOJO amid technical and financial concerns

13 Feb: Week closes at Rs.36.00, down 0.30% for the week, outperforming Sensex

Are Aastamangalam Finance Ltd latest results good or bad?

2026-02-14 19:36:45Aastamangalam Finance Ltd's latest financial results for Q2 FY26 present a mixed scenario. The company reported net sales of ₹3.62 crores, reflecting a sequential contraction of 23.14% compared to the previous quarter, which raises concerns about the sustainability of its revenue growth. Year-on-year, net sales also declined by 8.59%, indicating ongoing challenges in generating business. In terms of profitability, the company achieved a net profit of ₹2.38 crores, which is a decrease of 20.40% from the prior quarter. Despite this decline in profit and sales, Aastamangalam Finance managed to maintain a strong PAT margin of 65.75%, up from 63.48% in the previous quarter. This suggests that the company has been effective in managing costs and maintaining profitability even amidst declining revenues. The operating profit before depreciation, interest, and tax (PBDIT) was reported at ₹3.89 crores, down 14.69% ...

Read full news article

Aastamangalam Finance Ltd Downgraded to Strong Sell Amid Technical and Financial Concerns

2026-02-12 08:06:22Aastamangalam Finance Ltd, a Non Banking Financial Company (NBFC), has been downgraded from a Sell to a Strong Sell rating by MarketsMOJO as of 11 Feb 2026. This revision reflects deteriorating technical indicators, stagnant financial performance, and subdued market returns, signalling caution for investors amid a challenging sector environment.

Read full news article

Aastamangalam Finance Ltd Forms Death Cross, Signalling Bearish Trend

2026-02-11 18:00:20Aastamangalam Finance Ltd, a micro-cap player in the Non Banking Financial Company (NBFC) sector, has recently formed a Death Cross, a technical pattern where the 50-day moving average crosses below the 200-day moving average. This development signals a potential shift towards a bearish trend, reflecting deteriorating momentum and raising concerns about the stock’s medium to long-term outlook.

Read full news articleBoard Meeting Outcome for Outcome Of The Board Meeting 14.02.2026

14-Feb-2026 | Source : BSEUnaudited financial results for the quarter 31.12.2025

Board Meeting Intimation for To Consider Unaudited Results For 31.12.2025 Among Other Business

09-Feb-2026 | Source : BSEAastamangalam Finance Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 14/02/2026 inter alia to consider and approve To consider unaudited results for 31.12.2025 among other business

Board Meeting Outcome for Unaudited Results For Quarter Ended 30.09.2025

14-Nov-2025 | Source : BSEUnaudited results for quarter ended 30.09.2025

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

Aastamangalam Finance Ltd has announced 8:10 rights issue, ex-date: 13 Dec 24