Recent Price Movement and Market Comparison

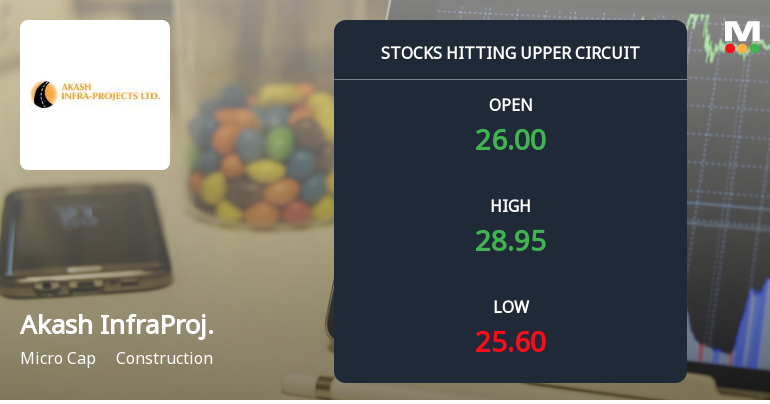

On 05-Dec, Akash Infraprojects recorded a price drop of ₹0.53, or 2.09%, closing at ₹24.77. This decline is part of a broader trend, with the stock underperforming the Sensex and its sector consistently. Over the past week, the stock has fallen by 2.90%, while the Sensex remained nearly flat, down just 0.06%. The one-month performance is even more stark, with Akash Infraprojects dropping 13.30% against a 2.30% gain in the Sensex.

Year-to-date, the stock has lost 25.84% of its value, in contrast to the Sensex’s 10.75% gain. Over the last year, the stock’s decline deepens to 32.40%, while the benchmark index rose by 5.98%. This trend extends over longer periods as well, with the stock falling nearly 26% over three years and a s...

Read full news article