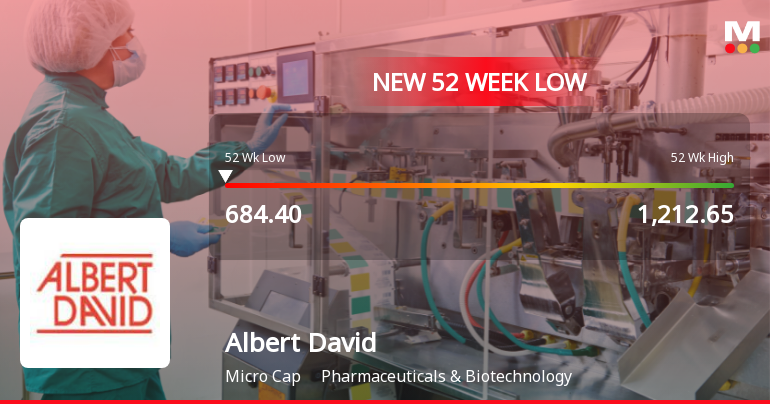

Albert David Ltd Stock Falls to 52-Week Low Amid Continued Financial Struggles

2026-01-27 12:12:18Albert David Ltd, a player in the Pharmaceuticals & Biotechnology sector, has touched a new 52-week low, closing just 0.67% above its lowest price of Rs 684.4. This marks a significant milestone in the stock’s ongoing downward trajectory, reflecting persistent financial difficulties and subdued market performance over the past year.

Read full news article

Albert David Ltd is Rated Strong Sell

2026-01-25 10:10:16Albert David Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 14 May 2025, reflecting a significant reassessment of the stock’s outlook. However, the analysis and financial metrics presented here are based on the company’s current position as of 25 January 2026, providing investors with the latest insights into its performance and prospects.

Read full news article

Albert David Ltd Stock Hits 52-Week Low at Rs.686.45

2026-01-19 10:09:43Albert David Ltd, a player in the Pharmaceuticals & Biotechnology sector, recorded a fresh 52-week low of Rs.686.45 today, marking a significant decline amid a sustained downward trend over recent sessions.

Read full news article

Albert David Ltd Stock Falls to 52-Week Low of Rs.705

2026-01-14 11:16:56Albert David Ltd, a player in the Pharmaceuticals & Biotechnology sector, has touched a new 52-week low of Rs.705 today, marking a significant decline in its stock price amid ongoing downward momentum and underperformance relative to its sector and broader market indices.

Read full news article

Albert David Ltd is Rated Strong Sell

2026-01-14 10:10:21Albert David Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 14 May 2025. However, the analysis and financial metrics presented here reflect the company’s current position as of 14 January 2026, providing investors with an up-to-date view of its fundamentals, returns, and overall market standing.

Read full news article

Albert David Ltd is Rated Strong Sell

2026-01-03 10:10:05Albert David Ltd is rated Strong Sell by MarketsMOJO, with this rating last updated on 14 May 2025. However, the analysis and financial metrics discussed below reflect the stock’s current position as of 03 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

Albert David Ltd Stock Falls to 52-Week Low of Rs.730.05

2025-12-30 09:54:48Albert David Ltd’s shares declined to a fresh 52-week low of Rs.730.05 on 30 Dec 2025, marking a significant milestone in the stock’s ongoing downward trajectory. The pharmaceutical and biotechnology company’s stock has underperformed its sector and broader market indices, reflecting persistent pressures on its financial performance and valuation metrics.

Read full news article

Albert David Stock Falls to 52-Week Low of Rs.738.95 Amidst Prolonged Downtrend

2025-12-26 10:44:31Albert David, a player in the Pharmaceuticals & Biotechnology sector, touched a new 52-week low of Rs.738.95 today, marking a significant milestone in its ongoing price decline. This level reflects a continuation of the stock’s subdued performance over the past year, contrasting sharply with broader market trends.

Read full news article

Albert David Sees Revision in Market Evaluation Amid Challenging Financial Trends

2025-12-23 10:10:16Albert David, a microcap player in the Pharmaceuticals & Biotechnology sector, has undergone a revision in its market evaluation reflecting ongoing challenges in its financial and technical outlook. The recent assessment highlights shifts across key analytical parameters, signalling caution for investors amid subdued returns and operational pressures.

Read full news articleAlbert David Limited - Other General Purpose

21-Nov-2019 | Source : NSEAlbert David Limited has informed the Exchange regarding Disclosure of related party transactions for the half year ended on September 30, 2019.

Albert David Limited - Press Release

18-Nov-2019 | Source : NSEAlbert David Limited has informed the Exchange regarding a press release dated November 15, 2019, titled "Extract of Unaudited Financial Results for the quarter and half year ended on 30th September, 2019".

Albert David Limited - Outcome of Board Meeting

15-Nov-2019 | Source : NSEAlbert David Limited has informed the Exchange regarding Board meeting held on November 14, 2019 for approval of unaudited financial results for the quarter and half year ended 30th September, 2019. .

Corporate Actions

11 Feb 2026

Albert David Ltd has declared 50% dividend, ex-date: 25 Jul 25

No Splits history available

No Bonus history available

No Rights history available