Strong Quarterly Performance Drives Investor Confidence

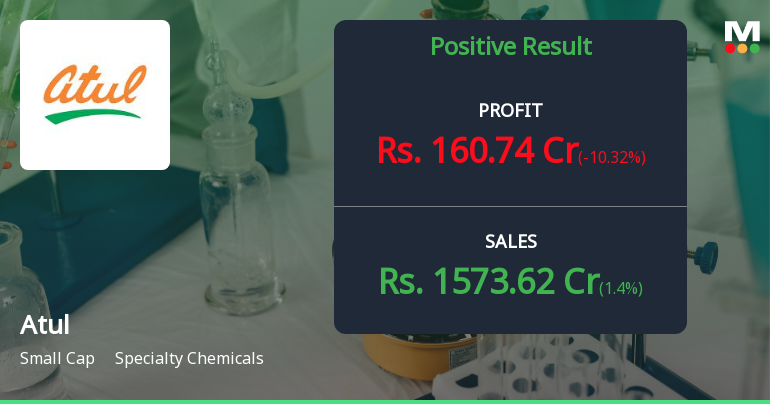

Atul Ltd.'s recent financial disclosures have played a pivotal role in bolstering investor sentiment. The company reported a profit after tax (PAT) of ₹339.98 crores for the latest six-month period, marking an impressive growth of 38.46%. This surge in profitability is complemented by the highest quarterly net sales recorded at ₹1,573.62 crores, signalling strong operational momentum. Additionally, the company’s return on capital employed (ROCE) for the half-year stood at a notable 12.64%, underscoring efficient utilisation of capital resources.

These encouraging results have helped the stock outperform the broader market and its sector peers in the short term. Over the past week, Atul Ltd. has gained 5.96%, signi...

Read full news article