Key Events This Week

27 Jan: Stock hits 52-week and all-time low of Rs.204

28 Jan: Price rebounds with a 0.99% gain to Rs.209.65

29 Jan: Minor pullback of 0.48% to Rs.208.65

30 Jan: Strong recovery with 2.52% gain to Rs.213.90

AWL Agri Business Ltd Falls to 52-Week Low of Rs.204

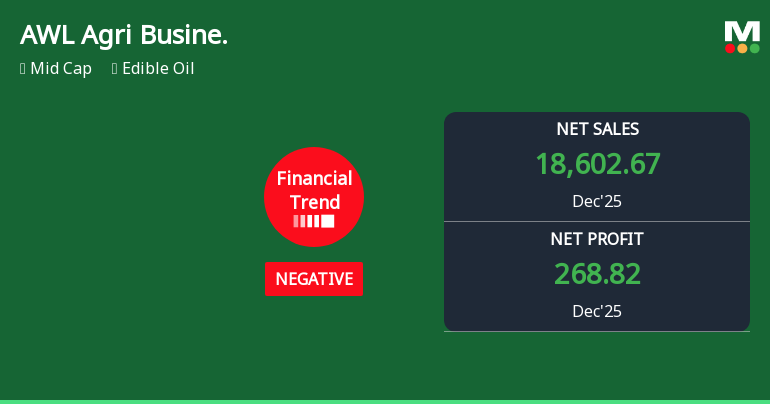

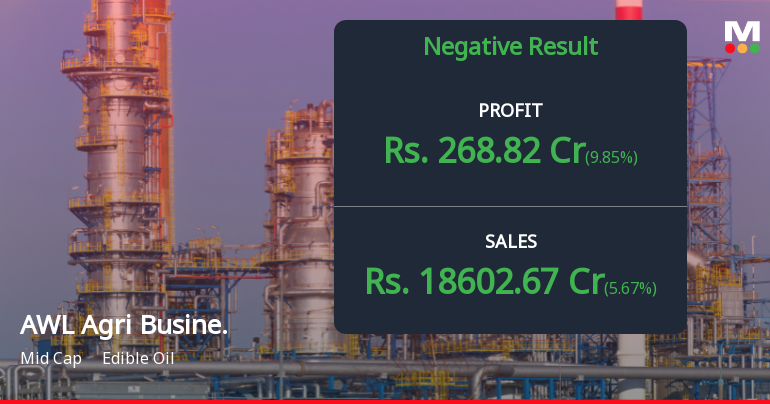

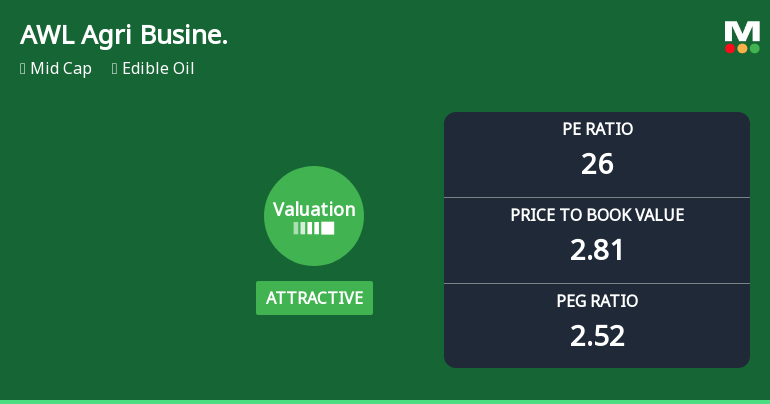

2026-01-27 10:48:33AWL Agri Business Ltd’s stock declined to a fresh 52-week low of Rs.204 on 27 Jan 2026, marking a significant downturn amid persistent underperformance relative to its sector and benchmark indices. The stock’s recent slide reflects a combination of subdued quarterly results, reduced promoter stake, and ongoing challenges in maintaining market momentum.

Read full news article

AWL Agri Business Ltd Shares Plunge to All-Time Low Amidst Prolonged Downtrend

2026-01-27 09:36:51AWL Agri Business Ltd, a key player in the edible oil sector, has reached a new all-time low of Rs.204, marking a significant milestone in its recent market trajectory. The stock’s continued decline reflects a series of financial and market pressures that have weighed heavily on its valuation and investor sentiment.

Read full news articleAWL Agri Business Ltd Declines 1.60%: Four Key Factors Behind the Weakness

2026-01-24 11:01:33

Key Events This Week

Jan 19: Stock hits 52-week and all-time low (Rs.207.25)

Jan 20: Continued decline amid heavy volume drop (Rs.210.10)

Jan 21: New 52-week and all-time low recorded (Rs.205.35 / Rs.205.85)

Jan 23: Week closes at Rs.209.25 (-0.40% on day)

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

29-Jan-2026 | Source : BSEIntimation of Investors/Analyst Call

Board Meeting Intimation for Approval Of Unaudited Financial Results (Standalone & Consolidated) For The Quarter And Nine Months Ended On 31St December 2025.

28-Jan-2026 | Source : BSEAWL Agri Business Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 03/02/2026 inter alia to consider and approve Unaudited financial results (Standalone & Consolidated) for the quarter and nine months ended on 31st December 2025.

Disclosure Pursuant To Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

27-Jan-2026 | Source : BSEDisclosure pursuant to Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Corporate Actions

(03 Feb 2026)

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available