Key Events This Week

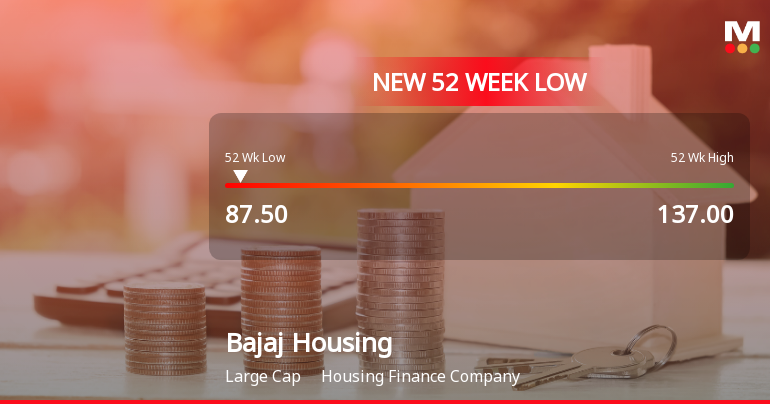

27 Jan: Stock hits 52-week and all-time low at Rs.87.5

28 Jan: Moderate gains amid broader market rally

29 Jan: Price dips 1.38% despite Sensex gains

30 Jan: Intraday high surge of 5.23%, closes at Rs.90.85

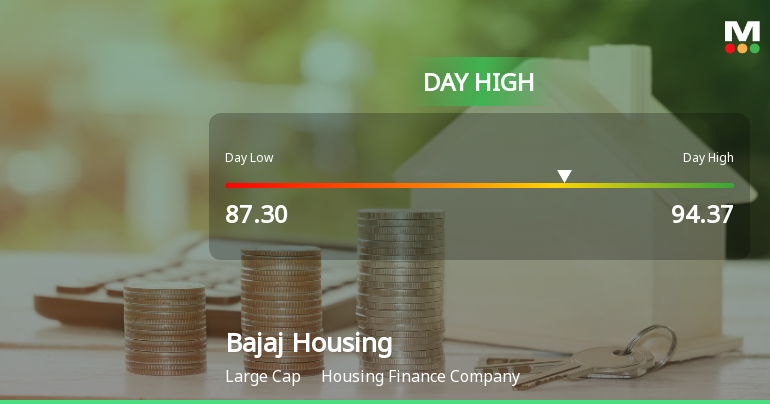

Bajaj Housing Finance Ltd Hits Intraday High with 5.23% Surge on 30 Jan 2026

2026-01-30 11:37:11Bajaj Housing Finance Ltd recorded a robust intraday performance on 30 Jan 2026, surging to a day’s high of Rs 94.37, marking a 7.24% increase from its previous close. This strong upward movement stands out amid a broadly subdued market environment, with the Sensex trading lower by 0.65% during the same session.

Read full news article

Bajaj Housing Finance Ltd Stock Hits 52-Week Low at Rs.87.3

2026-01-30 11:29:58Bajaj Housing Finance Ltd’s shares declined to a fresh 52-week low of Rs.87.3 today, marking a significant milestone in the stock’s recent performance. This new low reflects ongoing pressures amid a broader market environment where the Sensex opened lower and remains below key moving averages.

Read full news article

Bajaj Housing Finance Ltd Stock Hits All-Time Low Amidst Prolonged Underperformance

2026-01-30 09:40:44Bajaj Housing Finance Ltd has reached a new all-time low of Rs.87.3, marking a significant milestone in its recent market trajectory. Despite a slight positive movement today, the stock continues to reflect extended periods of underperformance relative to key benchmarks and its sector peers.

Read full news article

Bajaj Housing Finance Ltd Falls to 52-Week Low of Rs.87.5

2026-01-27 10:56:16Bajaj Housing Finance Ltd’s shares declined to a fresh 52-week low of Rs.87.5 on 27 Jan 2026, marking a significant drop amid broader sectoral and market pressures. The stock’s performance contrasts sharply with the broader market indices, reflecting a combination of company-specific and sector-wide factors.

Read full news article