Recent Price Movement and Market Context

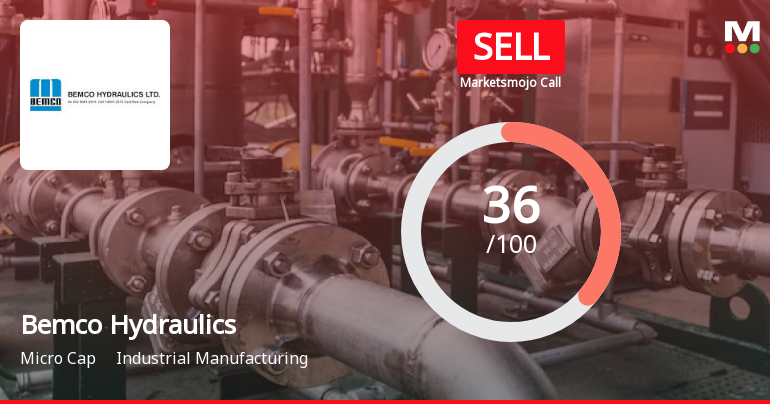

Bemco Hydraulics has experienced a volatile period, with its stock price declining by 3.70% over the past week and a more pronounced 15.23% drop in the last month. Year-to-date, the stock remains down by 13.97%, underperforming the Sensex, which has declined by 4.32% in the same timeframe. However, the company’s longer-term performance paints a more favourable picture, with a robust 8.65% return over the past year, significantly outpacing the Sensex’s 6.56% gain. Over three and five years, the stock has delivered exceptional returns of 165.35% and 1131.24% respectively, far exceeding benchmark indices.

On 23 Jan, the stock opened with a gap up of 3.09%, signalling positive investor sentiment at the start of trading. It reached a...

Read full news article