Key Events This Week

09 Feb: Stock surges 4.60% to Rs.957.65 on strong market momentum

11 Feb: Q3 FY26 results reveal profit plunge despite revenue surge

12 Feb: Company reports very positive financial trend amid robust quarterly growth

13 Feb: Stock closes week at Rs.863.85, down 4.40% on weak market sentiment

Bhartiya International Ltd is Rated Sell

2026-02-13 10:11:08Bhartiya International Ltd is rated 'Sell' by MarketsMOJO, with this rating last updated on 30 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 13 February 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Bhartiya International Ltd Reports Very Positive Financial Trend Amid Robust Quarterly Growth

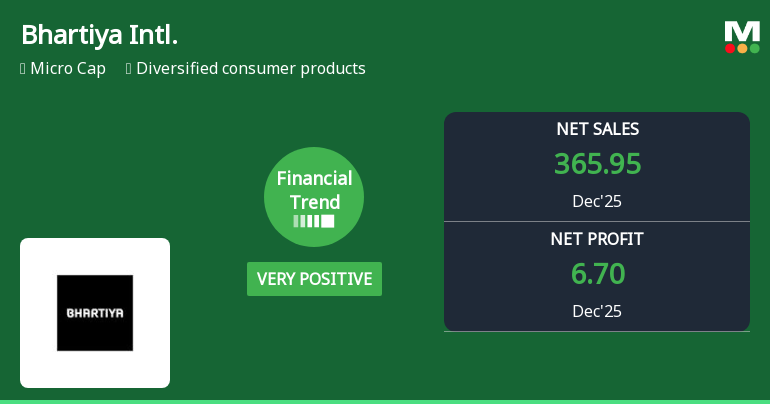

2026-02-12 08:00:24Bhartiya International Ltd has demonstrated a marked improvement in its financial performance for the quarter ended December 2025, shifting from a positive to a very positive trend. The diversified consumer products company posted robust revenue growth and significant margin expansion, signalling a strong turnaround in operational efficiency and profitability.

Read full news articleAre Bhartiya International Ltd latest results good or bad?

2026-02-11 19:39:15Bhartiya International Ltd's latest financial results for the quarter ending December 2025 reveal a complex picture characterized by significant year-on-year revenue growth alongside notable challenges in profitability. The company reported consolidated net sales of ₹365.95 crores, reflecting a robust year-on-year increase of 39.16% compared to ₹262.97 crores in the same quarter last year. However, this performance was overshadowed by a sequential decline of 8.38% from the previous quarter's sales of ₹399.40 crores, raising concerns about demand sustainability. The net profit for the quarter was ₹6.70 crores, which represents a substantial year-on-year increase of 543.71% from a loss of ₹1.51 crores in the prior year. Despite this impressive growth, the net profit saw a significant quarter-on-quarter decline of 32.53%, down from ₹9.93 crores in the previous quarter. This sharp drop in profitability indicat...

Read full news article

Bhartiya International Q3 FY26: Profit Plunge Raises Concerns Despite Revenue Surge

2026-02-11 17:47:40Bhartiya International Ltd., a micro-cap diversified consumer products manufacturer with a market capitalisation of ₹1,267 crores, reported a concerning third quarter for FY2026, with consolidated net profit plunging 32.53% quarter-on-quarter to ₹6.70 crores despite strong revenue growth. The stock trades at ₹966.40, up 1.30% following the results announcement, though the quarterly performance reveals underlying operational challenges that warrant investor caution.

Read full news article