Key Events This Week

2 Feb: Stock opens at Rs.254.10, down 1.40% amid market weakness

3 Feb: Intraday high of Rs.274.10 with a 7.32% surge; Mojo rating downgraded to Sell

4 Feb: Intraday high of Rs.280.00, 7.99% gain despite Sensex decline

5 Feb: Exceptional volume surge with 9.13 million shares traded; price closes at Rs.300.40 (+3.87%)

6 Feb: Technical upgrade to Hold; stock closes at Rs.291.70 (-2.90%)

BLS International Q3 FY26: Growth Momentum Stalls as Margins Contract

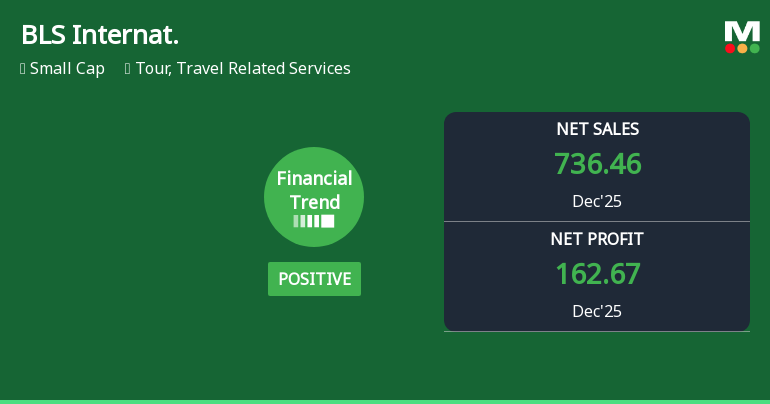

2026-02-06 17:22:43BLS International Services Ltd., the specialist provider of visa, passport and attestation outsourcing services, reported a consolidated net profit of ₹162.67 crores for Q3 FY26 (October-December 2025), marking a sequential decline of 7.17% from Q2 FY26 and a year-on-year growth of 34.81%. The results reveal a concerning trend of margin compression and stalling sequential momentum despite robust year-on-year comparisons. The stock closed at ₹291.70 on February 6, 2026, down 2.90% on the day, and has now declined 34.58% over the past year, significantly underperforming the Sensex's 7.07% gain during the same period.

Read full news article

BLS International Services Ltd Upgraded to Hold on Improved Technicals and Strong Financials

2026-02-06 08:18:12BLS International Services Ltd has seen its investment rating upgraded from Sell to Hold, reflecting a notable improvement in its technical indicators and robust financial performance. The upgrade, effective from 5 February 2026, is driven by a combination of enhanced technical trends, strong quarterly results, attractive valuation metrics, and a positive financial trajectory, signalling a cautious but optimistic outlook for investors in the tour and travel services sector.

Read full news article

BLS International Services Ltd Sees Technical Momentum Shift Amid Mixed Market Signals

2026-02-06 08:03:05BLS International Services Ltd has exhibited a notable shift in its technical momentum, moving from a bearish stance to a mildly bearish outlook, reflecting a tentative recovery in price action. Despite mixed signals from key technical indicators such as MACD, RSI, and moving averages, the stock’s recent 3.87% day gain and a weekly return of 17.92% against the Sensex’s 0.91% highlight renewed investor interest amid ongoing sector challenges.

Read full news article

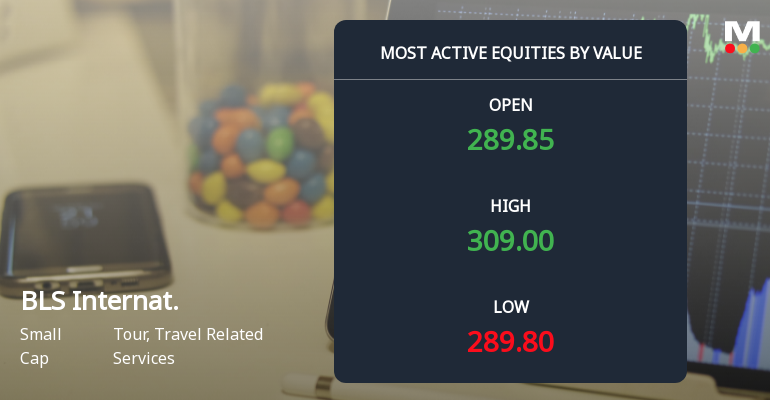

BLS International Services Ltd Sees Robust Trading Activity Amid Sector Outperformance

2026-02-05 10:00:23BLS International Services Ltd, a key player in the Tour and Travel Related Services sector, has emerged as one of the most actively traded stocks by value on 5 February 2026. Despite a cautious market backdrop, the stock demonstrated significant investor interest, registering a 4.60% gain and outperforming its sector and the broader Sensex index.

Read full news article

BLS International Services Ltd Sees Exceptional Volume Surge Amidst Mixed Market Sentiment

2026-02-05 10:00:22BLS International Services Ltd, a key player in the Tour and Travel Related Services sector, witnessed a remarkable surge in trading volume on 5 February 2026, accompanied by a robust price appreciation. The stock outperformed its sector and broader market indices, signalling heightened investor interest and potential accumulation despite a recent downgrade in its Mojo Grade to Sell.

Read full news article

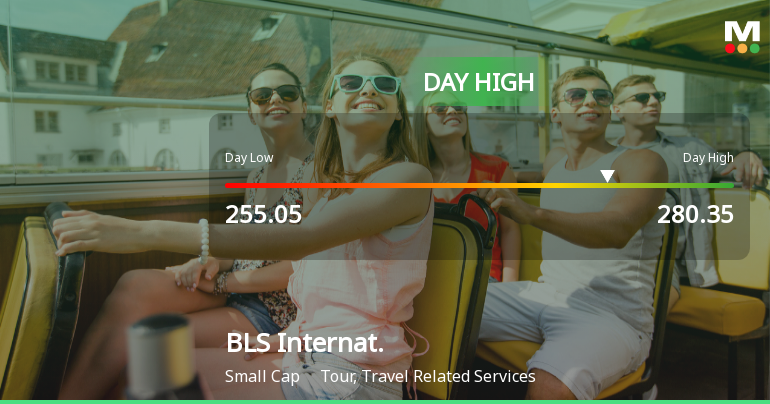

BLS International Services Ltd Hits Intraday High with 7.99% Surge on 4 Feb 2026

2026-02-04 11:16:45BLS International Services Ltd demonstrated robust intraday performance on 4 Feb 2026, surging to an intraday high of Rs 280, marking an 8.61% increase. The stock closed with a notable gain of 7.99%, significantly outperforming its sector and the broader market indices.

Read full news article