Recent Price Movements and Volatility

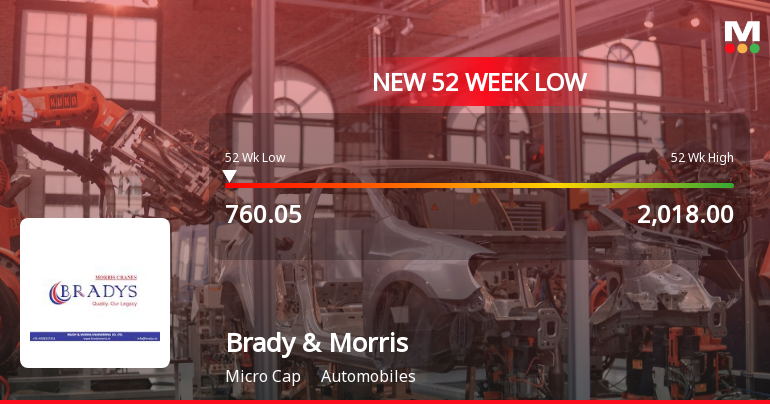

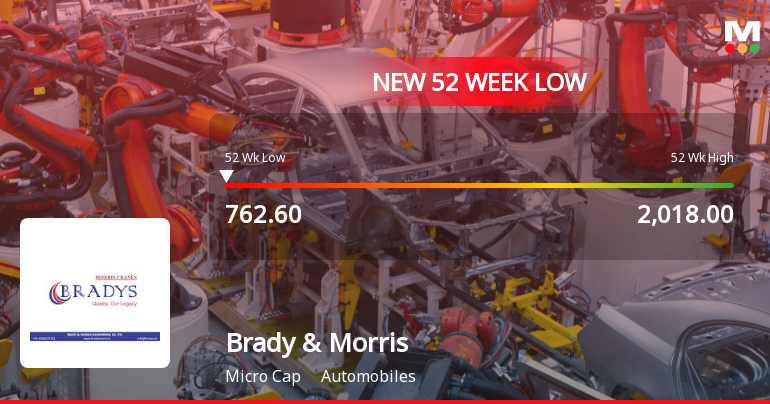

The stock hit a new 52-week low of ₹716 on the day, underscoring the bearish sentiment among investors. Despite an intraday high of ₹799, the share price ultimately succumbed to selling pressure, closing near its lows. The stock has experienced high volatility, with an intraday range of ₹83 and a volatility measure of 5.48%, indicating significant price swings within the trading session. Notably, the weighted average price suggests that a larger volume of shares traded closer to the lower end of the day’s range, signalling stronger selling interest.

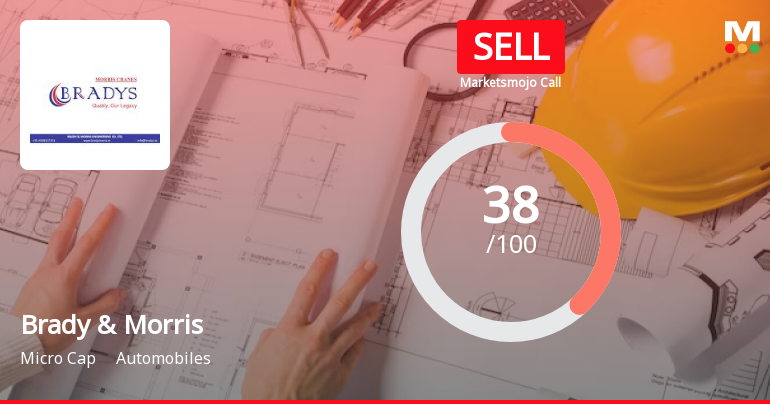

Brady & Morris has now declined for two consecutive days, losing 6.37% over this short period. It has also underperformed its sector by 2.69% on the day, reflecting broader challeng...

Read full news article