Britannia Inds. Sees Revision in Market Assessment Amid Mixed Financial Signals

2025-12-17 10:10:06Britannia Inds., a prominent player in the FMCG sector, has experienced a revision in its market evaluation reflecting a nuanced shift in its financial and technical outlook. This adjustment follows a detailed reassessment of the company’s quality, valuation, financial trends, and technical indicators, providing investors with a refreshed perspective on its market standing.

Read More

Britannia Industries Shows Shift in Price Momentum Amid Mixed Technical Signals

2025-12-15 08:04:46Britannia Industries, a key player in the FMCG sector, has exhibited a notable shift in its price momentum as recent technical indicators reveal a complex interplay of bullish and bearish signals. The stock’s current price movement, combined with monthly and weekly technical trends, offers investors a nuanced perspective on its near-term trajectory.

Read More

Britannia Industries Technical Momentum Shifts Amid Mixed Market Signals

2025-12-09 08:17:02Britannia Industries, a key player in the FMCG sector, has experienced a nuanced shift in its technical momentum, reflecting a complex interplay of market forces and indicator signals. Recent evaluation adjustments reveal a transition from a bullish to a mildly bullish trend, underscoring a period of consolidation and cautious investor sentiment.

Read More

Britannia Industries Shows Shift in Price Momentum Amid Mixed Technical Signals

2025-12-08 08:05:35Britannia Industries has exhibited a notable shift in its price momentum, reflecting a complex interplay of technical indicators that suggest evolving market sentiment. Recent trading sessions have seen the stock price move to ₹5,951.05, marking a 1.31% change from the previous close of ₹5,874.20, while technical parameters across weekly and monthly timeframes reveal a nuanced picture of momentum and trend strength.

Read More

Britannia Inds. Sees Revision in Market Evaluation Amid Mixed Financial Signals

2025-11-26 09:46:01Britannia Inds., a prominent player in the FMCG sector, has recently undergone a revision in its market evaluation metrics, reflecting a nuanced shift in its overall assessment. This change comes amid a backdrop of steady operational performance, tempered by valuation considerations and flat financial trends.

Read More

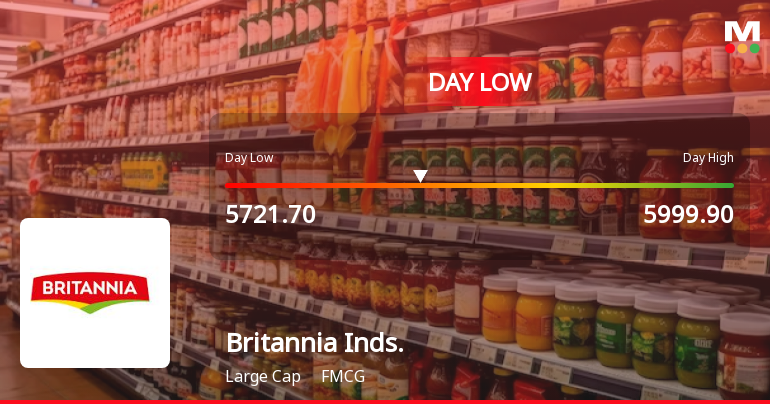

Britannia Industries Hits Day Low of Rs 5721.7 Amid Price Pressure

2025-11-11 09:43:31Britannia Industries' stock has declined significantly, reaching an intraday low amid a broader market downturn. The company has underperformed its sector and experienced consecutive losses over the past two days. Despite recent challenges, the stock has shown strong year-to-date performance compared to the Sensex.

Read MoreIs Britannia Inds. overvalued or undervalued?

2025-11-11 08:12:25As of 10 November 2025, the valuation grade for Britannia Industries has moved from very expensive to expensive, indicating a slight adjustment in its perceived value. The company is currently considered overvalued based on its high valuation ratios. Key ratios include a PE Ratio of 63.75, an EV to EBITDA of 46.03, and a PEG Ratio of 8.34, all of which are significantly higher than industry norms. In comparison to its peers, Britannia's PE Ratio is notably higher than Hindustan Unilever's 53.51 and Godrej Consumer's 61.47, both categorized as expensive. Additionally, while Britannia's EV to EBITDA is 46.03, Hindustan Unilever's stands at 33.13, further emphasizing the relative overvaluation of Britannia. Despite its strong recent stock performance, with a year-to-date return of 28.64% compared to the Sensex's 6.91%, the high valuation ratios suggest that the stock may not be a prudent investment at its cur...

Read MoreIs Britannia Inds. overvalued or undervalued?

2025-11-10 08:12:05As of 7 November 2025, the valuation grade for Britannia Industries has moved from expensive to very expensive. The company is currently considered overvalued based on its high valuation metrics. Key ratios include a PE ratio of 63.99, an EV to EBITDA of 46.19, and a PEG ratio of 8.37, all of which significantly exceed typical industry benchmarks. In comparison to its peers, Britannia's valuation stands out, with Hindustan Unilever at a PE of 53.63 and Nestle India at a PE of 81.21. Other competitors like Pidilite Industries and Godrej Consumer also reflect high valuations, but Britannia's ratios indicate a premium that may not be justified. Despite recent stock performance showing a 29.12% return year-to-date compared to the Sensex's 6.50%, the elevated valuation metrics suggest that the stock may not sustain its current price levels....

Read MoreIs Britannia Inds. overvalued or undervalued?

2025-11-09 08:10:23As of 7 November 2025, Britannia Industries has moved from an expensive to a very expensive valuation grade. The company is currently overvalued based on its high valuation multiples, including a PE ratio of 63.99, an EV to EBITDA ratio of 46.19, and a PEG ratio of 8.37. These figures indicate that the stock is trading at a significant premium compared to its earnings growth potential. In comparison to its peers, Britannia's PE ratio is higher than Hindustan Unilever's 53.63 and Pidilite Industries' 66.00, while its EV to EBITDA ratio is also elevated compared to Hindustan Unilever's 33.22. Despite recent strong stock performance, with a year-to-date return of 29.12% compared to the Sensex's 6.50%, the current valuation metrics suggest that Britannia Industries is not justified at its current price level of 6155.00....

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

15-Dec-2025 | Source : BSEPursuant to Regulation 30 read with Clause 7 of Para A of Part A of Schedule III of the SEBI Listing Regulations 2015 this is to inform you that the Board of Directors based on the recommendation of the Nomination and Remuneration Committee have approved the following: Appointment of Mr. Abhishek Sinha as the Chief Sales Transformation Officer of the Company with effect from 15th December 2025. Appointment of Mr. Subhashis Basu as the Chief Business Officer - Dairy of the Company with effect from 15th December 2025.

Intimation Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

15-Dec-2025 | Source : BSEWith reference to the subject cited above and our letter dated 10th November 2025 wherein it was informed that based on the recommendation of the Nomination and Remuneration Committee the Board of Directors at their Meeting held on 10th November 2025 appointed Mr. Rakshit Hargave (DIN: 03406793) as the Chief Executive Officer and Managing Director of the Company for a term of 5 years with effect from the date of his joining the Company on 15th December 2025 this is to inform that Mr. Rakshit Hargave has assumed the office today as the Chief Executive Officer and Managing Director of the Company.

Disclosure Of Environmental Social And Governance (ESG) Rating Under Regulation 30 Of The Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

10-Dec-2025 | Source : BSEPursuant to Regulation 30 read with Clause 3 of Para A of Part A of Schedule III of the SEBI Listing Regulations 2015 this is to inform you that NSE Sustainability Ratings and Analytics Limited a SEBI Registered ESG Rating Provider has independently assigned an ESG Rating Rating of 67 under the rating category Aspiring to the Company for FY 2024-25 as compared to the ESG Rating of 66 for FY 2023-24 based on the publicly available information disclosed by the Company.

Corporate Actions

No Upcoming Board Meetings

Britannia Industries Ltd has declared 7500% dividend, ex-date: 04 Aug 25

Britannia Industries Ltd has announced 1:2 stock split, ex-date: 29 Nov 18

Britannia Industries Ltd has announced 1:1 bonus issue, ex-date: 25 May 21

No Rights history available