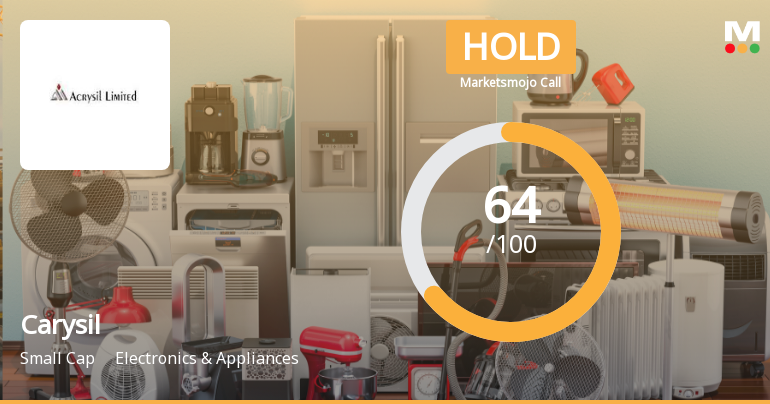

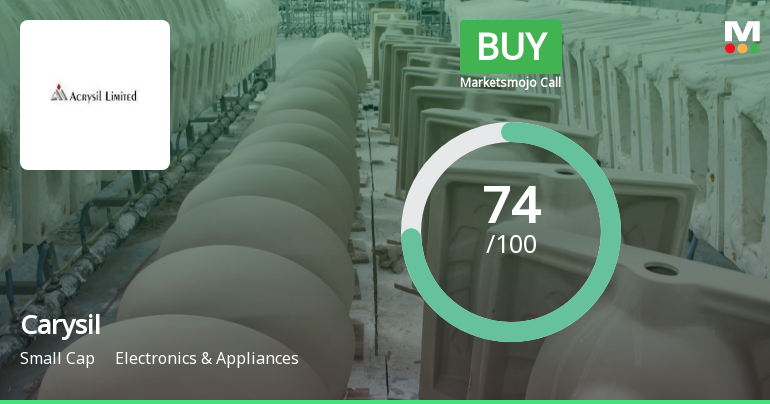

Carysil Ltd Upgraded to Buy by MarketsMOJO on Strong Fundamentals and Technicals

2026-02-04 08:06:57Carysil Ltd has been upgraded from a Hold to a Buy rating as of 3 February 2026, reflecting significant improvements across multiple parameters including technical indicators, valuation metrics, financial performance, and overall quality. This comprehensive upgrade follows a strong market performance and robust quarterly results, positioning Carysil favourably within the Electronics & Appliances sector.

Read full news article

Carysil Ltd Valuation Shift Signals Changing Price Attractiveness Amid Strong Market Returns

2026-02-04 08:01:33Carysil Ltd, a key player in the Electronics & Appliances sector, has witnessed a notable shift in its valuation parameters, moving from fair to expensive territory. This change comes amid robust stock performance that has significantly outpaced the broader market indices, prompting investors to reassess the company’s price attractiveness relative to its historical and peer benchmarks.

Read full news article

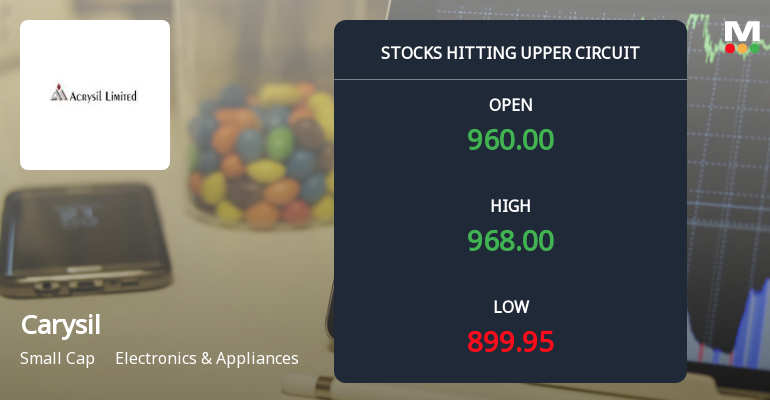

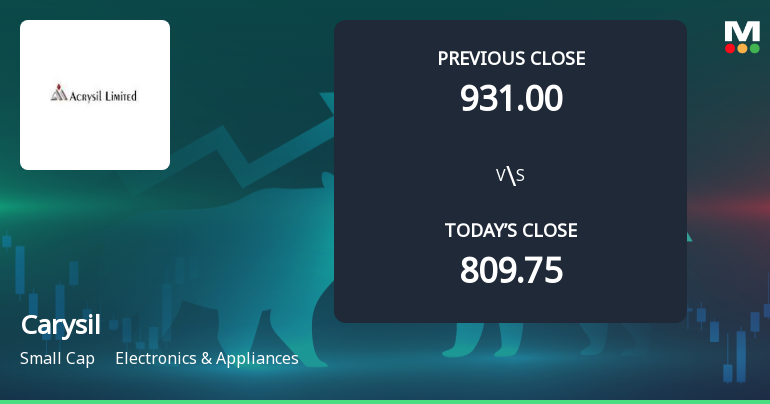

Carysil Ltd Surges to Upper Circuit on Robust Buying Momentum

2026-02-03 10:06:04Carysil Ltd witnessed a remarkable surge on 3 Feb 2026, hitting its upper circuit limit with a gain of 13.74% to close at ₹922.0. This strong buying pressure propelled the stock well above its previous levels, reflecting heightened investor interest amid sustained positive momentum in the Electronics & Appliances sector.

Read full news article

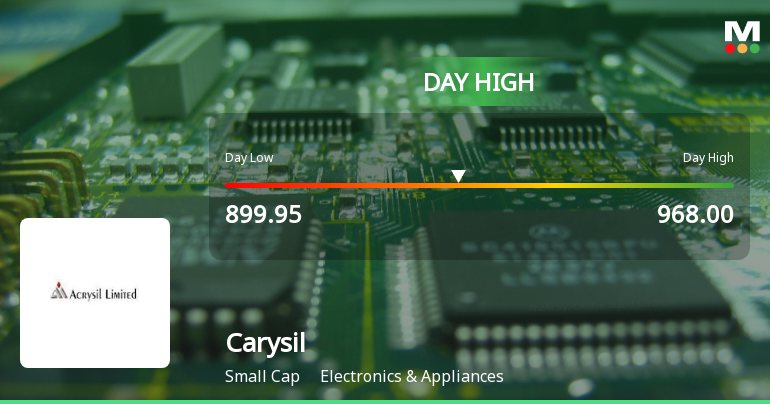

Carysil Ltd Hits Intraday High with 15.92% Surge on 3 Feb 2026

2026-02-03 09:34:21Carysil Ltd demonstrated a strong intraday performance on 3 Feb 2026, surging to an intraday high of Rs 968, marking a 19.54% increase from its previous close. The stock outperformed its sector and the broader market, reflecting heightened trading activity and volatility throughout the session.

Read full news article

Carysil Ltd Opens with Strong Gap Up, Reflecting Positive Market Sentiment

2026-02-03 09:33:56Carysil Ltd commenced trading today with a significant gap up, opening 18.56% higher than its previous close, signalling robust positive sentiment in the Electronics & Appliances sector. This strong start follows a sustained upward trend over the past week, underscoring the stock’s recent momentum amid broader market movements.

Read full news article

Carysil Ltd Technical Momentum Shifts Signal Mildly Bullish Outlook

2026-02-03 08:02:26Carysil Ltd, a key player in the Electronics & Appliances sector, has exhibited a notable shift in its technical momentum, transitioning from a sideways trend to a mildly bullish stance. Despite mixed signals from various technical indicators, the stock’s recent price action and moving averages suggest a cautiously optimistic outlook for investors.

Read full news article

Carysil Ltd Downgraded to Hold Amid Mixed Technical and Valuation Signals

2026-02-02 08:05:50Carysil Ltd, a prominent player in the Electronics & Appliances sector, has seen its investment rating downgraded from Buy to Hold as of 1 February 2026. This revision reflects a nuanced assessment across four critical parameters: Quality, Valuation, Financial Trend, and Technicals. While the company continues to demonstrate robust financial performance and operational efficiency, recent technical indicators and market dynamics have prompted a more cautious stance among analysts.

Read full news article

Carysil Ltd Technical Momentum Shifts Amid Sideways Trend

2026-02-02 08:03:04Carysil Ltd, a key player in the Electronics & Appliances sector, has experienced a notable shift in its technical momentum, moving from a mildly bullish stance to a sideways trend. This transition is underscored by mixed signals from key technical indicators such as MACD, RSI, Bollinger Bands, and moving averages, reflecting a complex market environment for the stock as it navigates recent price fluctuations and sector dynamics.

Read full news article

Carysil Ltd is Rated Buy by MarketsMOJO

2026-01-22 10:10:41Carysil Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 03 Nov 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 22 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and overall outlook.

Read full news articleAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

21-Jan-2026 | Source : BSEInvite for Earning Call Scheduled to be held on February 05 2026 at 04:00 p.m.

Board Meeting Intimation for Consideration And Approval Of Unaudited Financial Results For The Quarter And Nine Months Ended December 31 2025

20-Jan-2026 | Source : BSECarysil Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 04/02/2026 inter alia to consider and approve unaudited financial results for the quarter and nine months ended December 31 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

06-Jan-2026 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI ( DP) Regulations 2018 for quarter ended December 31 2025

Corporate Actions

(04 Feb 2026)

Carysil Ltd has declared 120% dividend, ex-date: 17 Sep 25

Carysil Ltd has announced 2:10 stock split, ex-date: 10 Jan 19

Carysil Ltd has announced 1:2 bonus issue, ex-date: 27 Sep 12

No Rights history available