Key Events This Week

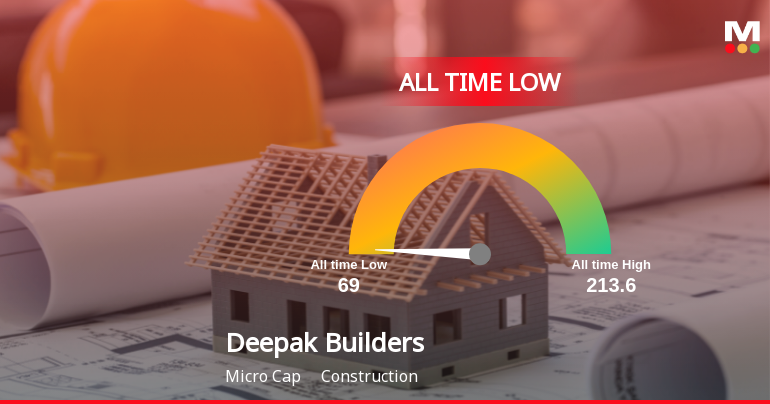

23 Feb: New 52-week and all-time low at Rs.84.1

24 Feb: Further decline to Rs.83.3 amid continued downtrend

25 Feb: Stock hits Rs.79.14, extending six-day losing streak

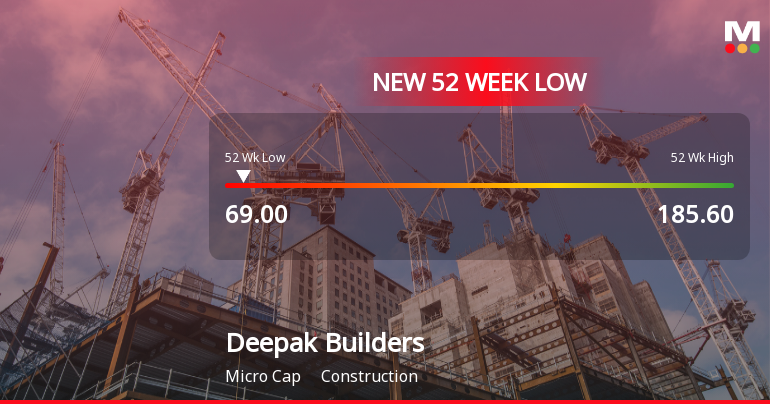

26 Feb: New 52-week low of Rs.79 recorded

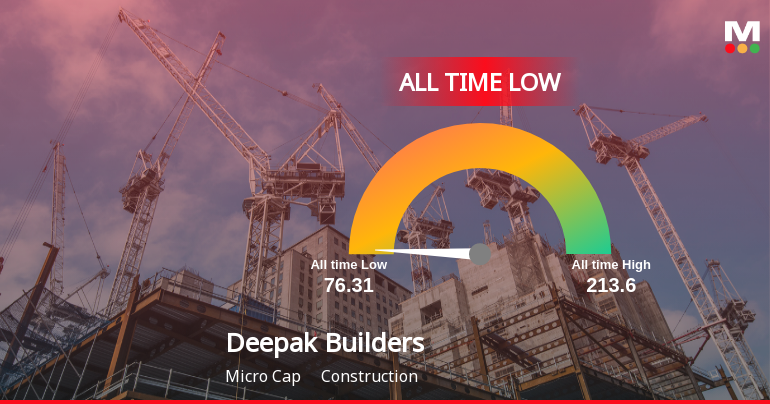

27 Feb: All-time low of Rs.76.31 reached, closing at Rs.76.07