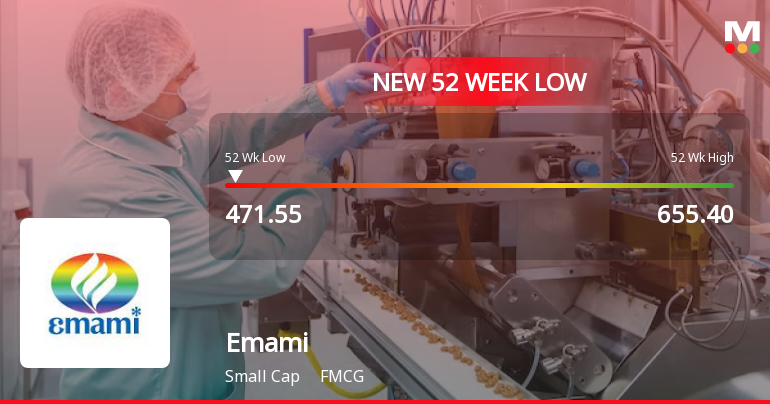

Emami Ltd. Stock Falls to 52-Week Low of Rs.471.55 Amidst Continued Downtrend

2026-02-02 09:45:20Emami Ltd., a prominent player in the FMCG sector, recorded a fresh 52-week low today at Rs.471.55, marking a significant milestone in its recent price trajectory. The stock has been under pressure, reflecting a series of challenges that have weighed on its market performance over the past year.

Read full news article

Emami Ltd. Stock Hits 52-Week Low at Rs.475 Amidst Underperformance

2026-02-01 13:40:55Emami Ltd., a key player in the FMCG sector, has touched a new 52-week low of Rs.475 today, marking a significant decline in its stock price. This drop reflects ongoing challenges in the company’s financial performance and market positioning, with the stock underperforming both its sector and broader market indices over the past year.

Read full news article

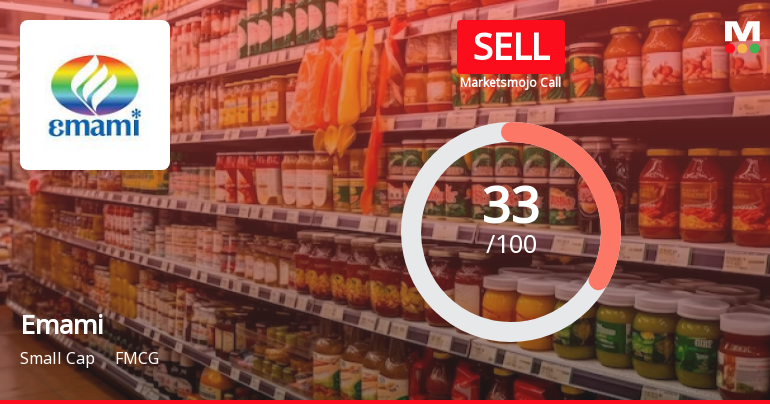

Emami Ltd. is Rated Sell by MarketsMOJO

2026-01-31 10:10:20Emami Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 29 September 2025. However, the analysis and financial metrics presented here reflect the stock's current position as of 31 January 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article

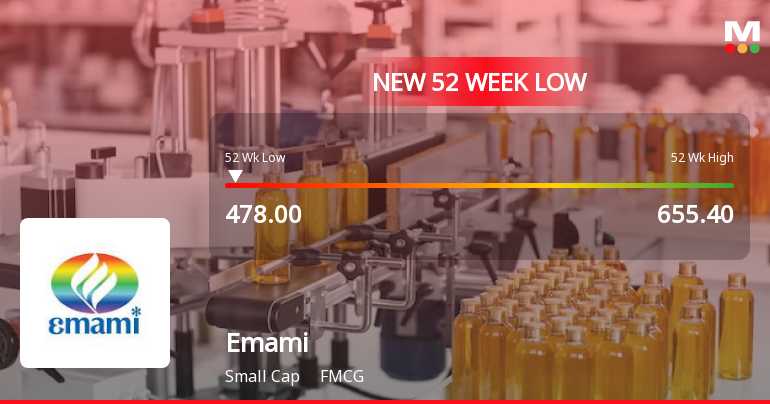

Emami Ltd. Stock Falls to 52-Week Low of Rs.478 Amidst Underperformance

2026-01-30 10:55:54Emami Ltd., a key player in the FMCG sector, recorded a fresh 52-week low of Rs.478 today, marking a significant decline in its stock price amid a broader market environment that has seen mixed performances. The stock’s recent movement reflects ongoing challenges in maintaining growth momentum and profitability compared to sector peers and benchmark indices.

Read full news article

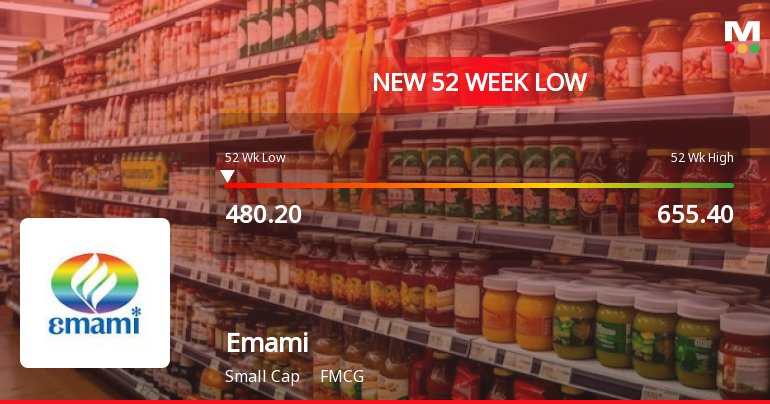

Emami Ltd. Stock Falls to 52-Week Low of Rs.480.2 Amidst Continued Downtrend

2026-01-29 12:36:12Emami Ltd., a prominent player in the FMCG sector, recorded a fresh 52-week low of Rs.480.2 today, marking a significant decline in its stock price amid a sustained downward trend over recent sessions. This new low comes as the stock continues to trade below all major moving averages, reflecting ongoing pressures on its market valuation.

Read full news article

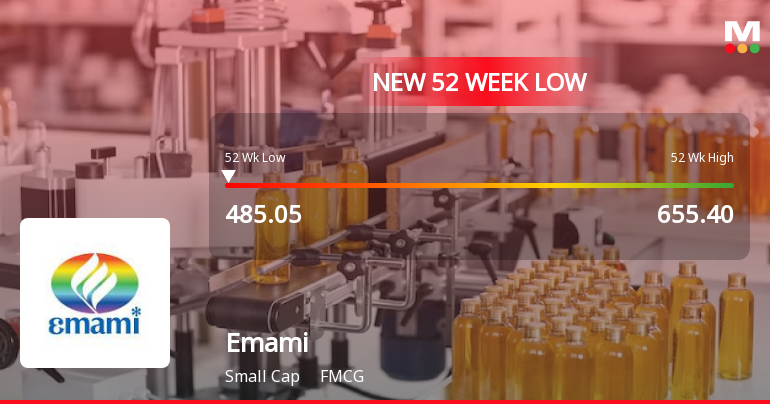

Emami Ltd. Stock Falls to 52-Week Low of Rs.485.9 Amid Continued Downtrend

2026-01-21 11:32:22Emami Ltd., a key player in the FMCG sector, recorded a fresh 52-week low today at Rs.485.9, marking a significant decline amid a sustained downward trend. The stock has underperformed its sector and broader market indices, reflecting ongoing pressures on its financial performance and market sentiment.

Read full news article

Emami Ltd. Stock Falls to 52-Week Low of Rs.496 Amidst Continued Underperformance

2026-01-20 10:36:03Emami Ltd., a prominent player in the FMCG sector, recorded a fresh 52-week low of Rs.496 today, marking a significant decline in its stock price amid ongoing challenges reflected in its financial performance and market positioning.

Read full news article

Emami Ltd. is Rated Sell by MarketsMOJO

2026-01-20 10:10:24Emami Ltd. is rated 'Sell' by MarketsMOJO, with this rating last updated on 29 September 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 20 January 2026, providing investors with an up-to-date view of the company’s fundamentals, returns, and market performance.

Read full news article

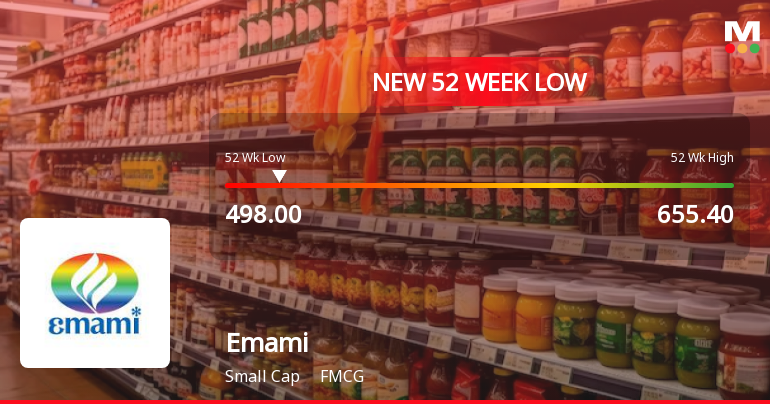

Emami Ltd. Stock Falls to 52-Week Low of Rs.498 Amidst Underperformance

2026-01-12 12:04:02Emami Ltd., a prominent player in the FMCG sector, witnessed its stock price decline to a fresh 52-week low of Rs.498 on 12 Jan 2026, reflecting ongoing pressures amid subdued financial performance and broader market headwinds.

Read full news articleDisclosure Under Regulation 30 Of The SEBI (Listing Obligations & Disclosure Requirements) Regulations 2015

28-Jan-2026 | Source : BSEThe Company has on 27th January 2026 received a cautionary letter (e-mail) from NSE for observation(s) reported by the Secretarial Auditor in ASCR for FY ended 31st March 2025.

Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

16-Jan-2026 | Source : BSEThe Exchange has received Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on January 15 2026 for Diwakar Finvest Pvt Ltd

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

07-Jan-2026 | Source : BSEPursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 this is to inform you that post declaration of Q3 FY26 Financial Results the Company will hold a Conference Call with Analysts / Investors on Wednesday 4th February 2026 at 4:00 P.M. (IST). The details of the Conference Call are enclosed herewith.

Corporate Actions

04 Feb 2026

Emami Ltd. has declared 400% dividend, ex-date: 14 Nov 25

Emami Ltd. has announced 1:2 stock split, ex-date: 21 Jul 10

Emami Ltd. has announced 1:1 bonus issue, ex-date: 21 Jun 18

No Rights history available