Key Events This Week

Jan 29: Q3 FY26 results highlight asset quality improvement and normalised provisions

Jan 30: Reports record quarterly earnings with strong turnaround

Week Close: Rs.70.01 (-1.42%) vs Sensex +1.62%

Feb 06

BSE+NSE Vol: 15.56 lacs

Equitas Small Finance Bank Ltd is rated 'Buy' by MarketsMOJO, with this rating last updated on 29 January 2026. However, the analysis and financial metrics discussed here reflect the stock's current position as of 01 February 2026, providing investors with the most up-to-date view of the company’s fundamentals, returns, and market standing.

Read full news article

Jan 29: Q3 FY26 results highlight asset quality improvement and normalised provisions

Jan 30: Reports record quarterly earnings with strong turnaround

Week Close: Rs.70.01 (-1.42%) vs Sensex +1.62%

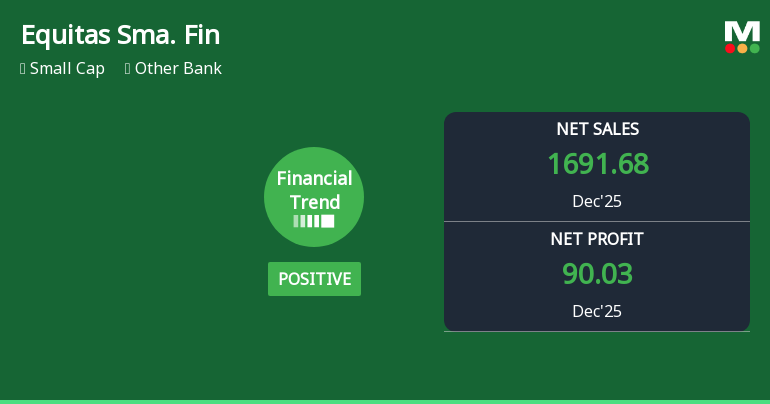

Equitas Small Finance Bank Ltd has demonstrated a marked improvement in its financial performance for the quarter ended December 2025, reversing previous negative trends with significant gains in revenue, profitability, and asset quality. The bank’s latest quarterly results highlight a positive shift in key financial parameters, signalling renewed investor confidence and a favourable outlook in the competitive small finance banking sector.

Read full news articleEquitas Small Finance Bank Ltd's latest financial results for Q3 FY26 demonstrate a notable recovery in profitability, with a net profit of ₹90.03 crores compared to a loss of ₹223.76 crores in the previous quarter. This marks a significant turnaround, reflecting a 272.95% increase in net profit quarter-on-quarter. The bank achieved its highest-ever net interest income of ₹851.63 crores, although this represents a slight decline from the previous quarter's figure of ₹773.68 crores. The bank's asset quality metrics also showed improvement, with gross non-performing assets (NPA) declining to 2.75%, the lowest level in recent quarters, and net NPA remaining stable at 0.92%. This indicates effective credit risk management and a successful cleanup of the loan book following the previous quarter's provisioning exercise. However, the net interest margin (NIM) compressed to 6.29%, down 26 basis points from the pr...

Read full news article

Equitas Small Finance Bank Ltd. delivered a remarkable turnaround in Q3 FY26, posting a net profit of ₹90.03 crores compared to a shocking loss of ₹223.76 crores in the previous quarter. The Chennai-based small finance bank, with a market capitalisation of ₹7,948.78 crores, demonstrated resilience as provisions normalised to ₹207.02 crores from an exceptional ₹612.25 crores in Q2 FY26, whilst maintaining robust asset quality metrics with gross NPA at 2.75% and net NPA at a low 0.92%.

Read full news article

Equitas Small Finance Bank Ltd has reached a significant milestone by hitting a new 52-week high of Rs.73.42, marking a notable phase of momentum in the stock’s performance amid a mixed market backdrop.

Read full news article

Equitas Small Finance Bank Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 26 December 2025. However, the analysis and financial metrics discussed below reflect the stock's current position as of 21 January 2026, providing investors with an up-to-date view of the company’s fundamentals, valuation, financial trends, and technical outlook.

Read full news article

Equitas Small Finance Bank Ltd has recently exhibited a notable shift in price momentum, transitioning from a mildly bullish to a bullish technical trend. Despite some mixed signals from monthly indicators, the stock’s daily and weekly charts suggest strengthening momentum, supported by key technical indicators such as MACD, RSI, Bollinger Bands, and moving averages. This article analyses the latest technical developments and their implications for investors.

Read full news article

Equitas Small Finance Bank Ltd is rated 'Hold' by MarketsMOJO, with this rating last updated on 26 December 2025. However, the analysis and financial metrics discussed here reflect the stock's current position as of 10 January 2026, providing investors with the latest insights into its performance and outlook.

Read full news articleNo Upcoming Board Meetings

Equitas Small Finance Bank Ltd has declared 10% dividend, ex-date: 09 Aug 24

No Splits history available

No Bonus history available

No Rights history available