Key Events This Week

Feb 9: Stock opens at Rs.189.90, declines 1.97% amid weak fundamentals

Feb 10: Valuation concerns highlighted; stock rebounds 2.39% to Rs.190.60

Feb 12: Price dips 1.92% to Rs.189.20 as Sensex falls

Feb 13: Rating upgraded to Sell on technical improvements; stock closes at Rs.187.75 (-0.77%)

Fusion Finance Ltd Upgraded to Sell on Technical Improvements Despite Valuation Concerns

2026-02-13 08:25:49Fusion Finance Ltd has seen its investment rating upgraded from Strong Sell to Sell, driven primarily by a shift in technical indicators despite persistent valuation and financial challenges. The company’s technical outlook has improved to mildly bullish, prompting a reassessment of its market stance, even as fundamental weaknesses and expensive valuations continue to weigh on investor sentiment.

Read full news article

Fusion Finance Ltd Technical Momentum Shifts Amid Mixed Indicator Signals

2026-02-13 08:04:57Fusion Finance Ltd, a player in the finance sector, is exhibiting a nuanced shift in its technical momentum as of early February 2026. While the stock’s overall technical trend has moved from sideways to mildly bullish, key indicators present a mixed picture, reflecting both cautious optimism and underlying bearish pressures. This analysis delves into the recent technical parameter changes, price momentum, and comparative performance against the Sensex benchmark.

Read full news article

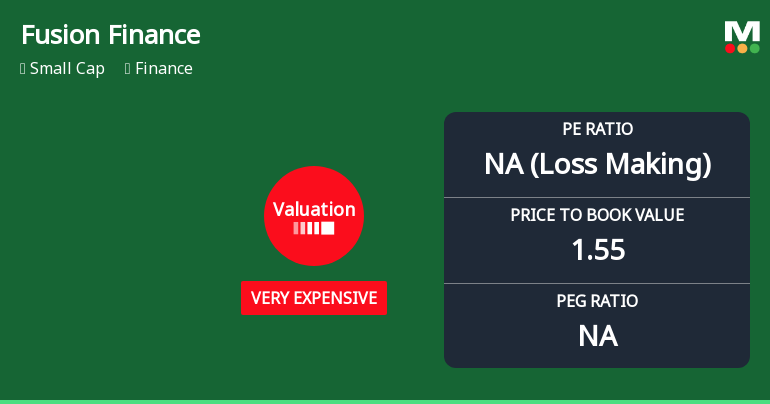

Fusion Finance Ltd Valuation Shifts Signal Heightened Price Risk Amid Weak Fundamentals

2026-02-10 08:03:35Fusion Finance Ltd has seen a marked deterioration in its valuation parameters, with its price-to-earnings (P/E) ratio plunging to negative territory and price-to-book value (P/BV) rising sharply, signalling a shift from risky to very expensive territory. This comes amid weak profitability metrics and a challenging market backdrop, raising concerns about the stock’s price attractiveness relative to peers and historical averages.

Read full news articleAre Fusion Finance Ltd latest results good or bad?

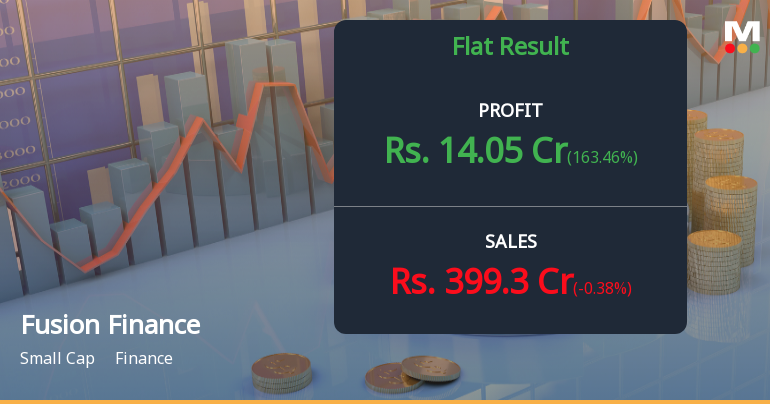

2026-02-07 19:23:38Fusion Finance Ltd's latest financial results for Q3 FY26 indicate a significant operational turnaround, highlighted by a net profit of ₹14.05 crores, a stark contrast to the substantial loss of ₹719.32 crores in the same quarter last year. This marks the company's first profitable quarter after a series of losses, reflecting a notable improvement in operational efficiency and interest cost management. The operating margin surged to 33.14%, a remarkable recovery from a negative margin of 63.18% year-on-year. However, the company faced challenges with revenue, which declined by 15.73% year-on-year to ₹399.30 crores, and also saw a slight sequential decrease of 0.38% from the previous quarter. This revenue contraction raises concerns about the sustainability of the recent profitability, especially as the nine-month revenue total shows a significant decline of 31.48% compared to the same period last year. In...

Read full news article

Fusion Finance Q3 FY26: Return to Profitability After Six Loss-Making Quarters

2026-02-07 09:46:13Fusion Finance Limited has posted a net profit of ₹14.05 crores in Q3 FY26, marking a dramatic turnaround from six consecutive quarters of losses that culminated in a staggering ₹719.32-crore loss in December 2024. The small-cap NBFC, with a market capitalisation of ₹3,098 crores, delivered this quarter's profit on revenue of ₹399.30 crores, though topline declined 15.73% year-on-year and remained essentially flat on a sequential basis.

Read full news articleAre Fusion Finance Ltd latest results good or bad?

2026-02-06 19:30:42Fusion Finance Ltd's latest financial results reveal a complex picture of the company's operational performance and ongoing challenges. The company reported a net loss of ₹22.14 crores for Q2 FY26, which, while a significant reduction from the previous quarter's loss of ₹92.25 crores, still indicates persistent operational difficulties. Over the past four quarters, Fusion Finance has accumulated losses exceeding ₹1,300 crores, raising concerns about its long-term viability. In terms of revenue, the company generated ₹400.82 crores in Q2 FY26, marking a sequential decline of 7.74% from the previous quarter and a substantial year-on-year decrease of 42.04% from ₹691.55 crores in Q2 FY25. This decline reflects a troubling trend, as it represents the seventh consecutive quarter of revenue contraction, highlighting ongoing issues with revenue generation and asset quality. On a more positive note, the operating...

Read full news article

Fusion Finance Ltd Technical Momentum Shifts Amid Mixed Market Signals

2026-02-06 08:03:43Fusion Finance Ltd has exhibited a notable shift in its technical momentum, moving from a mildly bearish stance to a more sideways trend, reflecting a complex interplay of bullish and bearish indicators across multiple timeframes. Despite a modest day gain of 0.37%, the stock’s technical parameters reveal a nuanced picture that investors should carefully analyse amid its strong sell rating and recent downgrade.

Read full news article

Fusion Finance Ltd is Rated Strong Sell

2026-02-02 10:10:26Fusion Finance Ltd is rated Strong Sell by MarketsMOJO. This rating was last updated on 01 December 2025, reflecting a shift from the previous 'Sell' grade. However, the analysis and financial metrics discussed here represent the stock's current position as of 02 February 2026, providing investors with an up-to-date view of the company’s performance and outlook.

Read full news article